Nikkei reports that BOE, a leading China-based maker of LCD and OLED displays, is reportedly looking to make glass core substrates for next-generation processors designed by domestic designers. The company plans to launch a pilot production line for glass core substrates in the second half of 2025, which will not only put it on the map in the semiconductor industry but also in line with giants such as Intel, Samsung, and TSMC.

"BOE is shifting its resources from display to focus more on semiconductor-related technologies," a key display and chip equipment supplier executive told Nikkei.

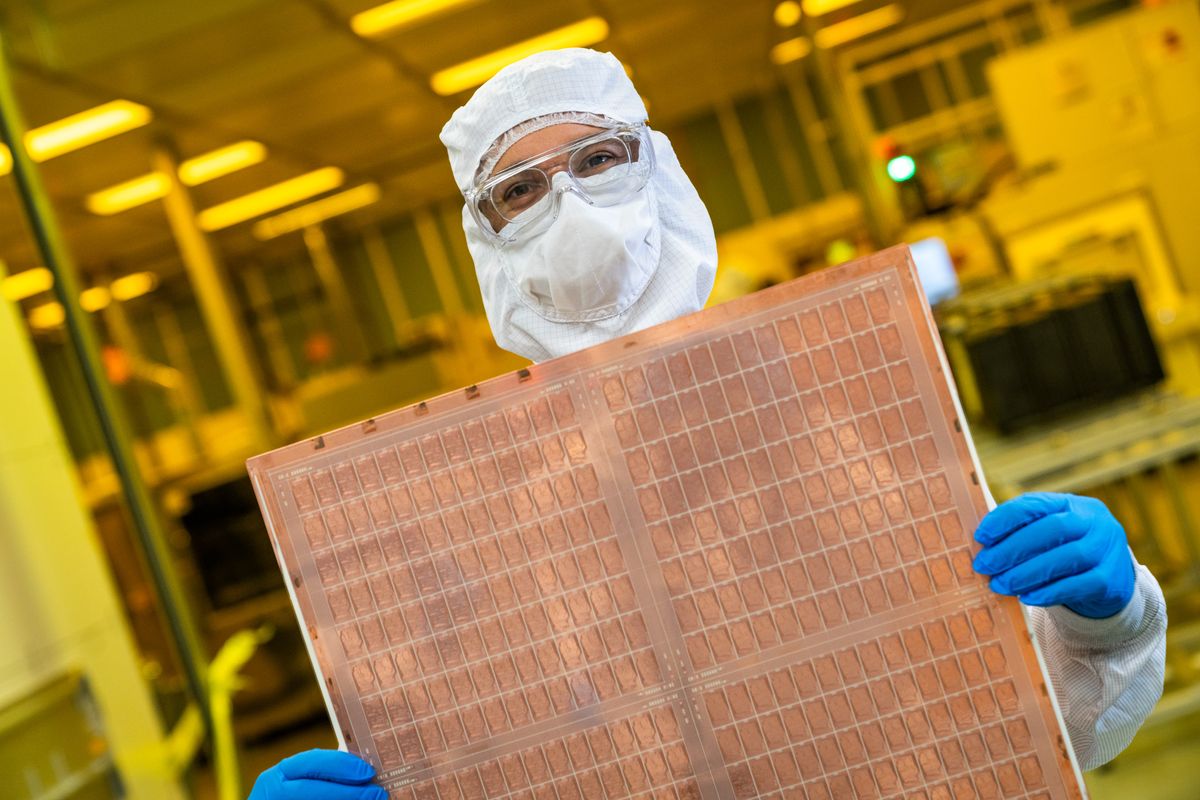

According to the report that cites two individuals familiar with the matter, BOE plans to establish a pilot production line for glass core substrates in the latter half of this year. BOE has never confirmed the plan to Nikkei. On the one hand, the company is familiar with handling rectangular panels and, one of the world's largest makers of LCD and OLED panels, knows how to manage yields. On the other hand, fundamental differences in glass composition and the stringent precision demands of semiconductor packaging mean that significant research and development, re-tooling, and new process technologies are mandatory.

The potential payoff is high, though: If these technical and economic hurdles can be overcome, panel-level packaging on advanced glass could unlock next-generation performance and cost benefits in chip assembly.

According to Nikkei Asia, BOE reportedly engages with suppliers to procure semiconductor equipment tailored for panel-based chip packaging technologies, reflecting its shifting priorities. The report says an executive from a major supplier of display and chip manufacturing equipment noted that BOE is reallocating its resources away from displays to place greater emphasis on semiconductor technologies.

Another executive from a company specializing in chipmaking tools indicated that BOE is not alone and that many display manufacturers aim to carve out a presence in the semiconductor industry. However, BOE is seen as having a stronger likelihood of success due to its ample resources and proactive approach to achieving technological breakthroughs. According to Nikkei, the source added that BOE is dedicated to researching innovative materials such as glass core substrates. Boyce Fan, a research vice president at TrendForce, echoed this perspective.

He observed that Chinese display manufacturers are expanding into the semiconductor sector, with BOE leading due to its advanced capabilities and abundant resources. However, Fan emphasized that significant progress in this area cannot be achieved quickly, as the processes require thorough testing of the technology and sufficient client demand to materialize.

New challenges = New opportunities, major ones

Glass substrates offer advantages over organic ones, including exceptional flatness for enhanced lithography precision and better dimensional interconnect stability. These qualities are critical for next-generation system-in-packages (SiPs) with dozens of chiplets. Additionally, according to Intel, glass substrates excel in thermal and mechanical stability, enabling them to handle higher temperatures, which is particularly beneficial for data center applications. Finally, they promise to support an up to 10X higher interconnect density, essential for improving power delivery and signal routing in advanced SiPs.

There are challenges for BOE and other display panel makers associated with going from LCD and OLED production as they will have to deal with materials they are exploring but are not yet mass-producing. From an AMD patent, we know that the company explores glass substrates made of materials like borosilicate, quartz, and fused silica, which provide significant benefits compared to conventional organic materials as they feature remarkable flatness, dimensional stability, and superior thermal and mechanical stability. While borosilicate, quartz, and fused silica could provide some benefits to displays, and therefore BOE and its rivals are likely R&D'ing them, it is not clear how close they are for mass production.

U.S. government's curbs against China's semiconductor sector somewhat slow down its development, but they also open doors for companies to enter this industry, being confident that they will not face any significant rivalry. Now that leading chip designers and makers cannot supply to major entities in China, domestic companies get a carte blanche to develop advanced computing platforms without significant risks of losing contracts to Western companies. To that end, spending on R&D of new materials and manufacturing technologies and re-tooling fabs could be well justified for companies like BOE.

1 day ago

5

1 day ago

5

English (US) ·

English (US) ·