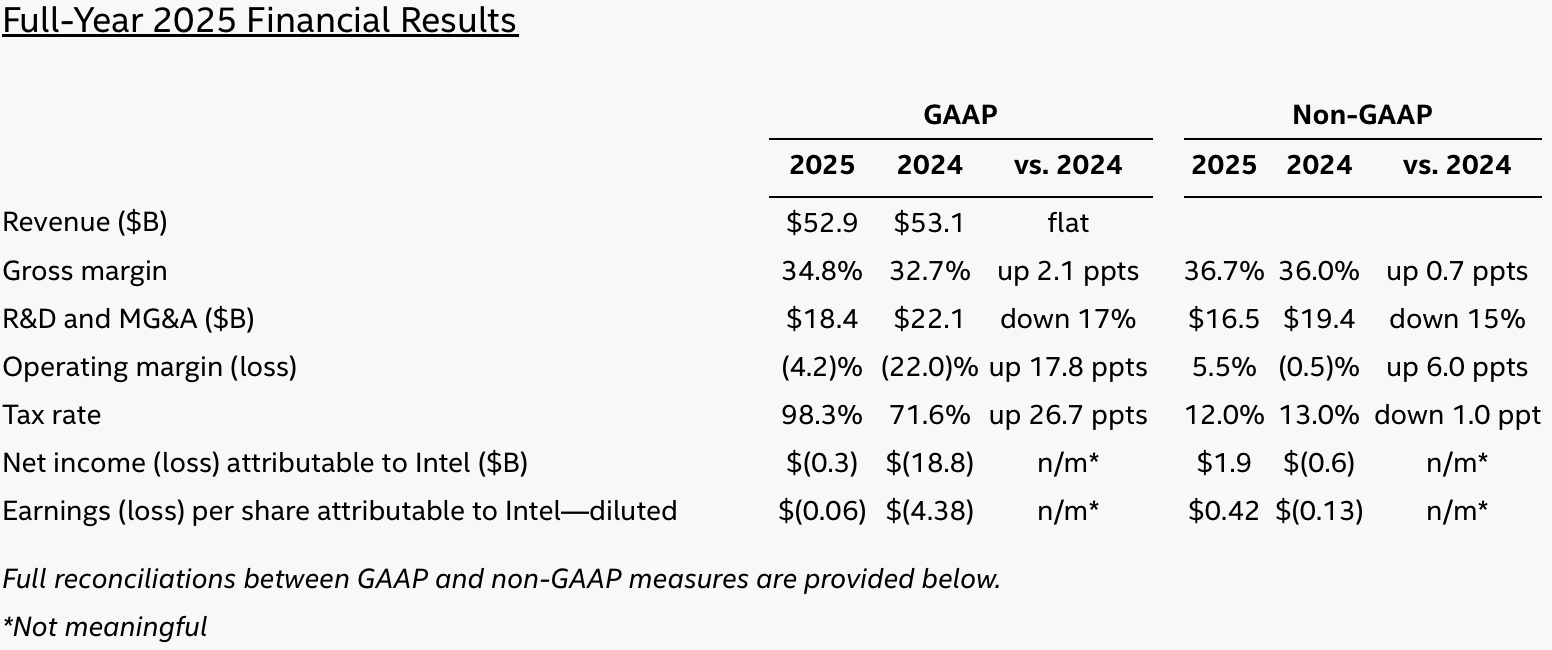

Intel reported its financial results for the fourth quarter and full year of 2025, closing the year with $52.9 billion in revenue, its weakest annual result since 2010. Despite earnings declines both in Q4 and for the whole year, Intel says that its earnings in the fourth quarter exceeded expectations as demand outstripped supply, due to the ongoing AI buildout.

Furthermore, the company reports a GAAP net loss of $300 million in 2025. Compared to its staggering $18.8 billion loss in 2024, this can be framed as a breakthrough. However, this is not quite yet a turnaround, as the result came with important caveats.

In Q4 2025, Intel earned $13.7 billion in revenue, unchanged from the previous quarter and down 4% year-over-year (YoY), as the company's shipments were constrained by wafer supply from its own fabs and TSMC. Due to strong competition and unfulfilled demand, the company reported a GAAP loss of $600 million for the quarter, as gross margin declined to 36.1%, compared to 39.2% a year earlier. For the full year, revenue was $52.9 billion, essentially flat compared to 2024, but gross margin improved to 34.8%.

However, Intel's near breakeven result was made possible by roughly $20.4 billion in external financial injections, including $2 billion from SoftBank, $4.46 billion from Silver Lake (for a 51% stake in Altera), $5 billion from Nvidia, and $8.9 billion from the U.S. government. Even with external funding, Intel still ended the year in the red, but without the injections, its losses would have deepened.

Operational performance

Taking a closer look at different business units, performance varied across business segments. The Client Computing Group (CCG) posted $8.2 billion in Q4 revenue, down both sequentially and YoY, its operating income declined to $2.2 billion as operating margin dropped to 27%. While client CPU demand in Q4 was traditionally very strong, Intel deliberately redirected constrained internal wafer capacity toward higher-margin data center products, thus increasing reliance on externally sourced wafers for client processors, which hit margins of the CCG business unit badly.

Meanwhile, this strategy benefited the Data Center and AI Group (DCAI), which posted $4.7 billion in Q4 revenue, up 15% sequentially and 7% YoY. Operating income surged to $1.3 billion, lifting margins to 26.4%, a dramatic improvement from 8.6% a year earlier and the best result for DCAI in quarters. Again, Intel had to acknowledge that demand for Xeon processors exceeded supply and expects this imbalance to persist into 2026 due to demand from the AI segment.

Intel Foundry generated $4.5 billion in Q4 revenue, up 6.4% sequentially, supported by growing shipments of Intel 3-based Xeon 6 CPUs, Intel 4-based Arrow Lake, and (to a minimal degree) early Panther Lake wafers. EUV-based processes now account for over 10% of foundry revenue, up from less than 1% in 2023. However, as usual, the foundry business posted a $2.5 billion operating loss due to a mix of factors, including ongoing capacity investments and the early ramp-up of Intel's 18A.

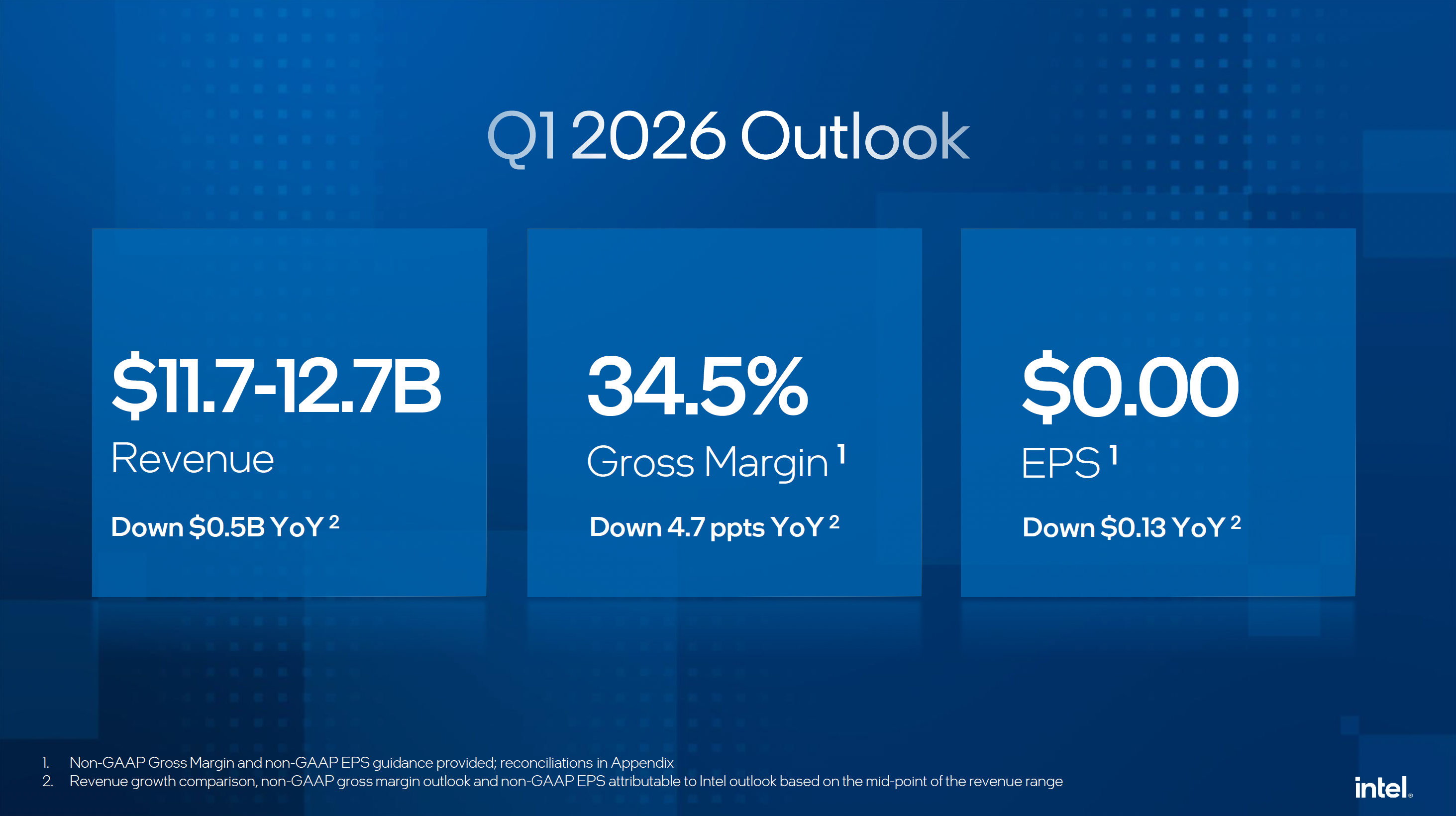

Q1 2026 outlook

Looking ahead into the first quarter, Intel forecasts revenue of $11.7 billion – $12.7 billion, which is down from the same quarter a year ago.

The prediction stems from continued supply constraints and the lack of buffer inventory that Intel sold in Q3 and Q4 2025. As a consequence, Intel will sell whatever it can get throughout the first quarter of 2026, something that inevitably hits margins, and they are projected to decline to 32.3% (as it will be harder to get as many of the premium SKUs out as possible). The good news is that the company's management expects supply conditions to improve starting in Q2.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

6 hours ago

7

6 hours ago

7

English (US) ·

English (US) ·