The crypto market is up on Oct. 29 as investors flooded crypto investment funds, and optimism mounted ahead of the US 2024 presidential election.

The total crypto market capitalization has risen by approximately 4.6% in the last 24 hours to reach $2.4 trillion. The rise in market cap includes gains from Bitcoin (BTC) and Ether (ETH), which have risen around 4% and 4.7%, respectively.

Crypto market performance Oct. 29. Source: Coin360

Let’s look at the factors driving the crypto market up today.

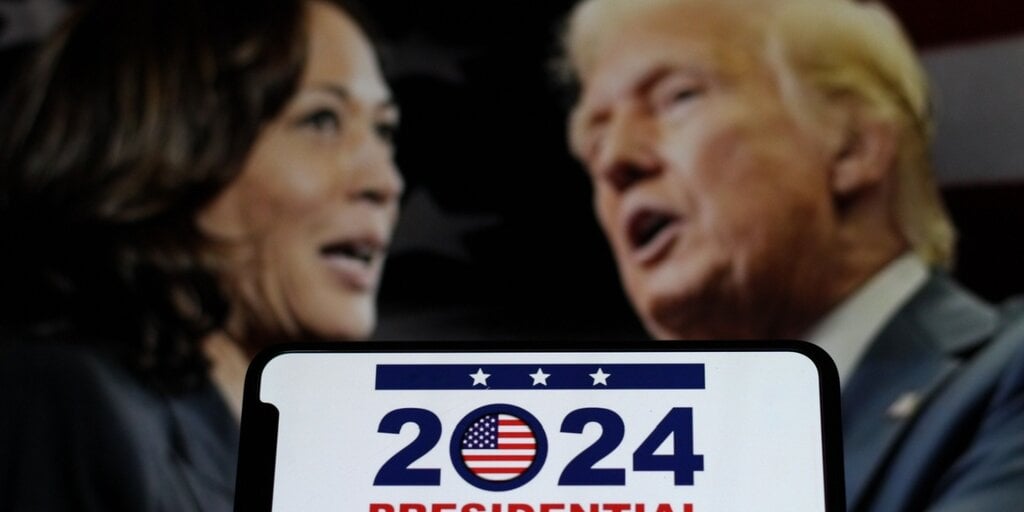

Trump’s potential presidency boosts crypto

With the US elections just seven days away, market sentiments are shifting as former President and Republican presidential candidate Donald Trump extends his lead over Vice President Kamala Harris in betting markets.

Key swing states have begun to lean Republican, with Michigan being “the only remaining state with a 50-50 race,” as observed by capital markets commentator The Kobeissi Letter.

The Kobeissi Letter shared Kalshi’s election prediction data showing Trump’s chances of winning the presidential race at 62% vs. Harris’s 38%.

Kalshi prediction market bet pool for US presidential election outcome as of Oct. 29. Source: Kalshi

Against this backdrop, traders are increasingly pricing in a potential Trump presidency and its possible impacts on the crypto market. Trump has been courting the crypto industry, presenting himself as a crypto-friendly candidate.

Democratic nominee and Vice President Kamala Harris’ stance on crypto is not clear and market participants are uncertain how her potential presidency could affect the entire digital asset market.

A Trump win is widely viewed as a possible catalyst for the price of Bitcoin and other cryptocurrencies, but investors are watching and waiting as the election nears.

Elsewhere, futures traders are waiting for the Federal Reserve rate policy decision on Nov. 7, just two days after the election day.

According to data from CME Group’s FedWatch Tool, the odds of a 0.5% rate cut at the Nov. 7 FOMC meeting have reduced to 0% at the time of writing, against a 95% expectation of a 0.25% rate cut and 5% possibility of rates remaining unchanged.

Fed target rate probabilities for Nov. 7 FOMC meeting. Source: CME Group

Investors flock to crypto investment funds

The crypto market’s ongoing gains align with the huge capital flows into the crypto investment products.

According to CoinShares’ “Digital Asset Fund Flows Weekly” report published on Oct. 28, institutional investors increased their exposure to digital assets, with crypto investment products seeing total inflows of $901 million during the week ending Oct. 25.

Once again, the lion’s share of movement was attributed to Bitcoin investment funds, which received $920 million in inflows.

Capital flows for crypto investment products. Source: CoinShares

According to the report, the year-to-date inflows now total $27 billion, nearly three times the 2021 record, with inflows of $10.5 billion.

CoinShares head of research James Butterfill attributed this to positive sentiment surrounding US presidential elections saying:

“We believe that current Bitcoin prices and flows are heavily influenced by US politics, with the recent surge in inflows likely linked to the Republicans' poll gains.”In the meantime, SoSoValue reported approximately $3.8 billion flowed into spot Bitcoin ETFs over the last two weeks, a figure not seen since March. More than $479 million entered these investment products on Oct. 29 alone.

Spot Bitcoin ETF flows table. Source: Farside Investors

The long-term trend for spot Bitcoin ETF flows remains on the rise, suggesting a significant surge in demand over the past 15 days, which positively impacts BTC prices.

Cryptomarket structure strengthens

The total crypto market capitalization has been increasing since mid-October 2023, rising 162% to reach a high of $2.721 trillion on March 14. Profit-booking across the board, geopolitical tensions and macroeconomic uncertainty resulted in a 37% decline in this value to $1.7 trillion on Aug. 5. The market has now recovered and rests 15% below the 2024 peak.

This has led to a V-shaped recovery pattern on the daily chart, reinforcing the recent strong momentum in backing the rally in crypto prices. The daily relative strength index (RSI) is positioned above the midline at 57, suggesting that the bulls are regaining control of the market.

Total crypto market capitalization, four-hour chart. Source: TradingView

As a rule of this technical setup, increased buying from the current levels could see the total crypto market cap rise toward the neckline of the prevailing chart pattern of $2.72 trillion in the near term.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

4 days ago

7

4 days ago

7

:quality(85):upscale()/2024/10/31/801/n/49351082/b84152bf6723c91b32cc73.86821940_.jpg)

English (US) ·

English (US) ·