Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

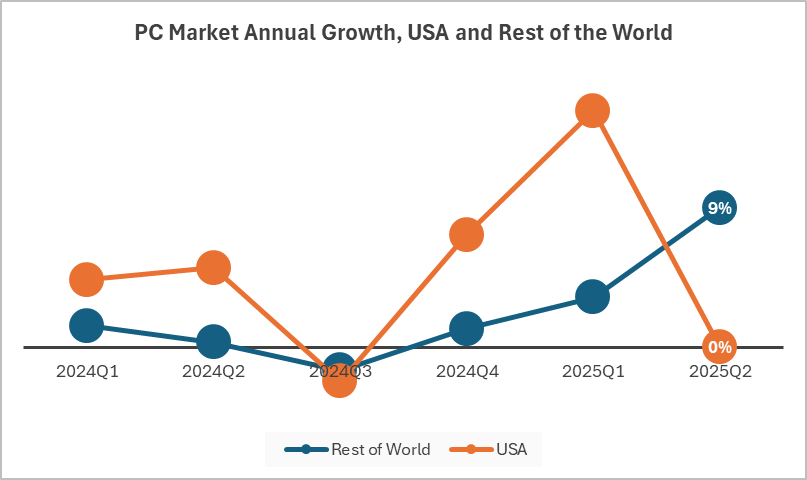

In brief: PC shipments grew globally in the second quarter of the year, with one major exception: the US, where year-on-year growth was flat at 0%. The sharp decline is being blamed on the looming import tariff deadline, which was due today but has been pushed to the start of August.

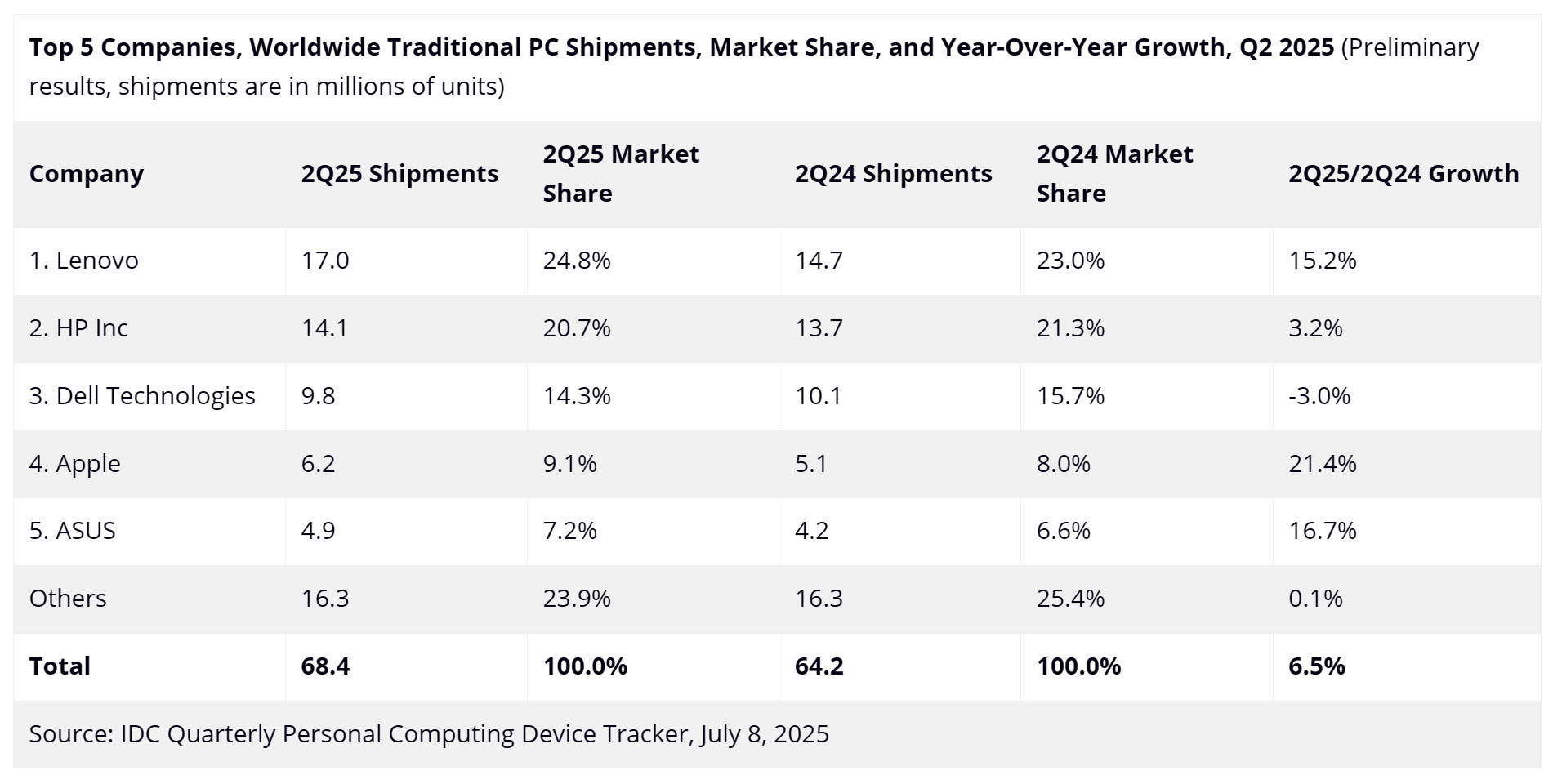

According to IDC's preliminary results, global PC shipments in Q2 grew 6.5% in the second quarter, reaching 68.4 million shipments. But taking the US out of the equation, the growth figure rises 9%.

Compared to last year, PC shipments in the US were flat at 0%. IDC says this is due to demand in the US slowing down in anticipation of the tariffs following a spate of panic buying earlier in the year.

Trump announced a 90-day pause on his higher tariff rates of 25% to 40% in April. They were set to come into effect today (July 9), but the President this week delayed them to August 1.

Trump has sent letters to leaders of 14 nations, informing them of his latest tariff plans and adding that the rates could be modified "upward or downward, depending on our relationship with your country."

The rest of the world is showing an increased demand for PCs, which IDC says is being fuelled by an aging install base and the transition to Windows 11. Microsoft's latest OS finally became the most popular version of Windows this month, 3 years and 9 months after launch. Windows 10's October 14 end-of-support date is drawing closer, pushing more holdouts to Windows 11.

IDC notes that the PC industry doesn't want to miss out on the opportunity to take advantage of the current down market, but at the same time, vendors don't want to be stuck with inventory they can't sell.

"The bigger concern is what overall demand looks like as we get late into Q3 and beyond," the analyst company wrote. "Price increases will likely be dispersed over time and geography depending on vendor strategy which can potentially lead to some attractive promotions as a way to clear inventory backups, which seems odd at a time when prices are expected to rise because of tariffs."

Looking at individual companies, Lenovo takes the majority of the market share (24.8%). It was followed by HP (20.7%), Dell (14.3%), Apple (9.1%), and Asus (7.2%). It was an especially good quarter for Apple, which saw the largest YoY growth in the top five: 21.4%.

Image credit: Clastr Cloud Gaming

English (US) ·

English (US) ·