Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

Editor's take: What would happen if Ubisoft were actually acquired, as current rumors suggest? Speculation is that a new owner would redirect it to produce fewer, but more commercially viable games and scrap some of its niche projects in favor of established franchises. There is no way to know for sure, but the market certainly favors the prospect of a buyout.

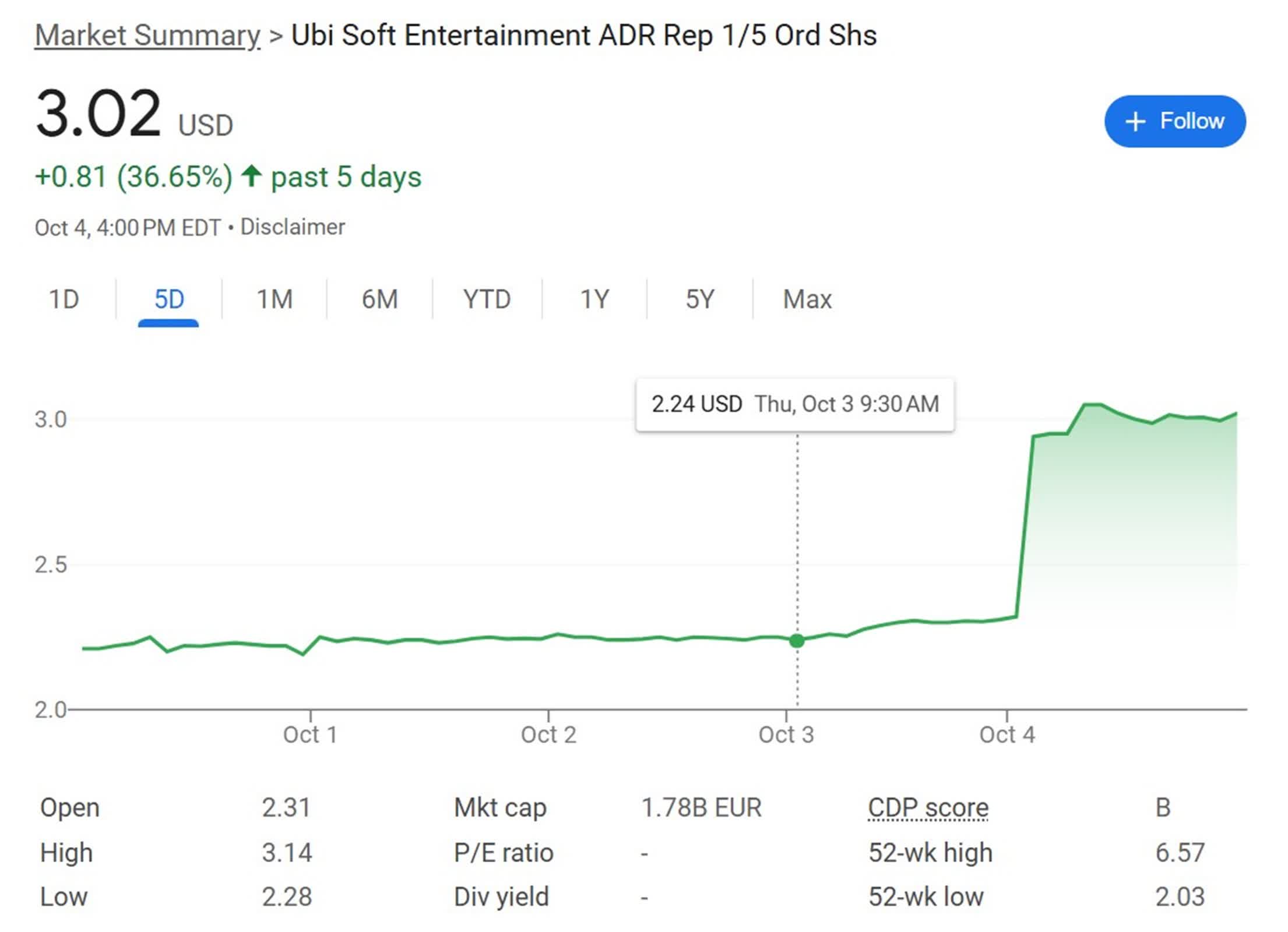

Last week Bloomberg reported that, according to people familiar with the matter, Tencent Holdings and the Guillemot family are exploring options for Ubisoft, including a potential buyout. The parties likely were not happy with the leak, but it ultimately provided a much-needed boost for the French video game developer, which has lost over half its market value this year. Following the story, Ubisoft's shares surged by 33 percent in Paris, marking the steepest gain since the company's initial public offering in 1996.

Ubisoft, known for its Assassin's Creed franchise, has seen its shares fall by about 40 percent this year, reaching their lowest point in over a decade last month. The company's market capitalization now stands at approximately €1.8 billion ($2 billion).

Tencent and the Guillemot Brothers have been consulting with advisers to find ways to stabilize Ubisoft and increase its value. One possibility under consideration is taking the company private.

Currently, Tencent owns 9.2 percent of Ubisoft's net voting rights, while the Guillemot family holds about 20.5 percent. Some minority shareholders, including AJ Investments, have been pushing for either privatization or a sale to a strategic investor.

The discussions are still in early stages, and there's no guarantee they will result in a transaction. Both Tencent and the Guillemot family are also considering other alternatives, Bloomberg said.

Ubisoft's stock price over the last five days

Ubisoft has been struggling for a few years after facing intense development pressures during the pandemic. This led to setbacks in launching new titles and the cancellation of some projects in development.

In 2022, there was significant merger and acquisition activity in the gaming sector, with reports that major private equity firms were evaluating potential offers for Ubisoft. Subsequently, the company's founding family entered into a partnership agreement with Tencent, which acquired a 49.9 percent stake in Guillemot Brothers, in addition to its direct stake in Ubisoft. This move was seen as a strategy to keep potential buyers at bay while allowing the Guillemot family to maintain control of Ubisoft's governance.

Ubisoft had been counting on Star Wars Outlaws to be a huge hit, but the game failed to live up to these expectations. The company then decided to delay the release of the next Assassin's Creed entry, Shadows, for further refinement. It admitted this was a result of "the learnings from the Star Wars Outlaws release." It also confirmed that the Star Wars adventure had a "softer than expected launch," selling only one million copies in the month since release.

The company cut its guidance for the financial year, expecting bookings to fall to around €1.95 billion ($2.1 billion). It also expects net booking for the fiscal second quarter to be down to €350 million to 370 million ($387 million to $410 million) from its previous forecast of €500 million euros ($554 million).

:quality(85):upscale()/2024/10/29/625/n/1922564/ec222ac66720ea653c5af3.84880814_.jpg)

:quality(85):upscale()/2024/10/25/846/n/49351082/bfc0fdb3671bef086c3703.42134063_.jpg)

:quality(85):upscale()/2021/07/06/971/n/1922153/7d765d9b60e4d6de38e888.19462749_.png)

:quality(85):upscale()/2024/10/29/957/n/1922441/c62aba6367215ab0493352.74567072_.jpg)

English (US) ·

English (US) ·