Although Intel's focus for this year's CES is to introduce its Core Ultra 3-series 'Panther Lake' processors and laptops, the company's chief executive, Lip-Bu Tan, still used the tradeshow to talk about 14A (1.4nm-class) process technology and reassure potential clients and investors that its development is proceeding well.

"We are going big time into 14A," said Lip-Bu Tan in an Intel News video on X. "Stay tuned, we are going to see a lot of great momentum on the 14A in terms of yields [and] IP portfolio to serve the customer well.

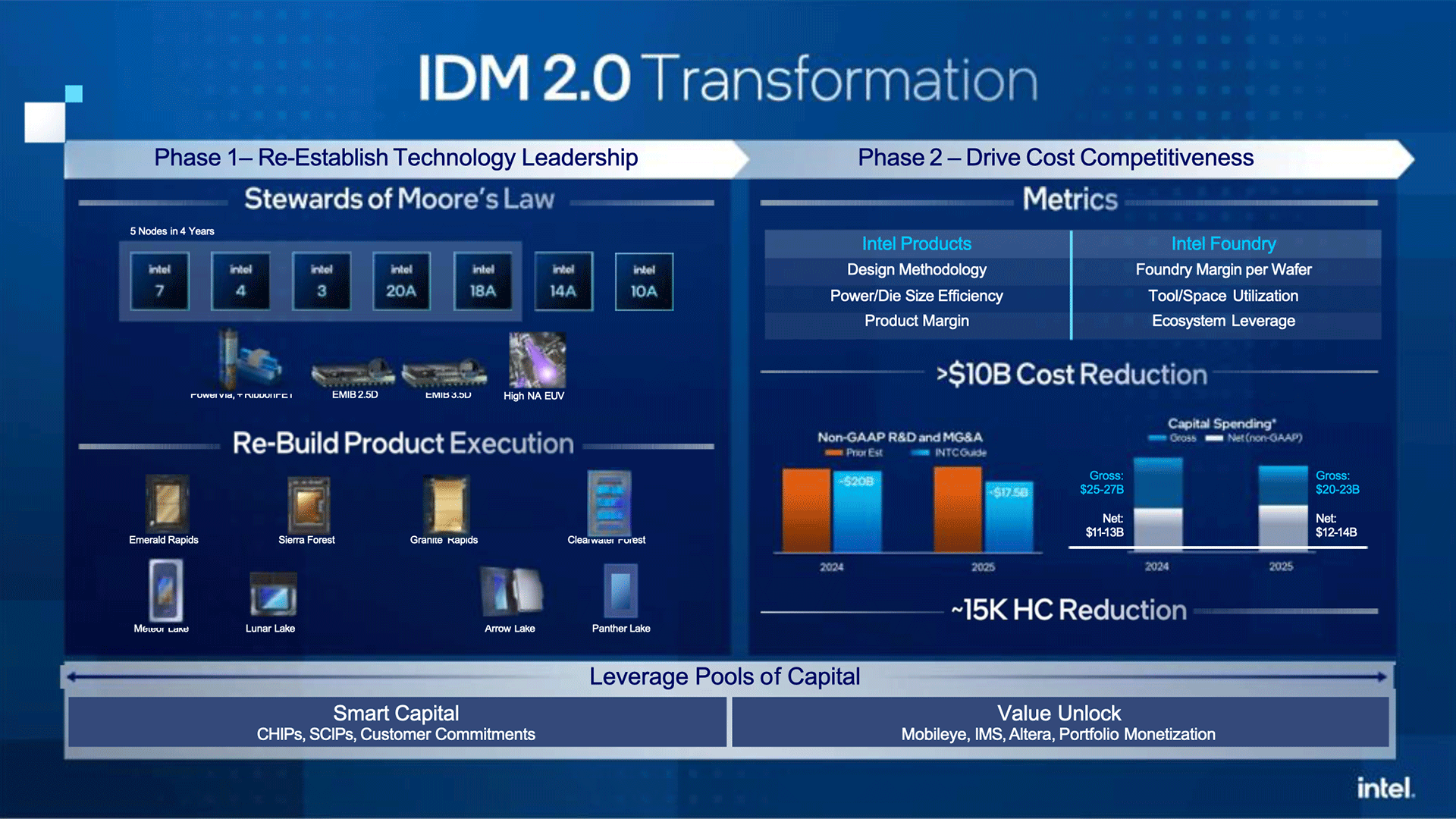

It goes without saying that Intel's 18A fabrication technology — which is used to make the compute tile of Panther Lake processors — is an important manufacturing process for Intel in the sense that it introduces gate-all-around (GAA) RibbonFET transistors and PowerVia backside power delivery network (BSPDN). However, 14A is by all means no less important because it builds on top of what the company will learn 18A. The 14A production node will introduce Intel's 2nd Generation RibbonFET GAA transistors; 2nd Gen BSPDN called PowerDirect that will connect power directly to source and drain of transistors, enabling better power delivery (e.g., reducing transient voltage droop or clock stretching) and refined power controls; and Turbo Cells that optimize critical timing paths using high-drive, double-height cells within dense standard cell libraries, which boost speed without major area or power compromises.

Yet, there is another aspect of Intel's 14A manufacturing process that is particularly important for the chipmaker: its usage by external customers. With 18A, the company has not managed to land a single major external client that demands decent volumes. While 18A will be used by Intel itself as well as by Microsoft and the U.S. Department of Defense, only Intel will consume significant volumes. For 14A, Intel hopes to land at least one more external customer with substantial volume requirements, as this will ensure that Intel will recoup its investments in the development of such an advanced node.

But there is a major catch. Intel's current capital expenditure (CapEx) plan does not include investments in 14A capacity for third-party clients. Hence, even if Intel lands an order from a major customer (think Apple, AMD, Nvidia, or Qualcomm), it will have to invest in additional capacity, which will delay Intel Foundry reaching the breakeven point.

"When we win a customer for Intel 14A, we will have to layer on expenses well ahead of getting revenue," said John Pitzer, corporate vice president of corporate planning and investor relations at the RBC Capital Markets Global Technology, Internet, Media and Telecommunications (TIMT) Conference in November. "I do think for transparency purposes, as a sort of customer traction materializes, it is likely to push out that end. I am thinking though, most investors will be okay with that because it will be confirmation that we can actually stand up an external foundry."

Contract chipmakers typically discuss upcoming process nodes with customers before capacity exists and add capacity only after early adopters commit. At Intel, this model is different because the Products Group is the main customer, so capacity is built first to meet internal demand. This is especially critical for leading-edge fabs like those for Intel 14A, which require both Low-NA and High-NA EUV tools and other costly equipment. Given the enormous capital expense, foundries cannot afford idle assets, and normally ramp capacity only when utilization is well above 80% is guaranteed.

But offering a process node without available capacity to external customers risks undermining Intel's foundry ambitions. Competitors such as TSMC and Samsung Foundry typically expand fabs with multiple anchor customers already committed and expect additional demand to follow. Since advanced tools like EUV scanners have long lead times, Intel could miss key foundry opportunities if it cannot provide capacity for third-party clients on time.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

18 hours ago

12

18 hours ago

12

English (US) ·

English (US) ·