The Trump administration is considering expanding the chip sanctions the Biden administration put on China, according to people familiar with the matter. This expansion would cover Nvidia’s H20 chips, which the company specifically developed for China to comply with the U.S.’s export limitations. This talk of expansion will not take effect soon, however, according to Bloomberg, especially as the new administration is still putting its own people in the various positions the needs to be filled.

This marked another blow to Nvidia's market capitalization this week; the company lost $589 billion in value on Monday after the release of DeepSeek AI. Nvidia's shares dropped to $118 on Monday (down from $142 the week before), and rebounded to $127 per share yesterday. But after news of possible expanded chip sanctions, the share price dropped by 6.9% to $122 per share.

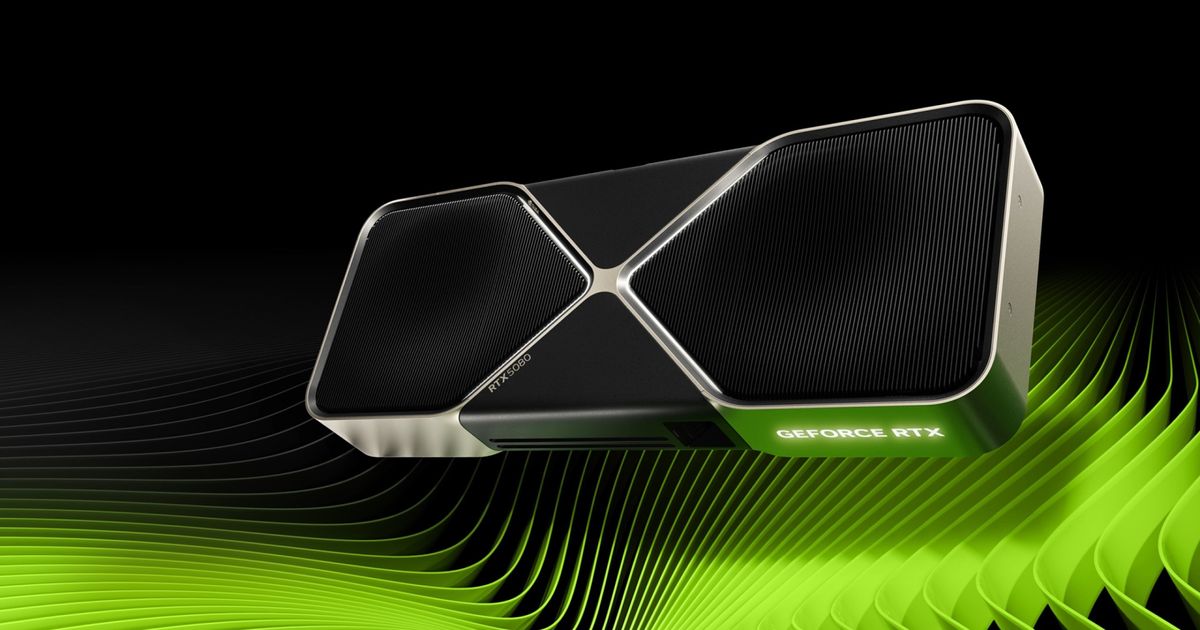

China is still Nvidia’s biggest customer despite all the bans and sanctions the U.S. government has imposed. The company is still estimated to make $12 billion selling AI GPUs to China in 2024, even though they’re only offering the Nvidia H20 — a defanged version of its H200 AI chip. In fact, the company’s sales of this sanctions-compliant chip has increased by 50% quarterly since its introduction.

There's a chance that even the compliant H20 chip will be banned for export, though, especially as the release of DeepSeek showed that China could create leading-edge AI models while using less powerful hardware. Trump’s Commerce Secretary nominee, Howard Lutnick, said that he will have a strong stance on semiconductor controls during a confirmation meeting. While he did not give any more specifics, this could mean that the Trump White House will consider an expansion of trade sanctions against China, which will negatively affect Nvidia’s bottom line.

Nvidia has previously said that these restrictions do more harm to the American economy than good, claiming it forces Chinese companies to be independent and create their own technologies that could potentially leave the West behind. Furthermore, it weakens American companies that rely heavily on sales in China, reducing revenue that it could otherwise use for further research and development to advance U.S. technologies. Even former U.S. Commerce Secretary Gina Raimondo said that holding back China’s chipmaking progress is a fool’s errand.

Nvidia still has time to present its case to the White House before a new round of bans and sanctions comes down. The company must walk a fine line between appeasing the people in power in Washington, D.C. and keeping its revenues at a record high, so it must tread carefully.

21 hours ago

8

21 hours ago

8

English (US) ·

English (US) ·