TLDR:

- DeFi Development Corp. buys 17,760 SOL at $153.10, totaling $2.72 million in value.

- Company now holds over 640,000 SOL, valued at approximately $98.1 million.

- Staking strategy spans own and third-party validators to generate native SOL rewards.

- Shares reflect 0.042 SOL per unit, with per-share value estimated at $6.65.

DeFi Development Corp. has returned to its aggressive Solana accumulation strategy. This is after purchasing nearly 18,000 SOL tokens worth $2.72 million.

The publicly traded company now holds over 640,000 SOL tokens valued at approximately $98.1 million. This latest acquisition demonstrates continued institutional confidence in Solana’s long-term potential despite recent market volatility.

The purchase reinforces DeFi Development Corp’s position as the “MicroStrategy of Solana” in the cryptocurrency space. Market observers are closely watching how this institutional buying pressure affects SOL’s price trajectory.

DeFi Development Corp. SOL Purchase Strengthens Treasury Position

DeFi Development Corp announced the acquisition of 17,760 SOL tokens on July 3, 2025, at an average price of $153.10 per token. The Nasdaq-listed company, trading under ticker DFDV, specifically targets Solana accumulation as its primary treasury strategy.

Following this transaction, the company’s total holdings reached 640,585 SOL and SOL-equivalent assets.

The purchase brings DeFi Development Corp’s crypto treasury value to approximately $98.1 million, including staking rewards. Wu Blockchain reported the acquisition, highlighting the company’s consistent approach to building long-term SOL positions.

This marks a milestone in the company’s strategy to compound Solana holdings over time.

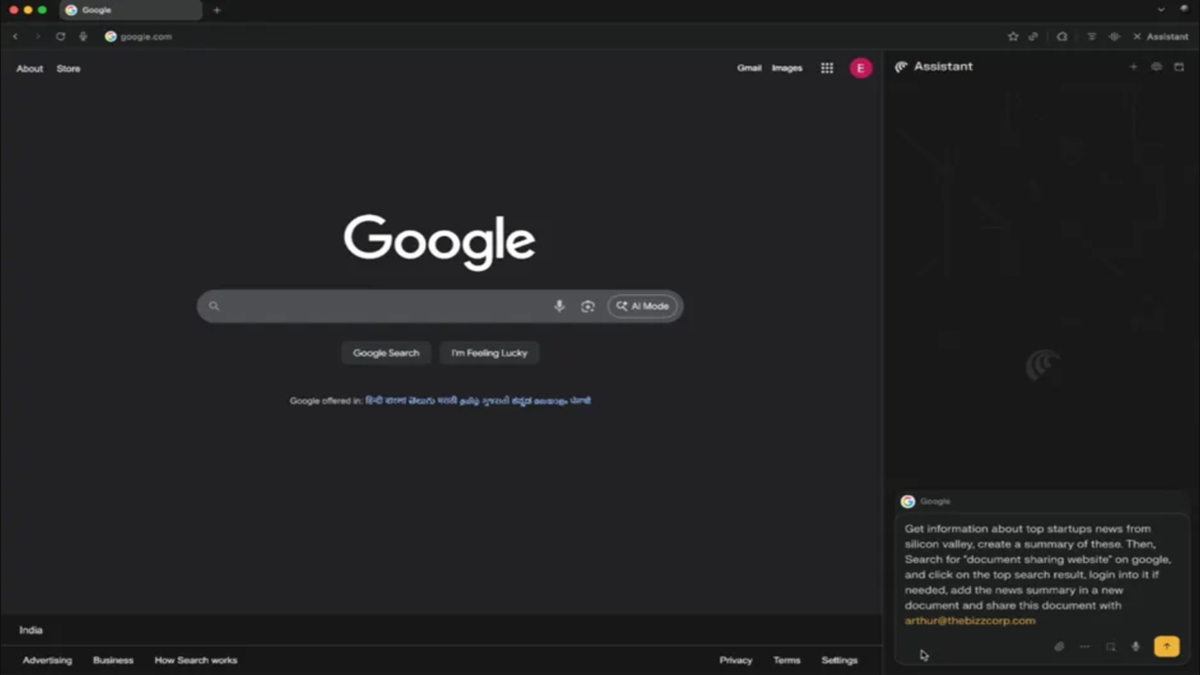

DeFi Development Corp. (Nasdaq: DFDV) announced the purchase of 17,760 SOL on July 3, 2025, at an average price of approximately $153.10 per token. As of that date, the company held a total of approximately 640,585 SOL and SOL-equivalent assets, valued at around $98.1 million.…

— Wu Blockchain (@WuBlockchain) July 3, 2025

The newly acquired SOL tokens will join the company’s existing staking operations across multiple validators. DeFi Development Corp operates its own Solana validators while also distributing stakes to other network participants. This diversified staking approach generates native yield on the company’s substantial SOL holdings.

Current metrics show the company maintains 0.042 SOL per share based on 14,740,779 total shares outstanding. The per-share value in USD stands at $6.65, reflecting the current market price of Solana tokens.

These staking rewards contribute to the overall treasury value and provide ongoing revenue streams.

Solana Market Dynamics Show Mixed Signals

Despite strong institutional buying, technical indicators present a complex picture for SOL’s short-term outlook.

Alva App noted that while institutional momentum remains robust, MACD signals show a bearish crossover with neutral CRSI readings. These technical patterns suggest potential short-term market turbulence ahead.

The continued institutional accumulation by companies like DeFi Development Corp supports long-term conviction in Solana’s ecosystem. However, traders should monitor volume spikes and market structure changes as institutional hedging flows create additional volatility.

The company’s substantial SOL position makes it a key player in the broader Solana ecosystem development.

DeFi Development Corp continues providing regular updates through public releases and regulatory filings. The company’s transparency approach aligns with its status as the first public company built specifically around SOL accumulation strategies.

Future treasury updates will follow similar disclosure patterns to keep shareholders informed about accumulation progress.

This latest purchase demonstrates management’s confidence in Solana’s fundamental strength despite current market conditions. The company’s disciplined approach to building SOL positions reflects a long-term view of blockchain technology adoption and Solana’s role in the expanding crypto ecosystem.

3 months ago

17

3 months ago

17

English (US) ·

English (US) ·