Tom's Hardware Premium Roadmaps

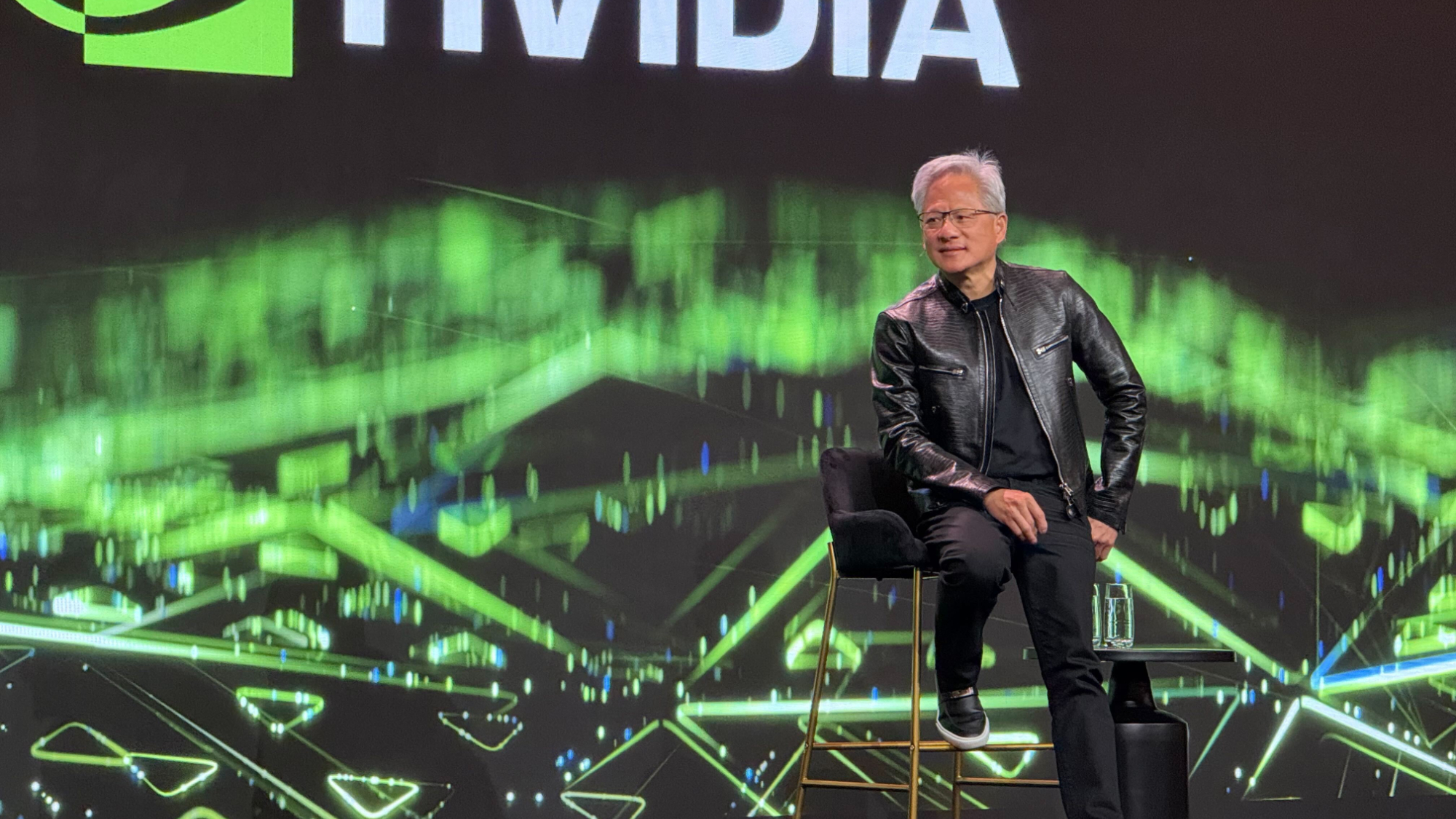

With the ongoing chip and supply crunch, senior figures across the chip and supply chain have found themselves vying for crucial supplies, whether that be HBM, GPUs, DRAM, or NAND flash. Nvidia CEO Jensen Huang is reportedly set to visit China, with the intent of lobbying the government to allow more Nvidia H200 AI accelerators into the country. Huang isn't the only senior figure in tech to make urgent trips to smooth out supply or sales issues, and they're growing ever more prominent.

Major companies are facing bottlenecks for the ongoing AI infrastructure buildout. It’s a reminder that no matter how big your company is or how much money you have to hand, some issues can’t just be solved by throwing money at the problem.

Sometimes, you need to have a face-to-face discussion. With supply chains now far more governed by allocation, lead times, and geopolitical friction, executive presence is becoming a key part of competitive deal-making. A CEO at your lunch table doesn’t just give you an inside line to the person with real decision-making power; it shows commitment, reassures shareholders, and shows that personal touch that can make all the difference.

Whether it’s for high-bandwidth-memory, glass cloth, GPUs, or cutting-edge wafers, CEOs from many of the major tech firms are heading to factory floors, board rooms, and restaurants across the globe to try to secure a better deal.

Making memories

Huang is one of the most obvious examples of this executive attention strategy. He was spotted eating and drinking with the heads of Samsung and Hyundai in Seoul, South Korea, at the end of October last year, partly to announce AI data center build-outs, but also to discuss memory supply. He followed that up with a trip to the Apec CEO summit later that same week, where he met the joint chairman of SK Group, the parent company of memory maker SK Hynix.

Just 10 days later, he’s in Taiwan meeting TSMC CEO, CC Wei, not only sporting TSMC-branded sneakers, but to obviously massage the relationship between the two, as Nvidia leapfrogs Apple to become the company's largest customer. Huang is far from the only CEO who uses this strategy of face-to-face deal-making. OpenAI Sam Altman visited TSMC for a “secret” meeting in late September 2025, as well as setting up meetings with Foxconn executives. Both are major suppliers of OpenAI, while Foxconn is a major partner with Japanese investment firm Softbank, which is also invested in OpenAI – it’s all so circular.

Reuters reported that executives from Chinese firms Alibaba, ByteDance, and Tencent were dispatched to Samsung and SK Hynix in October and November to lobby for increased allocation of memory chips. In December, Seoul Economic Daily reported that Microsoft, Meta, and Google sent purchasing executives to Korea to attempt to secure a greater supply of key components, such as memory chips. Google even allegedly fired staff who were unable to secure enough supply of memory, leaving it struggling to supply its customers in turn.

Trendforce also reported that following “intense visits” from a top-tier PC company, the unnamed company was able to secure memory supply agreements with Samsung, SK Hynix, and Micron. Apple and Qualcomm have been trying to secure more glass cloth fibers during visits to various firms and government departments in Japan and China in recent weeks, too.

The increasing frequency of these stories emerging is a pattern, as supplies get squeezed, companies are making it a matter of priority that key members of staff are deployed to negotiate, and some are more successful than others.

Bringing out the big guns

If memory shortages are a sign of the times, then major tech firms flying executives to Korea and Taiwan is a sign of a desperate struggle. Companies need these deals to be as competitive as they can, and they’re making sure that they put their best foot forward, and signal to suppliers that they have both the funds and the demand customers to keep business going.

In many cases, these meetings aren’t just private lunches; they’re public events, garnering press attention at the time and in the aftermath. They’re a signal of confidence; a public declaration of a partnership with a long tail. That certainty and long-term guarantee of business and revenue are the kind of commitments memory makers want see from customers as prices skyrocket. For everyone else hoping to ride the AI hype wave, commitments from companies like Nvidia, Google, Meta, and Microsoft, with their enormous cash stockpiles and diversified businesses, can mean a softer landing if and when the AI bubble bursts, too.

With the AI buildout causing shortages in a surprising array of businesses, bottlenecks are appearing everywhere. From glass cloth and NAND to PCB drill bits, to copper, and even electricity itself. Companies have a lot of supply fires to put out, and executives are the way they’re looking to shortcut that and get the deal done fast and effectively, while outcompeting similarly-sized companies looking to do the exact same thing.

As AI demand upends the industry, the enterprise and consumer hardware segment hangs by a thread, or perhaps a noodle. Unassuming restaurants in Taiwan and other regions have become ground-zero for billion-dollar deals.

4 hours ago

4

4 hours ago

4

English (US) ·

English (US) ·