The stability of Bitcoin at over $110,000 represents serenity to a market that was reeling after a volatile week that was precipitated by U.S.-China tariff news. Coming out of the tightening of the consolidation areas in the technical indicators, traders in XRP and Cardano are predicting a potential 35% rebound.

In this cautious optimism, investors are shifting to the best crypto to buy MAGACOIN FINANCE, which has already raised over $17 million and has a good presence of whales.

Bitcoin Holds Above $110K Despite Tariff-Induced Volatility

Bitcoin (BTC) traded around the range of approximately 113,000 and remained supported at that level on Friday, having been down to 108,000 at the start of the week. The downturn was catalyzed by the news by President Donald Trump of full tariffs on Chinese products, which caused an overall market shock in equities and crypto.

Still, despite the severe sell-off, the fact that BTC recovered over the 110,000 level indicates that the institutional pressure is still present. Analysts observe that excess leverage in the system was probably re-set following the liquidation of over $900 million of leveraged long positions. One of the market strategists announced the occurrence as a healthy purge to enable fresh accumulation.

Source: X

Whale following data also indicate that large buyers are adding more exposure between $108,000 and $111, 000. This accumulation trend usually goes before volatility contractions that may result in robust directional movements. Technical configurations indicate that the long-term hold onto BTC above 109,500 would maintain the BTC in an overall trajectory of growth, and the next resistance would be around 118,000.

Although macro uncertainty still exists, analysts reckon that Bitcoin resilience can act as a stabilizer in the overall crypto industry. The decision to consolidate over $110,000 in the near term is seen as positive, and other cryptocurrencies like XRP and Cardano will be able to recover.

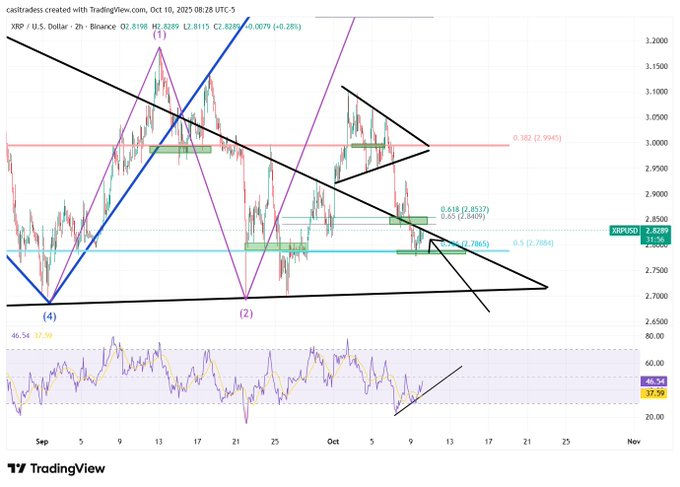

XRP Consolidates Between Key Levels as Traders Eye Breakout

XRP price is in a small range between $2.79 and $2.83, and is testing Fibonacci support levels. Analyst CasiTrades noted that the price has been obeying the zone of $2.79 on all the hourly and higher time frames which is an indication of continuing purchase strength.

An upsurge beyond $2.83 and subsequently at $3.00 would prove the beginning of a significantly bigger wave-three movement with levels of between $4.00 and $4.50 in mind.

Source: X

Source: X

Market trend is becoming better because the RSI is moving up and traders are citing the past trends that were associated with the Covid recovery of 2020. Analyst Amelie made comparisons of the current structure with the past cycles where sharp declines would be followed by multi-month gains. Technical models forecast the possibility of an upside extension to $4.00 and higher due to XRP maintaining a level above the $2.75 price zone.

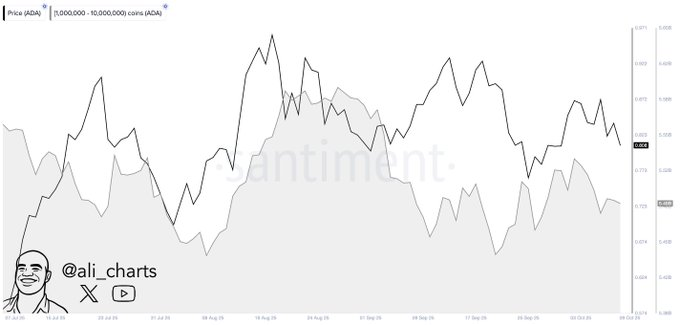

Cardano Stabilizes as Whale Distribution Slows

Cardano (ADA) is trading at around $0.81 following weeks of profit-taking and intense selling pressure. According to on-chain data provided by Santiment, big ADA wallets decreased their numbers slightly, which indicates that the momentum of selling is decreasing.

Derivatives measures also indicate a change towards balanced positioning, where the long-to-short ratio recovered after achieving its most bearish value in a month. Analysts are currently monitoring ADA to rebound and regain the $0.90-$0.95 band which will mark the way to a 35% rally objective.

Source: X

Even after the correction, ADA has not decreased its activity on its network, as well as its staking activity, which indicates that the community still participates. The traders still perceive the oversold structure of Cardano as a possible accumulation base before a more comprehensive recovery stage.

MAGACOIN FINANCE Presale Surges Past $15 Million

In the atmosphere of such consolidations, MAGACOIN FINANCE, a proven Ethereum-based presale project, has drawn an increasing level of investor interest. The Ethereum project has collected over $15 million, with more than 18,000 participants. Both CertiK and HashEx audits testify to the fact that the platform is concerned with the transparency of code and investor protection.

The tokenomics of the project focus on scarcity, deflationary burns, and governance by the community. Analysts are projecting a 75x ROI potential on the event that the trend of growth continues after listing.

Big wallets of Bitcoin and Avalanche ecosystems are being said to park MAGACOIN FINANCE as a tactical reserve in case the market goes bad. The trend is indicative of a wider shift in investors towards more established assets and focus early on projects that have verifiable security and growth potential.

Conclusion

As Bitcoin gathers above $110,000 and XRP and Cardano get ready to potentially rebound 35%, confidence is slowly re-entering the market. This has resulted in less leverage, and the whales have now resorted to accumulating, indicating the ability to have a healthier trading environment in the next quarter.

To those investors who want to have a balanced exposure, the MAGACOIN FINANCE can provide the early-stage growth opportunities with the verified audits, robust community backing, and clear roadmap. With the current ETF optimism, it is evident that Bitcoin, XRP, Cardano, and MAGACOIN FINANCE are some of the best cryptos to buy in this time around until ETF-driven inflows resume.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

1 month ago

35

1 month ago

35

English (US) ·

English (US) ·