Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

Editor's take: Canalys has released its latest predictions about the PC market. The channel-focused research company is describing a somewhat healthy technology business; however, it will likely suffer from tariffs and other harmful economic measures announced by the next US administration.

Canalys recently said that PC shipments in the US grew by a significant 7 percent during the third quarter of 2024. Year-on-year results were driven by notebook systems, which experienced a 9 percent annual growth over the same period. However, the future is uncertain and American politics will likely affect market trends in a very negative way.

The US PC market's recovery should continue during the next few months, Canalys said, but at a slower rate than previously anticipated. The Windows refresh cycle isn't exactly taking the market by storm, with many enterprise customers still clinging to Windows 10 despite Microsoft ending support this year.

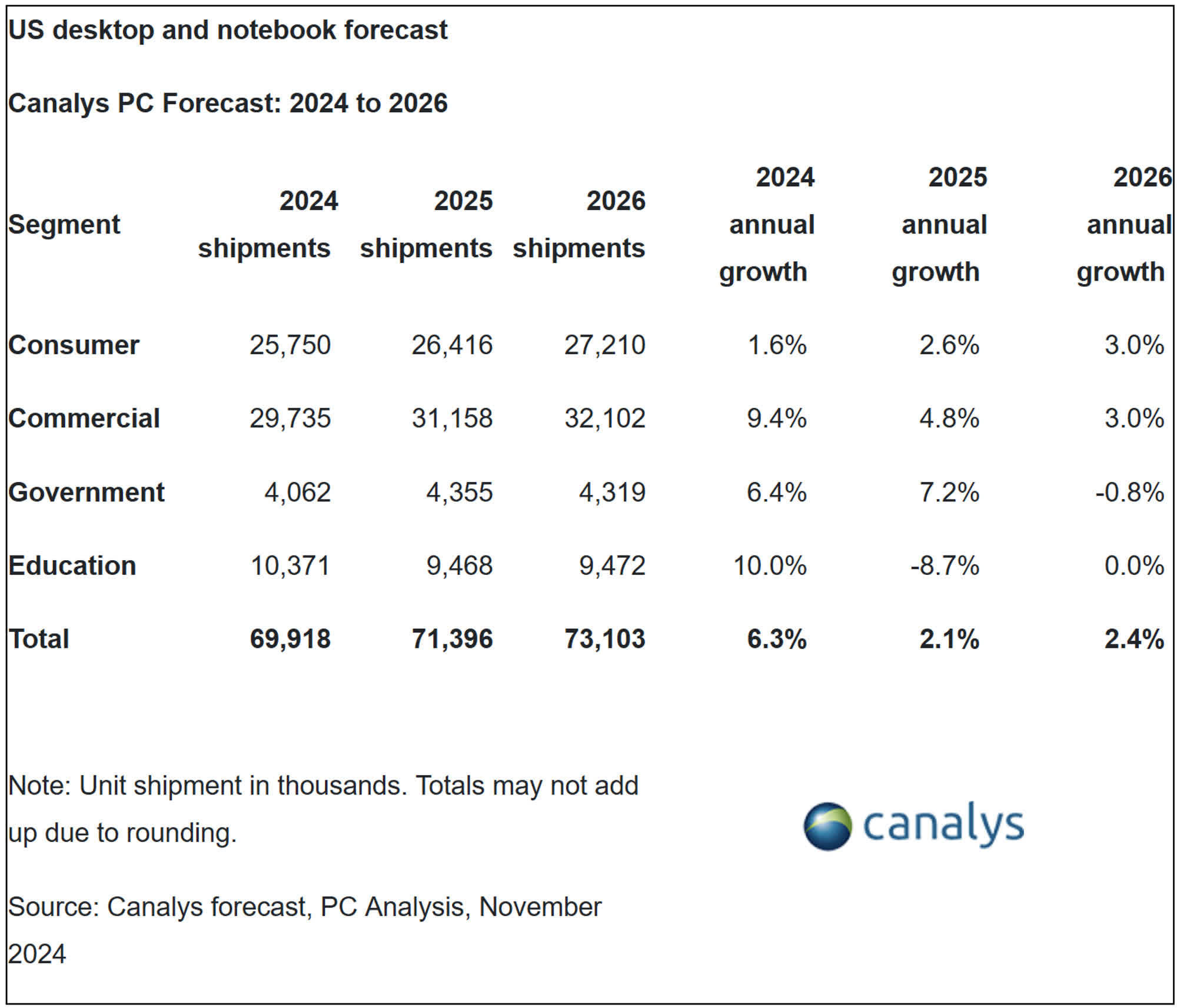

All things considered, total PC shipments in 2024 are expected to rise by 6 percent to 70 million units. Shipment growth is expected to slow down to 2 percent in both 2025 and 2026. Commercial demand remains "strong," Canalys said, and the Windows 11 refresh cycle still has a long way to go.

Analyst Greg Davis said that the commercial market is now the leading growth factor for PCs sold in the US. Both large and small businesses are going through a strong refresh process for their Windows PC fleets. Meanwhile, the consumer segment has been boosted by the seasonal discounting period focused on Black Friday and Cyber Monday sales.

Microsoft will stop providing security patches for Windows 10 on October 2025, Canalys noted. Despite the incoming deadline, the transition to Windows 11 has been going at a modest pace so far. Analysts are also worried about the anticipated policy changes announced by the next administration, which will cause significant instability issues for macroeconomic conditions in the US.

The new import tariffs will likely impact the PC market in a noticeable way, with device pricing rising as much as 46 percent if everything goes according to Donald Trump's plans. Supply chain players will try to oppose the new policies by stockpiling their inventories in early 2025, which should somewhat "rebalance" the anticipated shipment issues.

Other risk factors highlighted by Canalys include the proposed cuts to the US public sector budget, which could hinder PC provisioning for both federal government agencies and national education institutions. "Although 2025 budgets will remain largely intact, we anticipate future spending on technology from these areas could be reduced," Davis said.

English (US) ·

English (US) ·