Tom's Hardware Premium Roadmaps

Alongside memory, power, water, and political capital, AI data center builders and major component manufacturers are now contending with a new bottleneck in their supply chains: Glass cloth. As Nikkei Asia reports, major tech companies like Apple, Amazon, Google, and Nvidia are all tussling over the supply of glass cloth fibers, which are vital to component production, and the most advanced types are produced by a singular Japanese company.

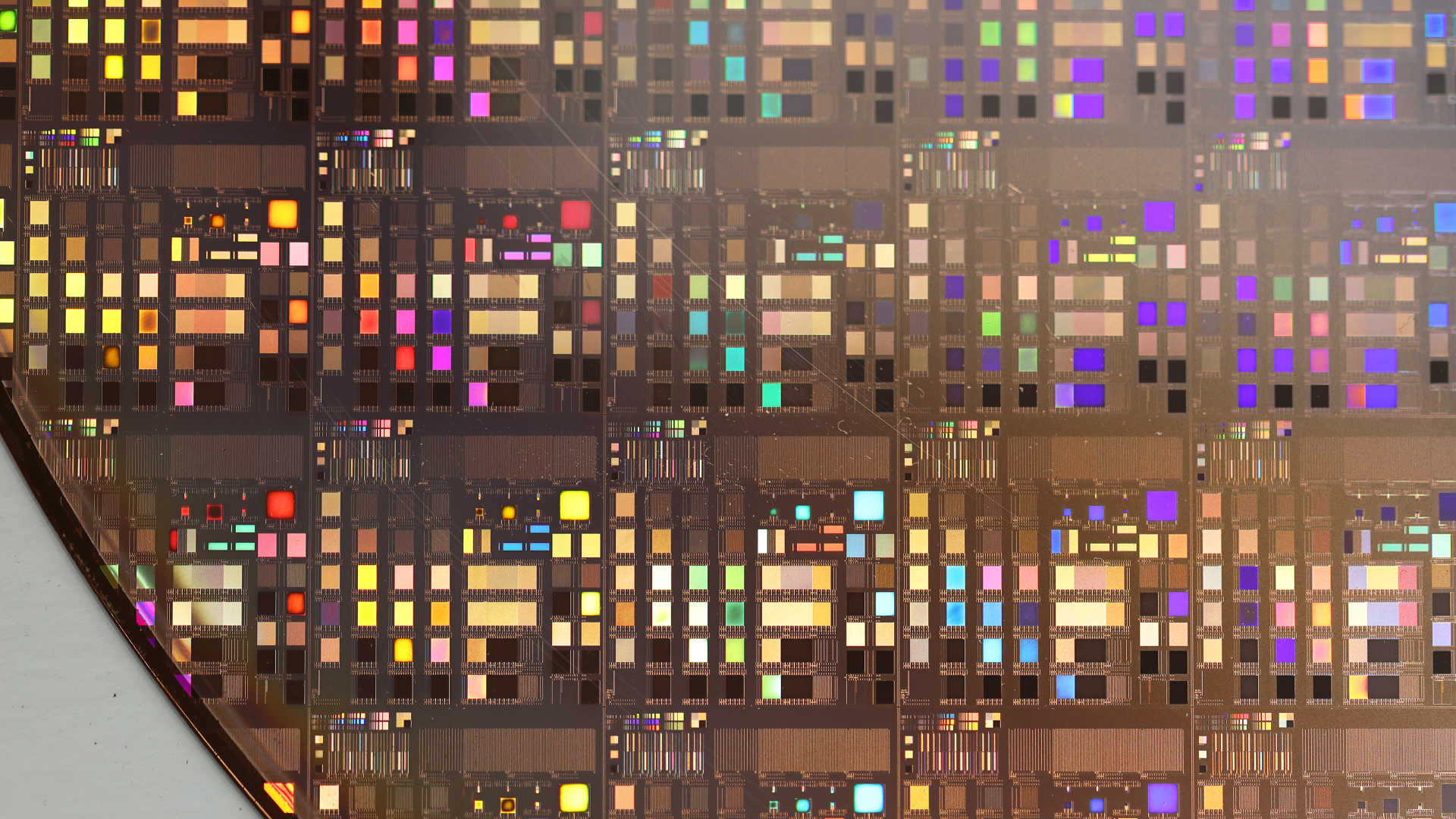

This special type of glass fiber material is known as low-coefficient-of-thermal-expansion (CTE) glass, colloquially known as T-Glass. The fibers are strong and rigid, facilitating high-speed data transmission, making them ideal for the latest generation processors, component PCBs, and various key AI components for the new data centers that everyone wants to build.

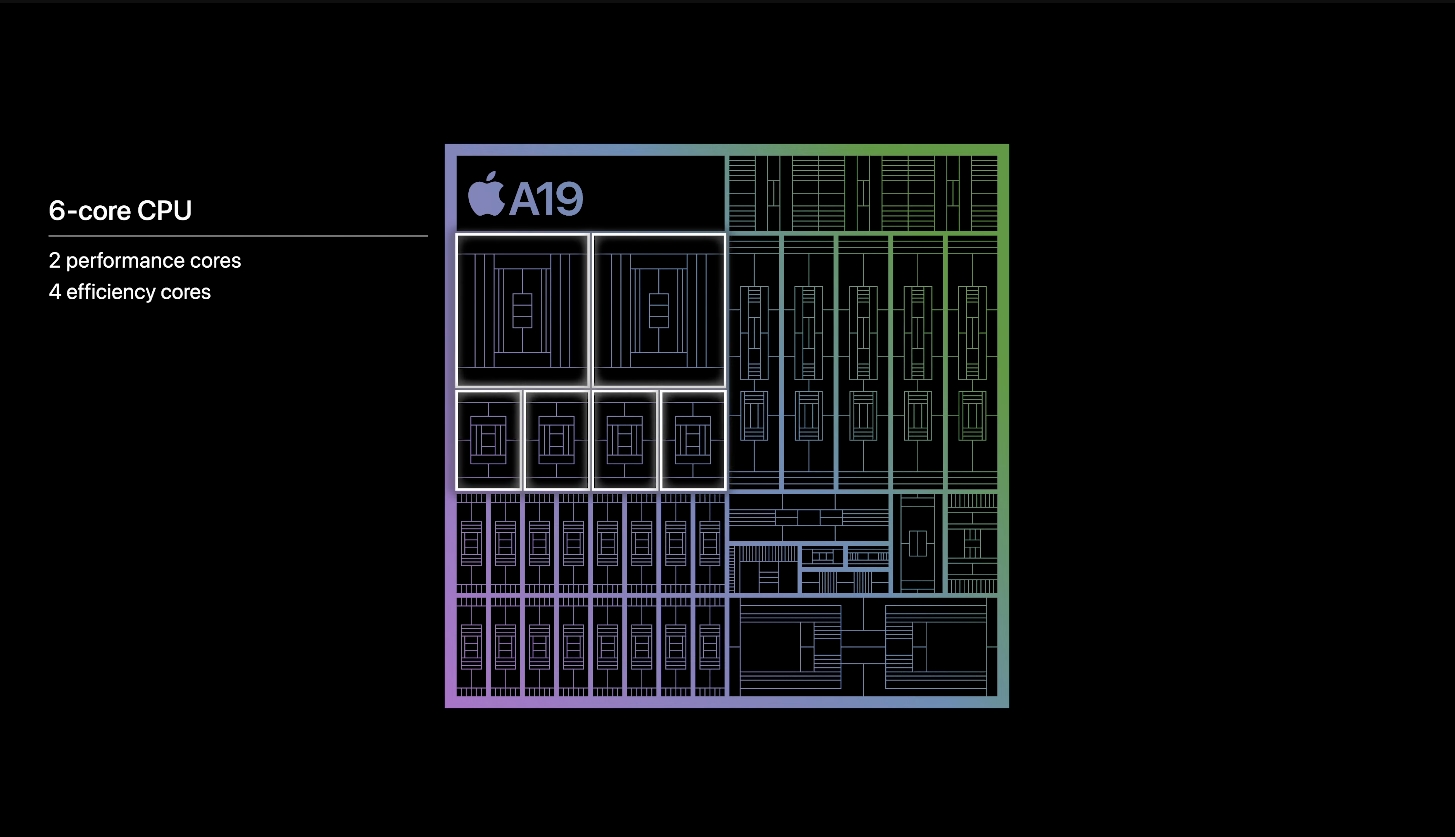

Like the memory industry shortages, this bottleneck for high-spec glass cloth risks interfering with major consumer component and device manufacturers like Apple, too.

There’s only so much glass out there

The burgeoning demand for Glass Cloth is creating a new, unforeseen shortage in the supply chain, with one Nikkei Asia source calling it “one of the biggest bottlenecks for the electronics-making and AI industry for 2026.” Considering we’ve already got shortages of memory, GPUs, power, and water to build and run these data centers, adding one more bottleneck isn’t going to help matters much.

Glass Cloth is not to be confused with Glass Substrates, which is a functionally distinct technology currently being adopted by the likes of AMD and Qualcomm.

In much the same way as Nvidia CEO Jensen Huang made trips to South Korea in the Fall of 2025 to court memory manufacturers, some companies saw this glass cloth shortage coming. Apple reportedly sent representatives to Japan to try to secure greater supplies of the materials used in developing PCBs in various products, including the glass cloth fibers produced by Nittobo. These meetings included interactions with Japanese government officials to see if Apple could be awarded a greater share of the company’s production.

It wasn’t the only company to do so, either. Nvidia and AMD have dispatched staff to Nittobo’s headquarters to try to secure more favorable deals.

Supply to be strained until at least 2027

Unfortunately, trying to sweet-talk their way to a greater share of existing supply may be the only hope these companies have of not being adversely affected by the glass cloth shortages. Nikkei Asia reports that supply issues of this vital material won’t be alleviated until 2027. As TrendForce reported in November, this comes from a strategic partnership Nittobo has signed with Nan Ya Plastics, a glass cloth manufacturer that operates under the Fomosa Plastics Group in Taiwan.

Although Nan Ya Plastics doesn’t offer the same advanced glass cloth fibers that Nittobo does, Nan Ya Plastics claims that by 2027, it will be able to produce around 20% of the speciality fibers currently produced by Nittobo, which could help ease the supply constraints currently facing Nittobo customers. Apple is alleged to have asked its Japanese supplier, Mitsubishi Gas Chemical (which uses Nittobo glass cloth to produce PCBs for Apple), to oversee the Chinese firm’s development of an alternative product that could be substituted for Nittobo’s cloth material.

Qualcomm has also visited an alternative Japanese glass cloth developer named Unitika to see if it could bring up production to alleviate the shortages. Unitika’s production levels are far below Nittobo’s, so any additional supply it can provide is expected to have a limited effect on the overall bottleneck.

None of these efforts of alternative supplies is likely to yield much in the way of results. 36KR reports that Nittobo, and fellow Japanese manufacturers Asahi Kasei and Asahi Glass collectively control over 70% of the glass fiber market, and a vast majority of the advanced glass cloth production. T-Glass and alternatives like NE-Glass are extremely difficult to develop and require extensive materials testing to achieve production at any kind of regular capacity with consistent quality.

Nittobo has been developing these products for decades, giving it an incredible head start, and these companies are incredibly protective of that advantage. They have traditionally limited sales to companies that don’t deal with Chinese manufacturers like Huawei and ZTE. Although this has led to the emergence of Chinese competitors, they can’t produce T-Glass like Nittobo and its Japanese contemporaries can.

For now, at least. They are innovating and using a new generation quartz cloth that has recently passed Nvidia’s certification, opening up the potential for alternative sources of advanced glass cloth in the future.

No bottleneck breakthroughs

For now, the shortage is here to stay, and that’s creating unique tensions in various affected industries. Apple, used to being one of the global megapowers in terms of purchasing power, is now facing competition in its supply chain from similarly sized heavyweights like Nvidia. That could mean supply constraints of next-generation Apple devices, an increase in BOM costs for products that are already sold at a premium, and potential launch delays if adequate stock can’t be raised.

All of this could slow or stall AI industry growth in 2026. For an industry that has relied on incredible momentum to keep it moving forward despite growing bubble concerns, that could be a real problem before too long.

3 hours ago

4

3 hours ago

4

English (US) ·

English (US) ·