President Trump's administration is reportedly in talks to acquire a 10% stake in Intel, according to Bloomberg.

Intel stock dropped on the news, but we now have further insight into how this deal may work. Sources close to the matter revealed to Bloomberg that the Trump administration will turn the rewards granted to Intel as part of the CHIPS Act into the purchase amount. Intel’s current valuation is around $100 billion, and the company has been set to receive about $10 billion in funding through the CHIPS Act. If you do the math, 10% of 100 is 10, making it a pretty clean conversion that could arrive more quickly for Intel than expected.

The CHIPS Act works on a milestone-based incentive system, meaning a company has to reach projected targets in order to unlock more funding. Intel had only received $2.2 billion up until January of this year, before Trump took office. We don’t know whether that $2.2 billion will be counted as part of the larger $10 billion that would otherwise be needed for the 10% stake.

The White House declined to comment to Bloomberg on this matter. If confirmed, this would make the U.S. government the largest stakeholder in Intel by far. Such an act wouldn’t be unprecedented either, as the U.S. Department of Defense recently invested $400 million in MP Materials Corp., a rare-earth producer, making the Pentagon its largest shareholder.

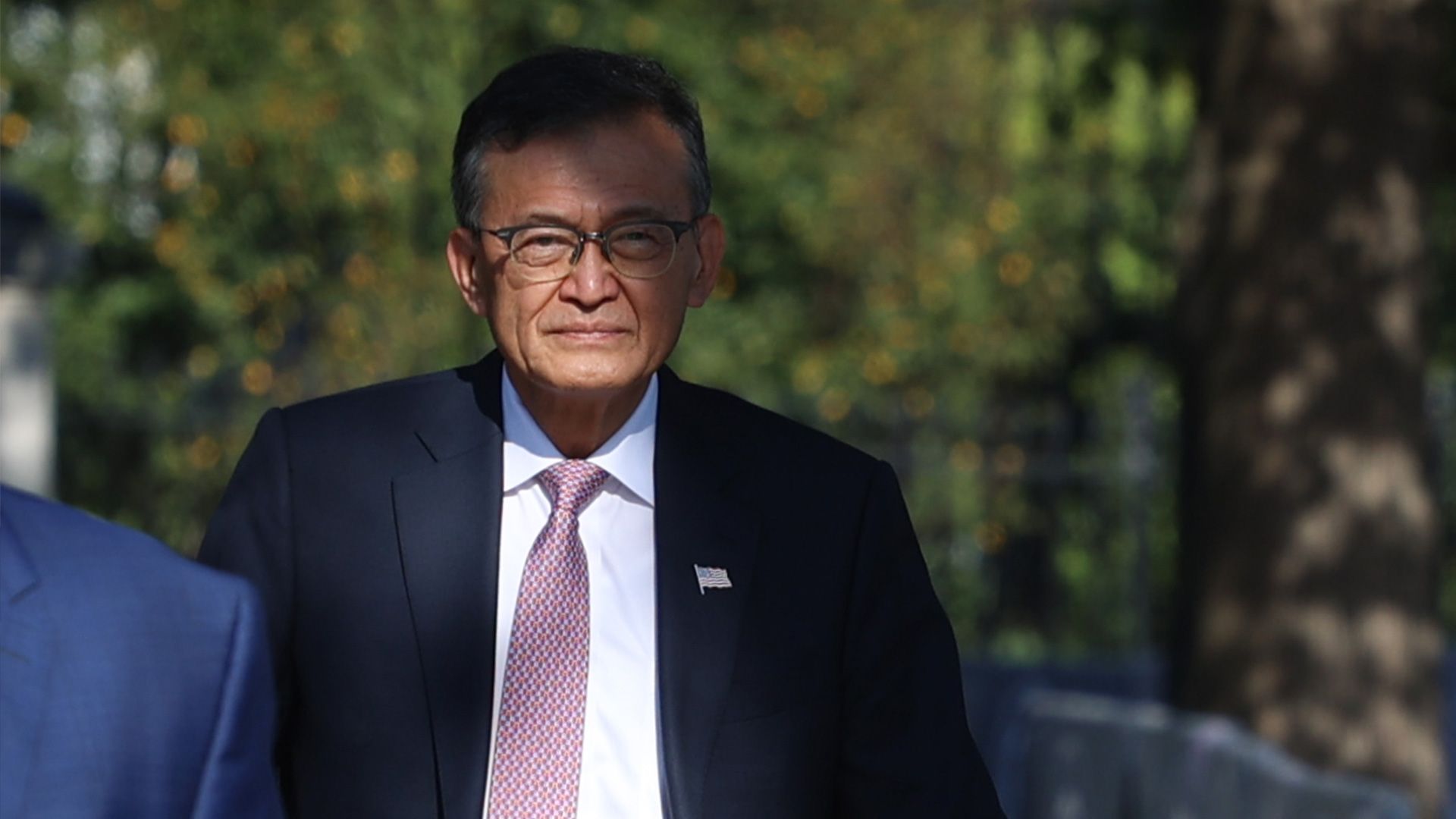

Lip-Bu Tan was installed as Intel CEO in March of this year, and since then the company has largely been on the cusp of ending its instability. Despite repeated commitments to U.S. soil and plans to bolster its fabs, Intel has faced consistent scrutiny, including Trump’s call for Tan’s resignation. Afterward, Tan visited the White House to discuss issues, including Tan’s former ties to China.

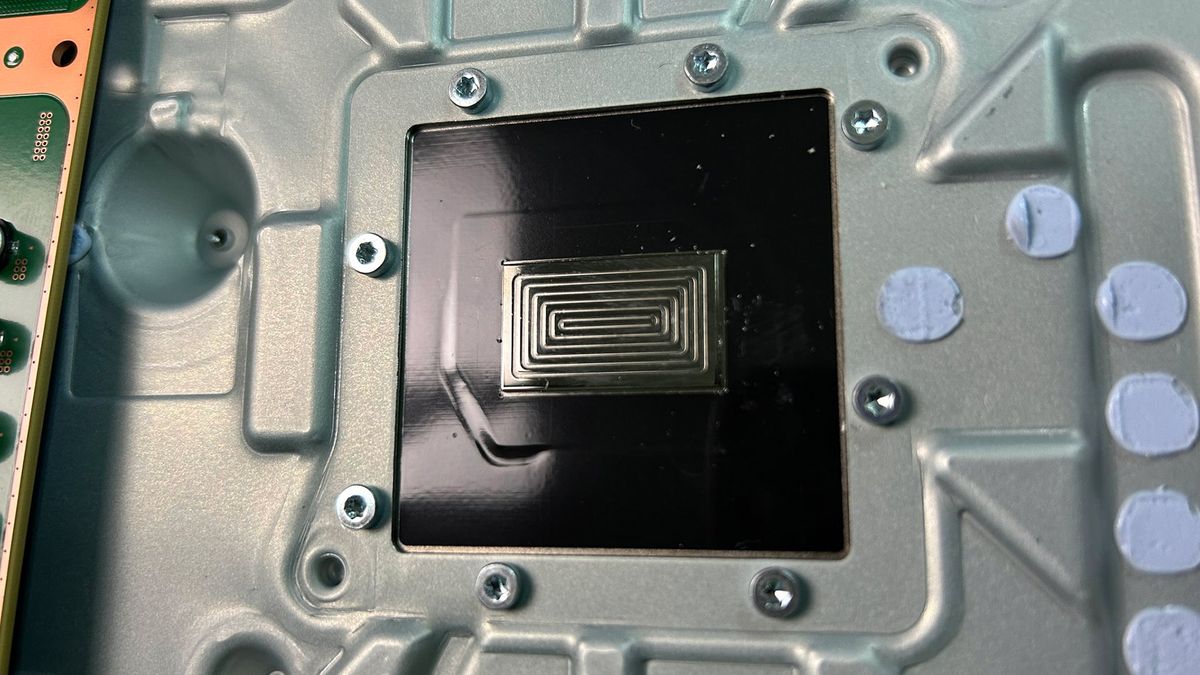

Intel has been on a downward spiral for the past two years. Where it once held a $200 billion market capitalization, it now sits at around $100 billion. Following former CEO Pat Gelsinger’s exit, Tan came in and quickly restructured the company, trimming the fat and laying off thousands of workers to focus on what matters: x86 and its ecosystem. Despite that, multiple reports have pointed toward struggles with the upcoming 18A and 14A nodes, which are Intel’s Hail Marys in the bleeding-edge semiconductor manufacturing industry.

Regardless of the specifics, this move would make Intel an even more critical player in U.S. geopolitics — going beyond just a semiconductor company and edging closer to being a lifeline for homegrown chips.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

3 months ago

77

3 months ago

77

English (US) ·

English (US) ·