Vitalik Buterin says public companies that buy and hold Ether broaden the token’s access to a wider range of investors, but cautioned on leveraging too heavily.

Ethereum co-founder Vitalik Buterin has thrown support behind so-called Ether treasury companies, but warned the trend could spiral into an “overleveraged game” if not handled responsibly.

In an interview with the Bankless podcast released on Thursday, Buterin said the growing number of public companies buying and holding Ether (ETH) was valuable as they expose the token to a broader range of investors.

“There’s definitely valuable services that are being provided there,” Buterin said. He added that companies buying into ETH treasury firms instead of holding the token directly gives people “more options,” especially those with “different financial circumstances.”

So-called crypto treasury companies have become the hottest trend on Wall Street, garnering billions of dollars to buy up and hold swaths of cryptocurrencies to give traders exposure to the tokens, with the most popular plays being Bitcoin (BTC) and Ether.

Leverage must not lead to ETH’s “downfall”

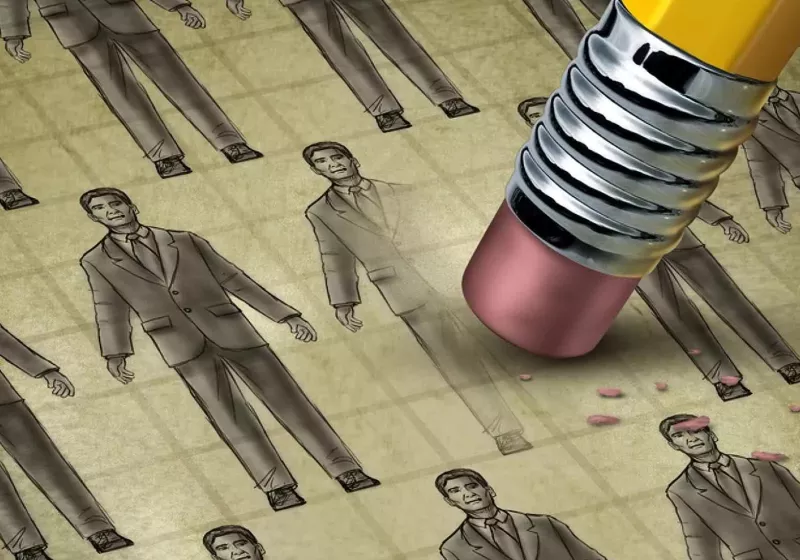

Buterin tempered his support with caution, stressing that ETH’s future must not come at the cost of excessive leverage.

“If you woke me up three years from now and told me that treasuries led to the downfall of ETH, then, of course, my guess for why would basically be that somehow they turned it into an overleveraged game.”He outlined a worst-case chain reaction where a drop in ETH’s price turned into forced liquidations that cascaded and forced the token’s price down, also causing a loss of credibility.

Are ETH Treasuries good for Ethereum?@VitalikButerin thinks they can be:

“ETH just being an asset that companies can have as part of their treasury is good and valuable… giving people more options is good.”

But he also issues a warning:

“If you woke me up 3 years from now… pic.twitter.com/W55oUD7Lke

However, Buterin is confident that ETH investors have enough discipline to steer clear of such a collapse.

“These are not Do Kwon followers that we’re talking about,” he said, mentioning the co-founder of the Terra blockchain that collapsed in 2022.

ETH treasury firms now hold nearly $12 billion

The market for public companies that hold Ether has ballooned to $11.77 billion, led by BitMine Immersion Technologies and SharpLink Gaming.

BitMine holds 833,100 ETH worth $3.2 billion — the fourth-largest holdings among public companies that hold any cryptocurrency.

Related: Ethereum beats Solana in capital inflows: $4K target in sight

SharpLink and The Ether Machine hold $2 billion and $1.34 billion worth of ETH, respectively, while the Ethereum Foundation and PulseChain round out the top five.

ETH making a comeback

ETH has seen a mixed year so far, falling from around $3,685 in January to a low of $1,470 on April 9, before rallying more than 163% to its current price of $3,870.

The trend of ETH treasury firms has been a notable catalyst behind the token’s comeback resurgence. Its price rally has helped ETH close the gap on Bitcoin and Solana (SOL), which have led the current bull cycle.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

3 months ago

34

3 months ago

34

English (US) ·

English (US) ·