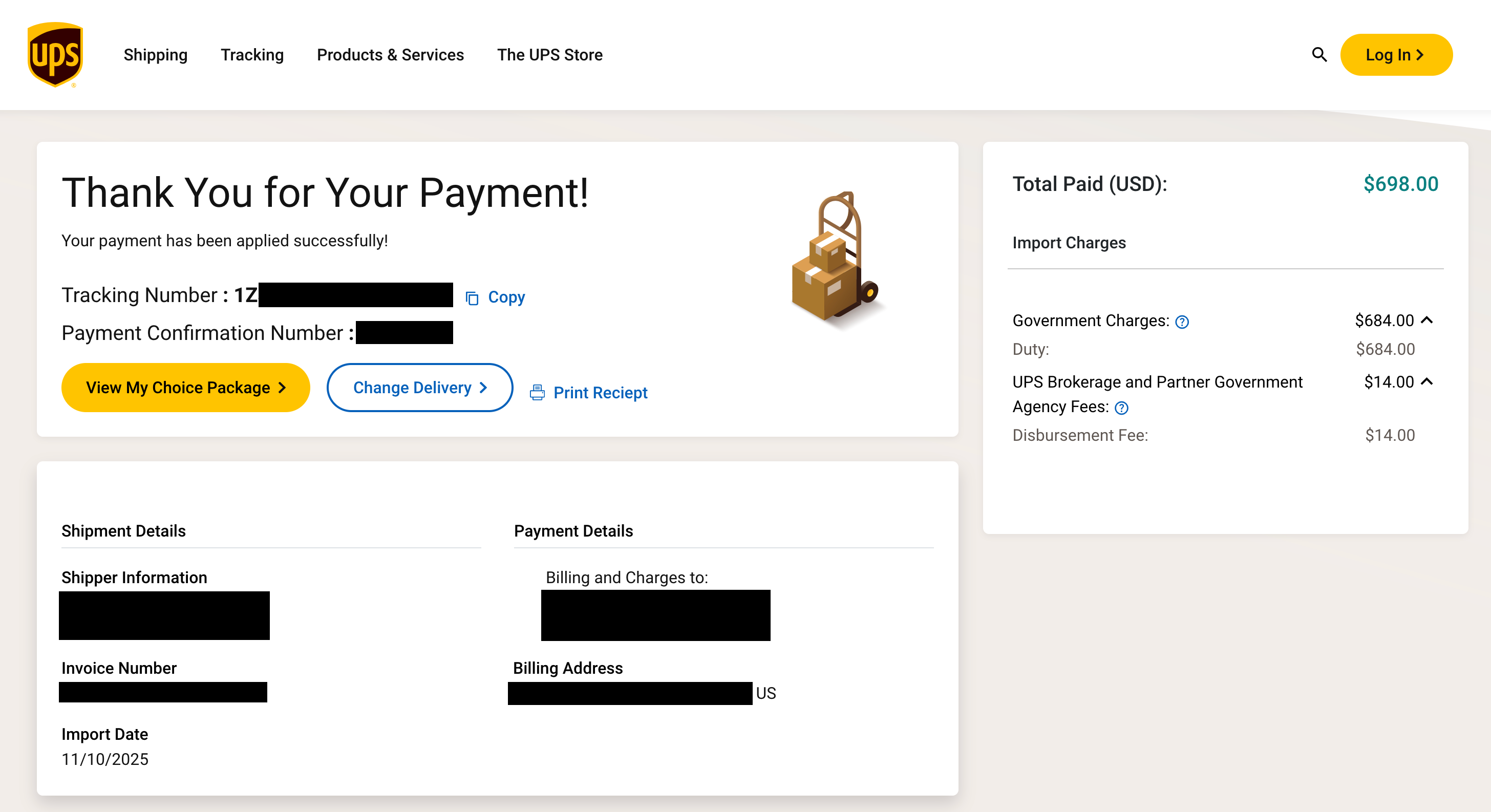

A PC hobbyist says he was hit with a $684 tariff bill on a $355 shipment of retro computing parts, in what appears to be a growing pattern tied to changes in federal import rules. The case, described in a blog post published November 15 by the writer behind OldVCR, involved a vintage parts order from Germany. UPS, the courier, later reduced the charge after the recipient disputed the tariff classification.

The incident is one of a growing number surfacing online as couriers and customs authorities apply tighter scrutiny to low-value imports. Under rules implemented earlier this year and finalized in late August, the United States has begun phasing out the so-called de minimis exemption that allowed shipments valued under $800 to enter duty-free, even when tariffs otherwise applied. The change was designed to close loopholes used by bulk e-commerce sellers and now affects one-off tech imports from small retailers as well.

This isn’t the first time hobbyists have been stung by tariff changes. A Business Insider investigation in October detailed cases where hobbyists received duty invoices after delivery, in some cases accompanied by late fees or threats from collections agencies. One buyer told the publication he received a $1,400 tariff bill on a $550 computer kit shipped from overseas.

UPS documentation confirms that duties and clearance-related fees are not included in quoted shipping costs. Instead, these charges are added post-delivery based on customs filings, which are often generated using the shipper’s provided data. If that data is incomplete or vague — a feasibly common scenario with shipments of vintage components — misclassification becomes more likely.

Buyers importing retro parts or niche hardware are encouraged to request specific HS codes and verify origin declarations with the seller in advance. Once a shipment has cleared under the wrong category, correction becomes more difficult and expensive.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

11 hours ago

6

11 hours ago

6

English (US) ·

English (US) ·