TLDR:

- Bitcoin leads $2.7B in inflows, matching 54% of gold ETP market size.

- Ethereum logs 12th straight week of inflows with $990M added.

- U.S. dominates regional inflows; Germany posts notable outflows.

- XRP sees $104M in outflows while Solana gains $92.6M in inflows.

Digital asset investment products attracted $3.7 billion in net inflows last week, marking one of the strongest weeks in the sector’s history.

This surge pushed total assets under management (AuM) to an all-time high of $211 billion. The inflows were led by Bitcoin and Ethereum, both showing renewed investor confidence and institutional demand. Trading volumes also climbed sharply, signaling increased participation across markets.

Regional flows, however, revealed mixed sentiment outside the United States.

Bitcoin Drives Weekly Gains as Institutional Demand Rises

Bitcoin recorded $2.7 billion in weekly inflows, the highest among all digital assets.

This increase raised Bitcoin’s total AuM to $179.5 billion, now matching 54% of the gold ETP market. According to the report, this wave of inflows marks the 13th consecutive week of gains for crypto investment products.

Market observers noted that the surge coincided with record activity on July 10, which posted the third-highest daily inflow ever. Exchange-traded product (ETP) volumes reached $29 billion for the week, doubling the 2024 average.

Short Bitcoin products showed little change, indicating a largely bullish sentiment.

Ethereum Sees Fourth-Largest Weekly Inflow

Ethereum also posted strong numbers, pulling in $990 million in its 12th straight week of inflows. This marks its fourth-largest weekly increase on record. Over the past three months, these flows accounted for nearly 20% of Ethereum’s total AuM.

The report also highlighted that Ethereum’s proportional growth outpaced Bitcoin during the period. Analysts attributed this trend to favorable technical indicators, including a drop in exchange reserves and rising trading activity.

Regionally, the United States led with $3.7 billion in inflows. Meanwhile, Germany recorded outflows of $85.7 million, signaling local investor caution. Switzerland and Canada posted moderate inflows of $65.8 million and $17.1 million respectively.

The data suggests that U.S.-based institutional investors remain the most aggressive buyers in the current market cycle. Regulatory clarity and ETF adoption are likely supporting this momentum. In contrast, European sentiment appears fragmented.

Altcoin Flows Reveal Diverging Sentiment fom Bitcoin

Other digital assets showed mixed performance. Solana attracted $92.6 million in inflows, reflecting growing investor interest beyond Bitcoin and Ethereum. XRP, however, experienced outflows of $104 million, the largest among tracked assets.

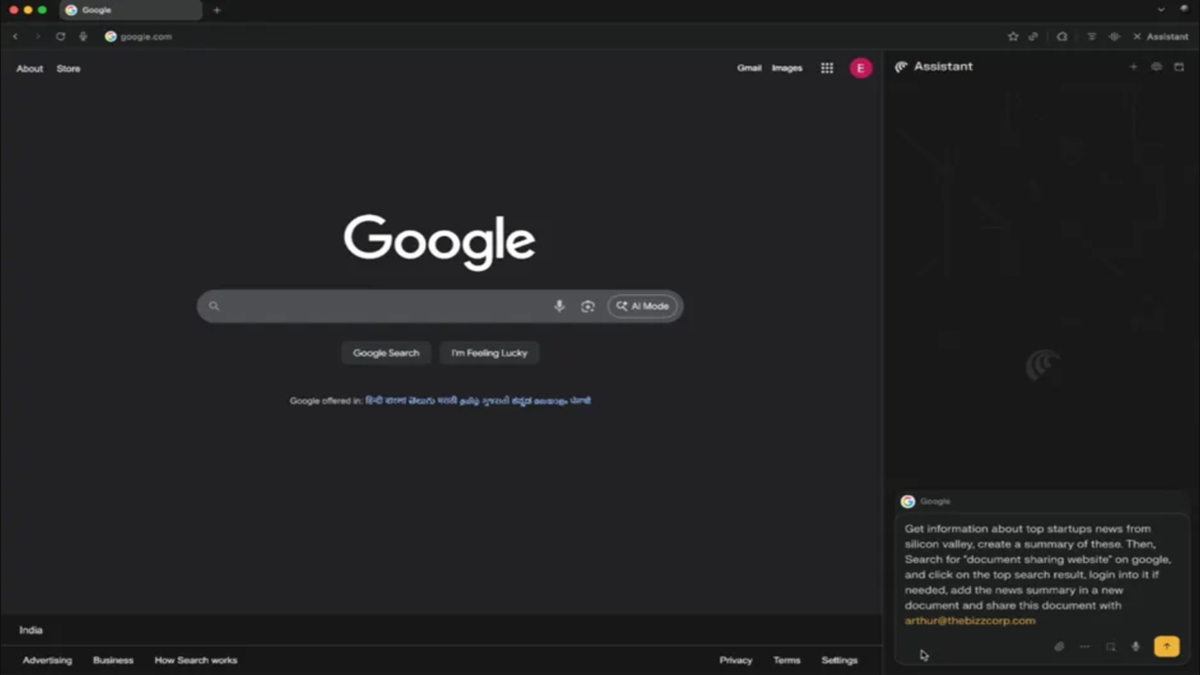

According to insights from AlvaApp, the inflows suggest strong backing from institutional managers and ETF products.

Reduced exchange supply and high volumes are reinforcing the bullish outlook. Yet, traders remain cautious of potential volatility due to overbought signals in the market.

The recent streak of inflows has lifted year-to-date net flows to $22.7 billion. Overall, the continued growth in both participation and capital signals a maturing market.

3 months ago

31

3 months ago

31

English (US) ·

English (US) ·