But Ukraine also shows the disadvantage at which Taiwan finds itself. In a secret workshop in Kyiv, a Ukrainian drone maker told WIRED that he had no choice but to source his antennas and chips from China. Taiwanese chips were too expensive.

Competing With DJI

“We are not able to compete with DJI,” Fang says, referring to the massive Chinese drone manufacturer.

Other countries that have scaled up their drone programs recently have accepted Chinese technology in their supply chain—either as an asset or a necessary evil. But Taiwan, for obvious reasons, is leery of including any Chinese tech.

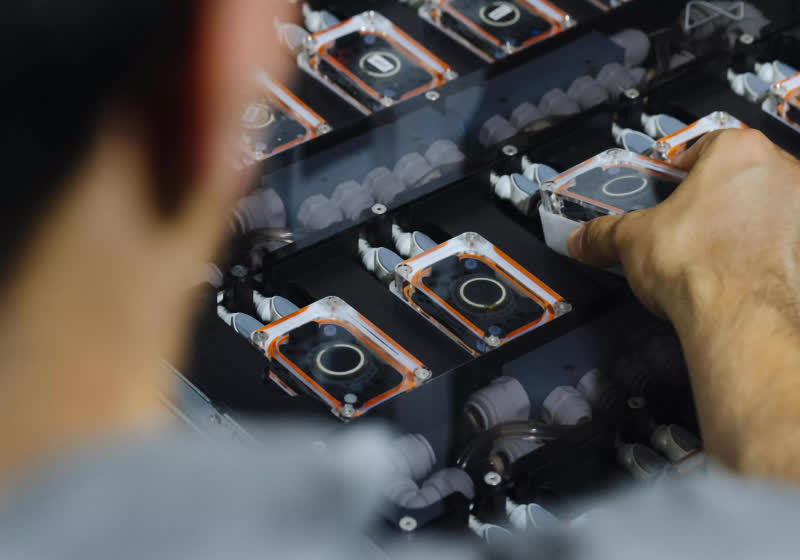

That makes drone manufacturing hard. China maintains a massive advantage in producing certain critical pieces of these UAVs—including the gimbals, optical sensors, and antennas. To buy that equipment, Taiwan needs to find allied suppliers, often at considerable cost.

Taiwan has even had difficulty leveraging its advantages. The country has an advanced battery industry, for example—but it’s heavily reliant on Chinese critical minerals. The island nation also boasts the world’s most impressive semiconductor industry: It produces 60 percent of the world’s semiconductors and 90 percent of the advanced semiconductors. But, Fang says, Taiwan does not produce any chips specifically for use on drones.

“Taiwanese drone makers are buying chips from Qualcomm and Nvidia, but those chips are not specifically for drones,” she says. “Those are communication chips, sensor chips, those are for more general use.” And even those general chips are significantly more expensive than their Chinese competitors, sometimes by a factor of 10.

“We definitely have the ability to make them,” Fang adds. “But the reason why these companies are not involved in this market is because the scale is just too small.”

It’s a catch-22: Taiwanese companies can’t increase production and reduce costs until they get more orders, but they can’t get more orders because their costs are too high.

“We need more government procurement from Taiwan itself,” Fang says. Thus far, the nation’s defense ministry has ordered fewer than 4,000 drones, although it plans to purchase tens of thousands more in the years to come. It owes to the fact, analysts say, that financing the kind of defense spending that Taiwan needs remains politically difficult. Earlier this year, opposition lawmakers in the Legislative Yuan passed a budget that slashed planned defense spending.

If Taiwan’s industry has any hope of growing by the scale the country needs, Fang says there’s a clear answer: America.

Building an Army of Drones

DSET has a number of recommendations, both for Taiwan and America, on how to establish this ambitious new industry. For starters, they argue, America needs to start actually supporting Taiwan’s local industry.

To date, no Taiwanese drone manufacturer has secured access to the Department of Defense’s “blue list”—its roster of trusted drone suppliers. Earning a spot on that list could mean millions or billions of dollars in orders from the Pentagon.

There has been some trade in the other direction. The US has supplied Taiwan with about 1,000 drones, mostly the smaller AeroVironment Switchblade loitering munition as well as a small number of the MQ-9 Reaper long-range drones.

2 months ago

40

2 months ago

40

English (US) ·

English (US) ·