OpenAI has committed more than $1.4 trillion that it will spend on building out its data center infrastructure to power the development and deployment of its AI models over the next eight years. Notably, OpenAI does not have $1.4 trillion. Also notable is the fact that the company doesn’t make that much money. That means it’ll remain reliant primarily on fundraising rounds to pay the bills as they come due. According to a report from the Financial Times, all OpenAI has to do is raise $207 billion by 2030 in order to keep operating at a deep loss. Easy peasy!

The report cites a recent analysis of OpenAI’s finances from HSBC, the British multinational financial services giant, which has taken into account the AI startup’s planned spending on infrastructure, compute, and energy costs, as well as its projected revenue to offset all those costs.

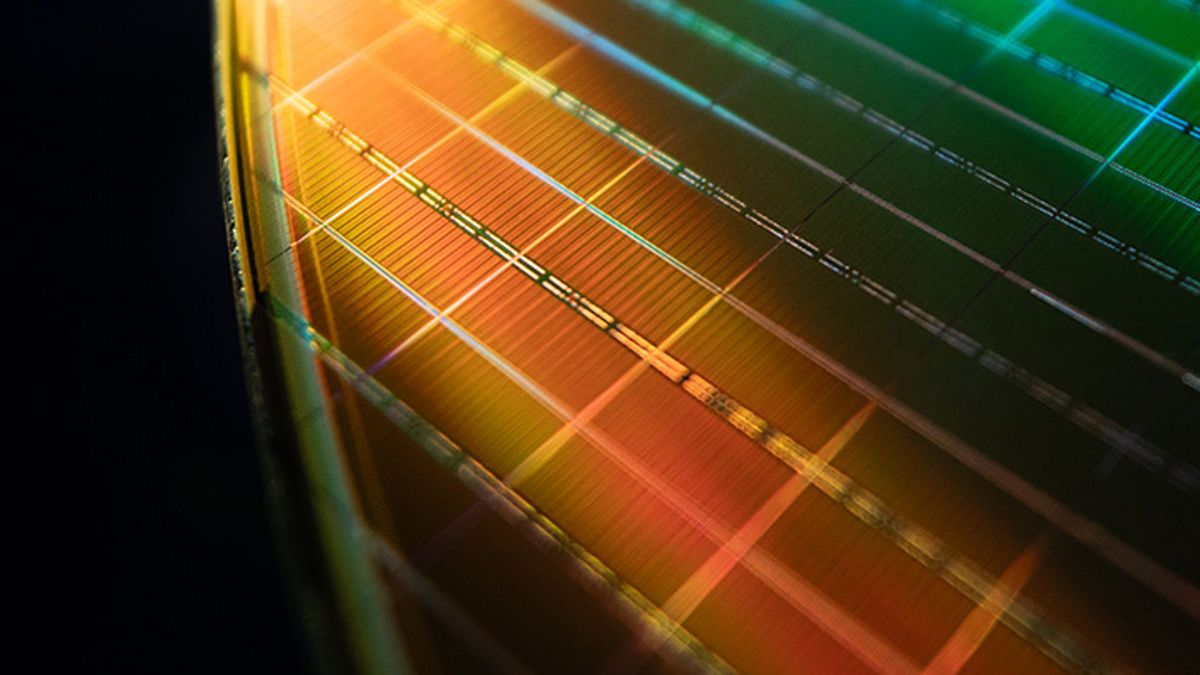

The bank estimates that OpenAI will run up a bill of $620 billion per year on data center costs, with a caveat that it has signed contracts for more computing power than is actually available at the moment. Then it created an estimate for the company’s customer reach, which is currently reported to be 800 million by OpenAI’s count and will reach three billion by 2030 under HSBC’s model. The bank generously estimates that OpenAI will convert 10% of that reach into paying customers, double its current rate of 5%. Those estimates are more generous than OpenAI’s reported internal ones, which have the company reaching 2.6 billion and converting 8.5% of them to paying subscribers by the end of the decade. HSBC also tosses OpenAI some advertising revenue under the assumption that LLM firms will take about 2% of the total digital ad market in the coming years.

With all that, HSBC projects that OpenAI will hit about $215 billion in annual revenue by 2030. That, once again, tops OpenAI’s own projections, which reportedly put it at about $200 billion annually by the end of the decade. Both models are calling for what is basically unprecedented growth, but let’s roll with it. Taking into account OpenAI’s current cash flow plus its projected expectation-busting growth projections would still leave the company with a funding deficit of $207 billion. Per HSBC, the company will need to raise that much just to continue operating in the red.

OpenAI has options to shrink that funding gap, though none of them are all that appealing. The company could back out of some of its data center commitments to shrink its expenditures, though it might not provide much comfort to investors who are counting on something closer to infinite growth. It could also blow past even the generous revenue projections made by HSBC, which seems unlikely and not really something it can just manufacture. If generating revenue were easy, the company would be doing it.

Then there’s the other option that OpenAI execs started floating before immediately getting push back: get a government bailout. Contingency plans usually aren’t a bad idea, but it probably doesn’t instill a whole lot of confidence that you’re planning on the possibility of failing so hard that you might drag the entire economy down with you.

English (US) ·

English (US) ·