Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

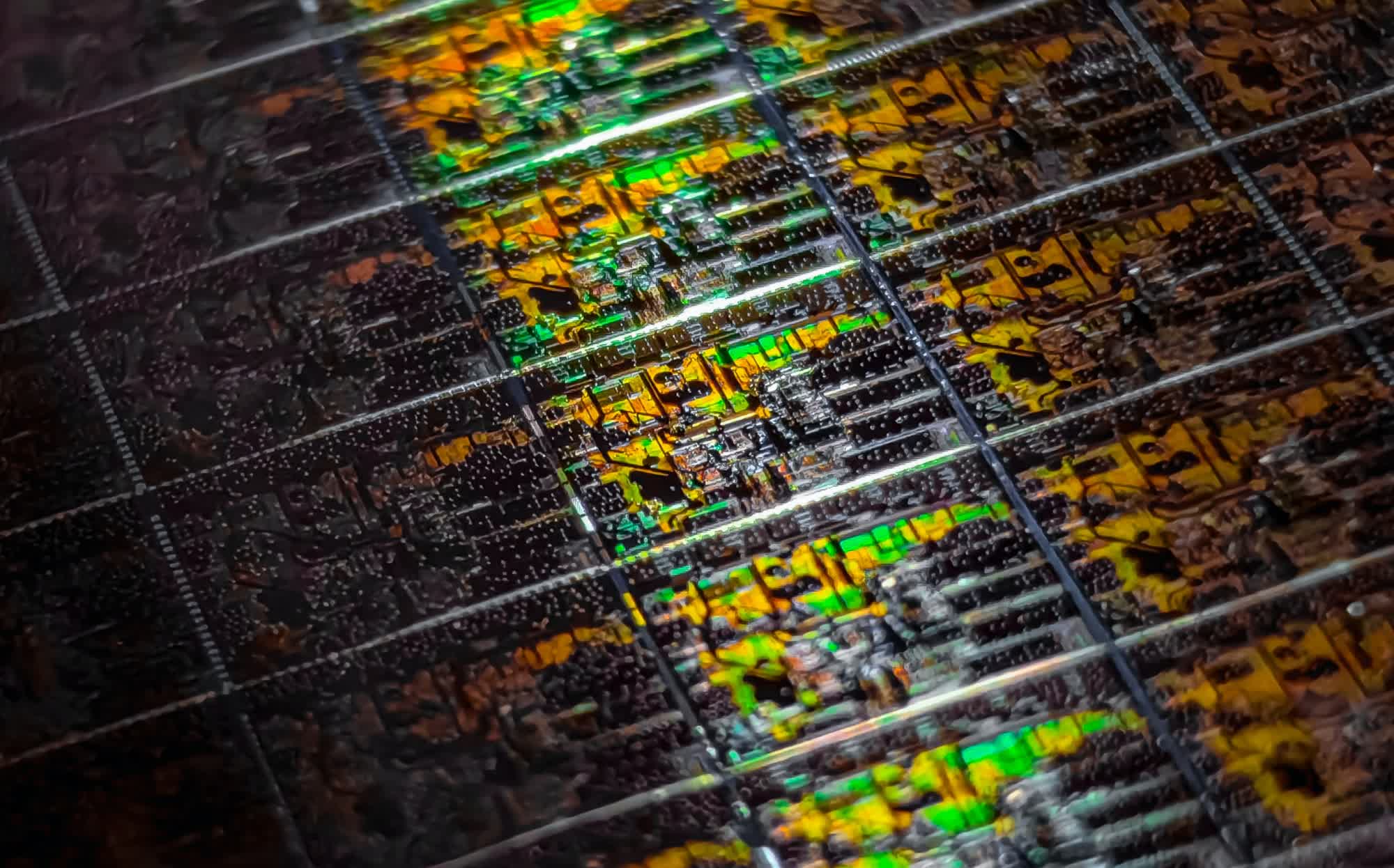

Cutting corners: Samsung's Texas semiconductor fab was intended to be a key facility for the mass production of advanced processes below 4nm. However, several setbacks have raised questions about Samsung's ability to compete in the advanced chip manufacturing space. The company is rapidly losing ground to TSMC, and unless it regains its footing, its decline could significantly impact the semiconductor landscape.

Samsung is facing ongoing challenges with 2nm chip yields, prompting the company to withdraw personnel from its $17 billion Taylor, Texas plant, which was designed to be a hub for mass production of advanced processes below 4nm. This decision, first reported by Business Korea, comes amid repeated delays in the company's mass production timeline, now pushed back from late 2024 to 2026.

Samsung's foundry yield for processes below 3nm currently stands below 50 percent, with its Gate-All-Around (GAA) technology yield reportedly as low as 10 to 20 percent. In contrast, the advanced process yields at its main competitor, TSMC, stand around 60 to 70 percent. Meanwhile, Samsung's chip manufacturing market share is dwindling as the performance gap widens, with TSMC holding 62.3 percent of the global foundry market, while Samsung's share has dropped to 11.5 percent.

Top 10 foundries by revenue (Q2 2024)

| 1 | TSMC | 20,819 | 18,847 | 10.5% | 62.3% | 61.7% |

| 2 | Samsung | 3,833 | 3,357 | 14.2% | 11.5% | 11.0% |

| 3 | SMIC | 1,901 | 1,750 | 8.6% | 5.7% | 5.7% |

| 4 | UMC | 1,756 | 1,737 | 1.1% | 5.3% | 5.7% |

| 5 | GlobalFoundries | 1,632 | 1,549 | 5.4% | 4.9% | 5.1% |

| 6 | Huahong Group | 708 | 673 | 5.1% | 2.1% | 2.2% |

| 7 | Tower | 351 | 327 | 7.3% | 1.1% | 1.1% |

| 8 | VIS | 342 | 306 | 11.6% | 1.0% | 1.0% |

| 9 | PSMC | 320 | 316 | 1.2% | 1.0% | 1.0% |

| 10 | Nexchip | 300 | 310 | -3.2% | 0.9% | 1.0% |

| Total of Top 10 | 31,962 | 29,172 | 9.6% | 96.0% | 96.0% | |

Units in USD millions. Data source: TrendForce

To see how far Samsung has fallen behind, one only has to look at TSMC's Arizona facility, where recent trial production has yielded results comparable to those of its established plants in Taiwan. The facility is on track to begin production at its first fab in the first half of 2025. The second fab, set to begin production in 2028, will produce chips using 2nm process technology with next-generation nanosheet transistors, in addition to 3nm technology.

Samsung is now rethinking its strategy and has kept only a skeleton crew at the Taylor plant. The company has a preliminary agreement with the U.S. government for close to $7 billion in subsidies under the CHIPS Act, which is now at risk, as the deal requires the plant to be operational.

To be fair, TSMC's Arizona facility also experienced setbacks in its construction and staffing. However, Samsung has been unable to resolve its issues, despite Chairman Lee Jae-yong's personal intervention, including visits to major equipment suppliers like ASML and Zeiss in search of solutions.

It may be that Samsung's challenges extend beyond technical issues. The pervasive bureaucracy within Samsung, slow decision-making, and low compensation are the main reasons for the decline in foundry competitiveness, a semiconductor professor told Business Korea. "The delayed investment timing compared to 20-30 years ago also indicates that the management is not fully aware of the current reality, necessitating a fundamental overhaul of the management system," this person said.

Samsung's recent struggles are particularly striking, given its history in semiconductor manufacturing. In 2022, the company became the first foundry to achieve volume production of 3nm chips, outpacing TSMC by nearly six months and Intel by several years. Samsung had ambitious plans to maintain its technological edge by being first to market with 2nm transistors. However, it now appears that this goal may be out of reach.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25624467/MPY_101_03438_R2C.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25242409/20230608_Palworld_Screenshot_02.png)

English (US) ·

English (US) ·