Nvidia and Intel are working on something few thought possible: A partnership so deep it could redraw the boundaries of the x86 ecosystem. Their new joint effort will see Nvidia RTX GPU chiplets integrated with Intel CPUs in a single package, using Intel's Foveros and EMIB (Embedded Multi-Die Interconnect Bridge) technologies.

These RTX SoCs are meant to target premium laptops, desktops, and AI PCs. Nvidia CEO Jensen Huang called them "a new class of integrated graphics laptops that the world has never seen before." But if this sounds familiar, it should. It’s not the first time Intel has played matchmaker with rival GPU companies. And it’s not the first time Nvidia has shown interest in tapping Intel Foundry, either.

Before the foundry

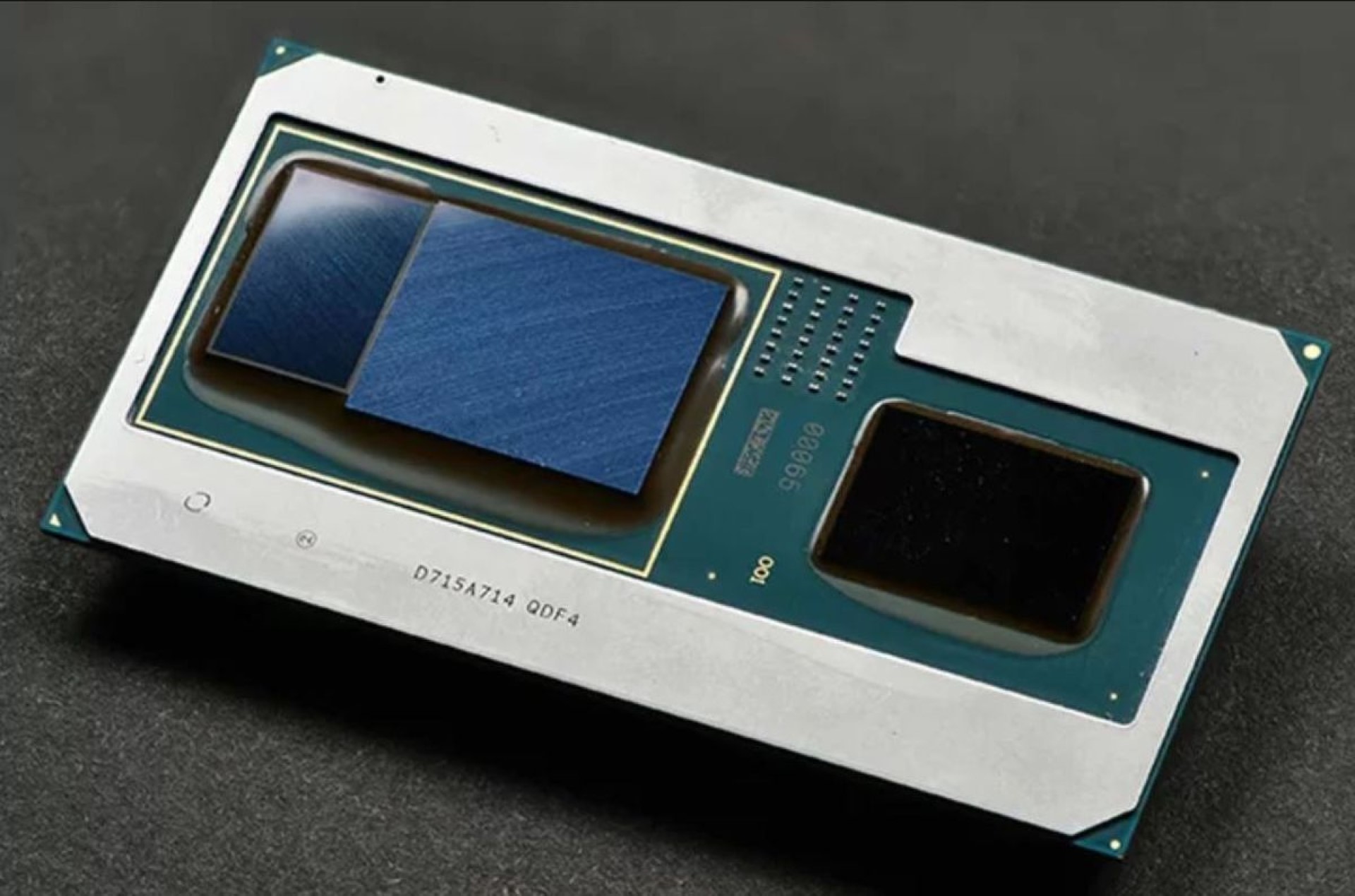

Intel's work on EMIB and Foveros began well before it tried to court outside customers. Back in 2017, Intel stunned the industry with Kaby Lake-G, a short-lived chip that paired an Intel CPU with an AMD Radeon RX Vega M GPU and HBM2 memory.

The package used EMIB to stitch the GPU and HBM together, making it Intel's first public testbed for advanced multi-die integration. The project was curious from the start: Intel and AMD were fierce rivals, but the product delivered solid performance. It found a niche in a handful of laptops and NUC systems, then vanished. Intel dropped the product in 2019, just as it began ramping up its own discrete GPU roadmap and hired several AMD executives.

Kaby Lake-G showed what was technically possible and how quickly plans can unravel without long-term alignment. Launched in 2017, the chip combined Intel’s Core CPU with AMD’s Vega GPU and HBM2 memory in a single EMIB package. It powered devices like the Hades Canyon NUC and Dell’s XPS 15 2-in-1, delivering solid performance in thin-and-light form factors.

But OEM adoption was limited, and Intel soon launched its own GPU roadmap under Raja Koduri. Once that happened, buying AMD parts no longer made strategic sense for Intel. Worse, driver support became murky. AMD ended active driver updates, and community reports suggested gaps, before Intel stepped in. In hindsight, Kaby Lake-G looked less like a lasting collaboration and more like an EMIB test run, wrapped in a marketing shell.

Jensen watches and waits

When Intel launched Intel Foundry in 2021, it did so intending to become the second-largest foundry in the world. Nvidia CEO Jensen Huang responded with cautious optimism. He confirmed that Nvidia was in talks with Intel and said he was open to using their services. But he also pointed out how difficult it is to become a world-class foundry. TSMC, Huang said, “dances with, what, 300 companies worldwide.” Intel didn’t.

Nvidia's strategy has always involved multiple foundry sources. It used Samsung for some GPUs, TSMC for most. Jensen has previously emphasized that, while Nvidia is open to a partnership with Intel, there is no rush. “We have to align technology, the business models have to be aligned, the capacity has to be aligned… we’re not buying milk here.”

In 2022, Huang said that he would consider using Intel-fabricated chips, and in 2023, Nvidia began testing Intel-made chips. Tom's Hardware spoke to Intel Foundry chief Stu Pann in 2024 regarding the RAMP-C project, which Nvidia and Intel are both formal partners for. This program offers federal funding to build test chips on 18A for military use. The latest update came in 2025, when sources claimed that Nvidia was continuing to trial the 18A process. So, it's not completely out of the blue, especially as Nvidia had another need — packaging.

As demand for Nvidia's AI GPUs surged in 2023, TSMC's CoWoS packaging lines became a bottleneck. Nvidia reportedly turned to Intel, which had excess capacity and mature 2.5D/3D packaging with EMIB and Foveros. With them, Intel could offer something even TSMC couldn’t: Turnkey multi-die integration across vendors. Nvidia, squeezed by TSMC’s CoWos bottlenecks during the Blackwell ramp, saw an opening. Reports suggest that Nvidia started shifting up to 5,000 wafers per month to Intel packaging lines in 2024. While Intel couldn’t match TSMC's process technology, it could deliver packages fast. That was enough to get Nvidia in the door and begin testing the partnership.

An unexpected partnership is born

By late 2025, Nvidia and Intel had formalized the relationship. They jointly announced an unexpected, multi-billion-dollar sweeping partnership to co-develop x86 chips with integrated Nvidia RTX GPU tiles, linked over NVLink with shared memory. These chips will use Intel's packaging tech but continue to rely on TSMC for the GPU die itself. The CPU die will be built by Intel, likely on the upcoming 18A or 14A node.

It’s not a full foundry deal yet, though. When asked directly, both Jensen Huang and Intel CEO Lip-Bu Tan avoided confirming any move to Intel's fabs. Huang notably praised TSMC as "magic" during the joint press conference. Tan said Intel would continue qualifying 18A and 14A "one step at a time."

But the joint product plan is serious. These SoCs will go after premium laptop and desktop markets — segments AMD has grown into with its Ryzen APUs. AMD’s Strix Halo APU pairs 16 Zen 5 cores with a 40-CU RDNA 3.5 GPU and a 50 TOPS NPU, all on one die. Intel and Nvidia aim to surpass that by splitting the work across chiplets. Intel provides high-performance x86 cores, while Nvidia supplies an RTX-class GPU, presumably featuring ray tracing, tensor cores, and full CUDA stack support. NVLink provides 900 GB/s of bandwidth between them, which is well beyond what PCIe 5.0 offers.

This gives the package a key edge: Real-time, coherent memory sharing between CPU and GPU. With Foveros and EMIB, Intel and Nvidia can scale performance without compromising on thermals or die area. Each chiplet is built on its optimal node. And because the package isn't tied to a single foundry, they can mix and match parts from different vendors.

Packaging as leverage

Intel knows it's behind on process technology. TSMC is already producing 3nm chips for Apple and targeting 2nm by 2026. Intel's 18A process only recently entered risk production. Its own filings admit that Intel Foundry has yet to attract significant customers. Foundry losses in Q2 2025 exceeded $3 billion. But where Intel has gained traction is in packaging.

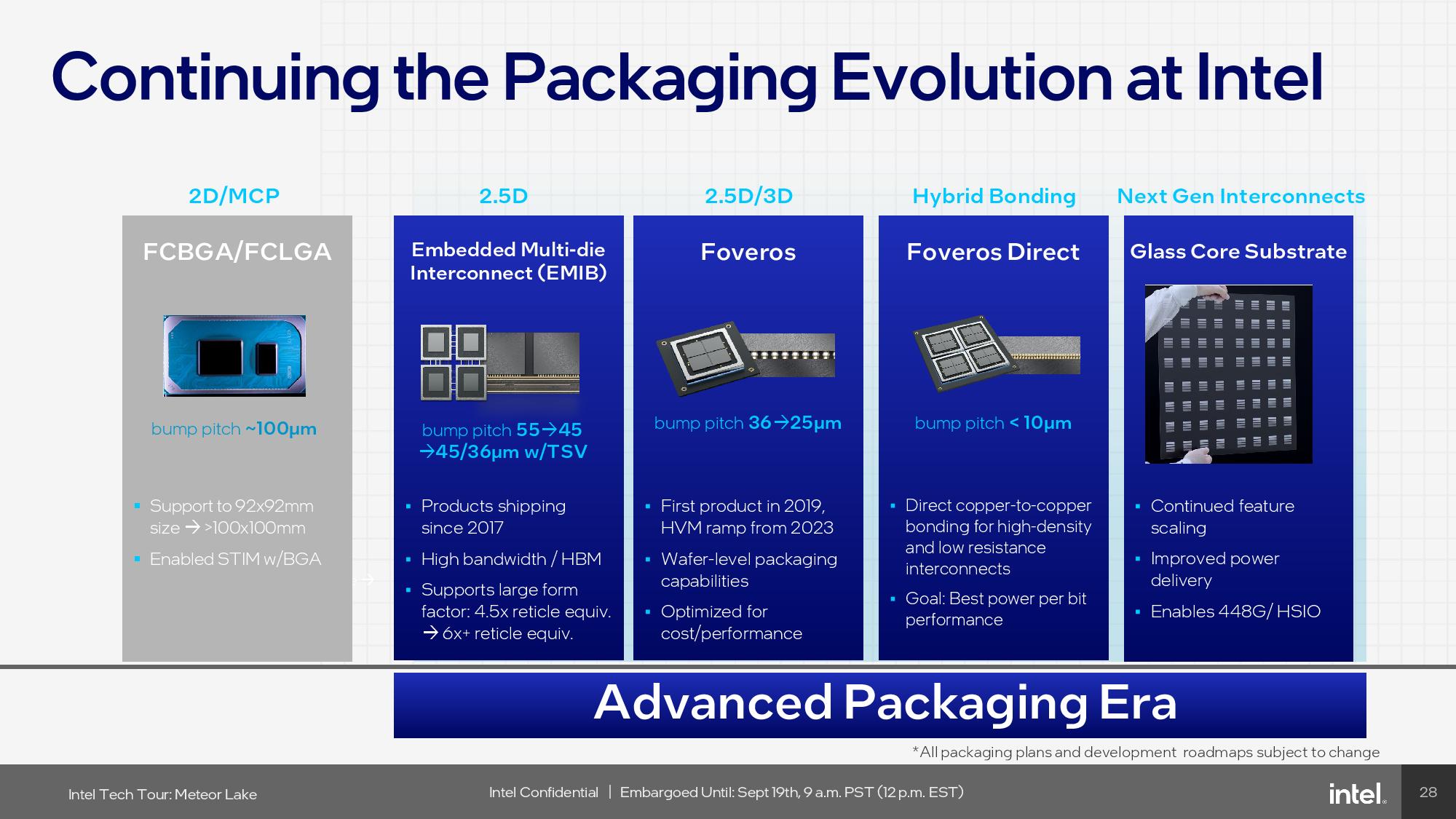

Foveros and EMIB allow Intel to integrate chiplets vertically and horizontally, respectively. EMIB links die side-by-side using tiny silicon bridges. Foveros stacks them. These technologies have been proven in multiple products, including Intel’s own Meteor Lake CPUs and the massive 47-tile Ponte Vecchio GPU. More importantly, they’re available to external customers.

The Nvidia deal validates that strategy. By becoming a packaging partner first, Intel buys time to mature its nodes. It also positions itself as a neutral assembler that can integrate TSMC-made GPU tiles with Intel CPU tiles in one package. That matters in an industry where system-level performance now depends more on how chips work together than on single-die monoliths.

The Intel-AMD Kaby Lake-G experiment failed due to a lack of roadmap alignment, as it ended once Intel had alternatives, and suffered from limited OEM interest. The Nvidia-Intel deal appears structured to avoid those pitfalls. Both companies have long-term incentives. Nvidia gains access to x86 without having to license or build it. Intel gets RTX branding and GPU power without betting on its struggling Arc division — but Intel is keen to hammer home the point that Arc isn’t being sidelined, telling Tom’s Hardware, “While we’re not sharing specific roadmaps at this time, everything we discussed aligns with and complements Intel’s existing strategy,” adding, “We remain committed to our GPU roadmap.”

AMD can't ignore this. Its integrated APUs gave it a stronghold in gaming laptops and small form-factor PCs. But the new Intel-Nvidia chip aims to be a premium alternative. OEMs already trust Nvidia’s RTX brand. If they can get RTX-level performance in an integrated package, they have less reason to spec in a discrete GPU or go with AMD. That could put pressure on AMD to scale up its APUs.

Why not a full foundry deal?

Huang and Tan were careful not to overpromise in a joint press conference following the partnership announcement. Nvidia still depends on TSMC for its cutting-edge nodes, with Blackwell fabbed N4. Moving that architecture to Intel would require significant validation and confidence in 18A yields. So far, there’s no evidence that confidence exists.

Ultimately, Huang will want redundancy at every level: node, foundry, packaging. Intel could provide that. Even a partial shift of packaging or future chiplet integration is valuable. It also gives Nvidia leverage in negotiations with TSMC. If Intel’s process nodes become competitive in the future, Nvidia can gradually ramp up usage.

This cautious, layered approach reflects Huang’s long-held views. He’s consistently said that GPUs and CPUs must work together. He’s praised Intel's ability to execute at the platform level. And he’s always made clear that Nvidia will use the best tools available, regardless of where they come from.

With all this in mind, it’s clear that the Nvidia-Intel deal isn’t born from a need to solve immediate bottlenecks. It’s a hedge, a collaboration, and a bet on packaging as the next frontier. It positions Nvidia closer to the heart of the PC and server markets without having to take on x86 development. It gives Intel a marquee partner to showcase its most advanced integration capabilities. And it signals that in a post-monolithic era, whoever controls the package may control the product.

It could still fall apart. There are a lot of dependencies: Intel has to deliver on its nodes. Nvidia has to be happy with the package thermals. OEMs have to buy in. But if it works, it could challenge AMD's momentum in the APU space, offer an alternative to discrete CPU+GPU platforms, and give both companies leverage in their respective battles with TSMC.

Jensen Huang has watched Intel Foundry closely since its inception. Now, he's shaping its future by placing his chips — both literally and strategically — where they might matter most.

1 month ago

79

1 month ago

79

English (US) ·

English (US) ·