Tom's Hardware Premium Roadmaps

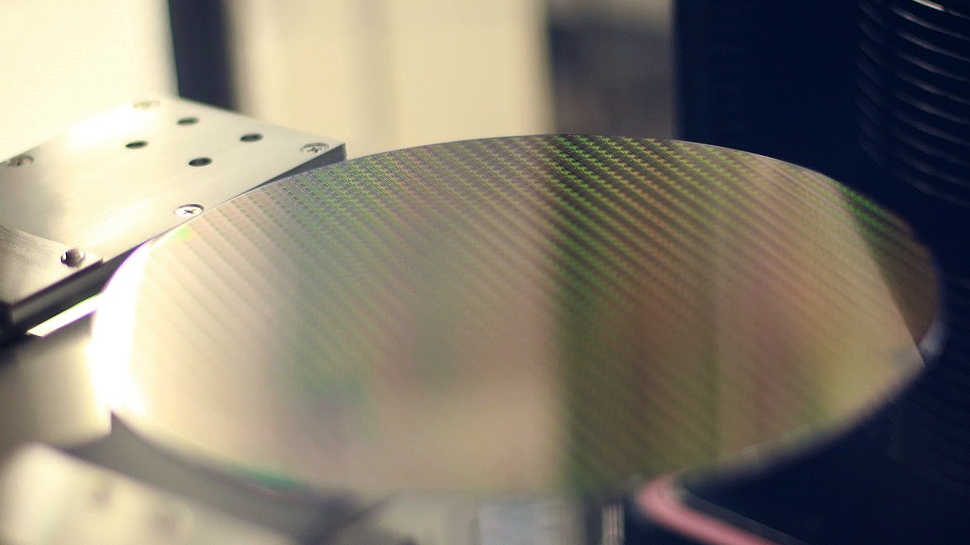

China’s SMIC has raised wafer prices by roughly 10% across parts of its production portfolio, according to TrendForce, with memory-related products leading the increase. The adjustment, which is expected to take effect “shortly,” comes as China’s largest foundry runs near full utilization and faces sustained demand from domestic customers building inventories of memory and logic chips.

While SMIC has not publicly confirmed the change, the pricing shift is consistent with its recent financial disclosures showing utilization rates approaching the mid-90% range and improving margins after several quarters of pressure.

Memory products set the pace

By far the strongest driver behind the price increase is memory. SMIC does not compete directly with the largest DRAM and NAND vendors, but it plays an important role in China’s domestic memory ecosystem, supplying wafers and mature-node capacity to companies producing DRAM, specialty memory, and controller silicon.

After more than a year of oversupply, memory pricing began to firm earlier this year as manufacturers cut output and demand recovered from data centers, AI infrastructure, and consumer electronics. HBM, which is not yet in production in China, has absorbed a growing share of advanced capacity at leading-edge fabs, while conventional DRAM and NAND suppliers have been cautious about bringing idle lines back online. That imbalance has tightened supply across the value chain, including at foundries like SMIC that serve domestic memory programs.

From a timing perspective, raising prices now is more favorable for Chinese memory. The company’s most advanced processes remain constrained by export controls, but its mature and specialty nodes are heavily utilized. That has created a sweet spot for memory-related production because, by raising prices where demand is strongest, SMIC can drive up revenue per wafer without materially risking utilization. That’s a balance that has been difficult to achieve over the last few years, when the memory market was at odds with its current supply-and-demand dynamics.

Capacity pressure and geopolitics

SMIC’s decision to increase prices cannot be separated from the geopolitical environment shaping China’s semiconductor industry. Export restrictions on advanced manufacturing equipment have limited SMIC’s access to the most cutting-edge tools, but they have also accelerated domestic demand for locally produced chips at mature nodes. Chinese customers that once relied on overseas foundries have increasingly turned inward, pushing utilization higher at SMIC and peers such as Hua Hong.

SMIC’s fabs are known to be operating close to capacity, leaving limited room to absorb additional demand without either expanding output or adjusting prices to extend their useful life. In that context, a 10% increase seems like it’s at the lower end than what the market would probably be willing to absorb given the sustained load on existing capacity.

What’s going on at SMIC contrasts with the situation at leading-edge foundries outside China. Companies such as Samsung have also adjusted prices, particularly for advanced nodes, where operating costs continue to rise. SMIC does not compete directly at those nodes, but the broader trend is similar and reinforces the idea that foundry pricing is firming across multiple tiers of the market.

Policy has also altered customer behavior, with Chinese system makers and component suppliers now preferring to secure long-term supply agreements, even at higher prices, to reduce exposure to trade disruptions. That willingness, whether down to government pressure or otherwise, supports price increases at domestic suppliers and reduces the likelihood of abrupt demand pullbacks that could otherwise force discounts.

Supply chain implications

The immediate impact of SMIC’s price increase will be felt most acutely by Chinese chip designers and memory producers that rely on its capacity. For those firms, higher wafer costs add pressure to margins already squeezed by competition and, in some cases, by government-mandated pricing discipline downstream. However, many of these customers are operating in markets where prices are also rising, allowing at least partial cost pass-through.

Beyond China, the move is another data point suggesting that the semiconductor downturn has reached its floor. Memory pricing has historically been volatile, but the current recovery is notable for its breadth. DRAM, NAND, and specialty memory are all seeing firmer conditions, and that strength is filtering back to foundries and materials suppliers. Globally, SMIC’s decision further highlights a divergence between segments; advanced-node logic remains capital-intensive and politically constrained, while mature-node capacity, once considered commoditized, is proving resilient. Foundries with strong positions in those nodes are increasingly able to exert pricing power.

That shift has implications for companies across the ecosystem, from equipment vendors to end-product manufacturers. Higher wafer prices contribute incrementally to higher chip costs, which can accumulate as designs move through packaging, testing, and assembly. While a 10% increase at the foundry level does not translate directly into a 10% increase in final device prices, it reinforces upward cost pressure in a market that had grown accustomed to discounts.

Taken together, the price adjustment reflects a foundry navigating constrained capacity, strong domestic demand, and a rapidly changing market. It is a reminder that, even without access to the most advanced nodes, suppliers can regain leverage when utilization tightens, and customers prioritize supply security. As memory markets continue to recover, similar dynamics may emerge at other mature-node fabs, both inside and outside China, reinforcing a broader recalibration of semiconductor pricing.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

3 weeks ago

17

3 weeks ago

17

English (US) ·

English (US) ·