Nvidia on Wednesday announced its financial results for the third quarter of its fiscal year 2025, once again beating its own sales records as all its data center GPUs were sold out during the quarter. The company's earnings totaled $57 billion, as sales of all its products — except gaming GPUs — were up. Nvidia does not expect its revenue growth to stop, so it models that its revenue will hit $65 billion in Q4 FY2026, and the company expects sales of its Blackwell and Rubin GPU platforms to hit $0.5 trillion by the end of calendar 2026.

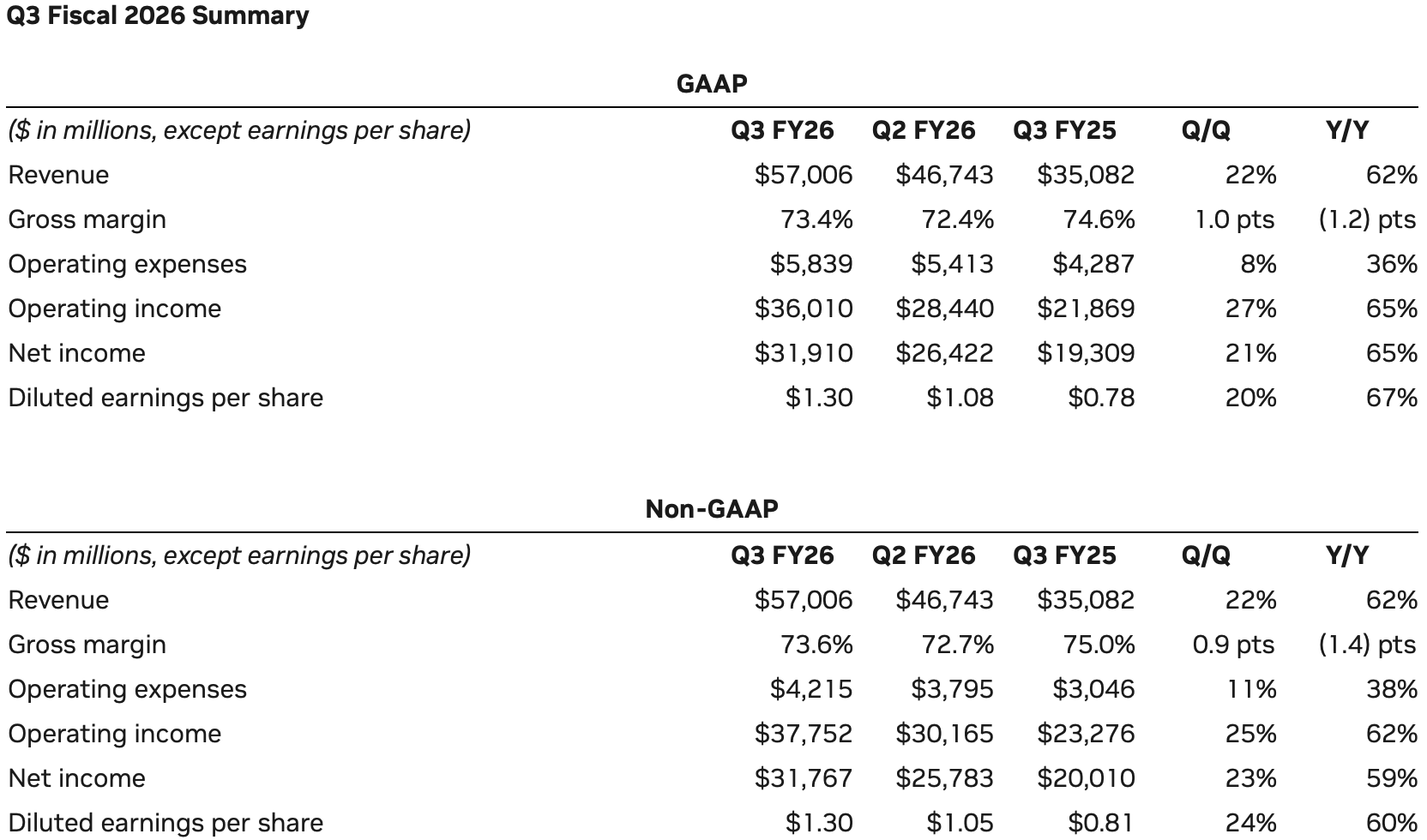

Nvidia's GAAP revenue reached $57.006 billion, up 62% year-over-year and 22% quarter-over-quarter, in the third quarter of the company's fiscal year 2026. The company's net income hit $31.91 billion, a 65% increase compared to Q3 FY2025, while its gross margin totaled 73.4%, up 1% sequentially, but down 1.2% YoY.

Sales of data center hardware exceeds $51 billion

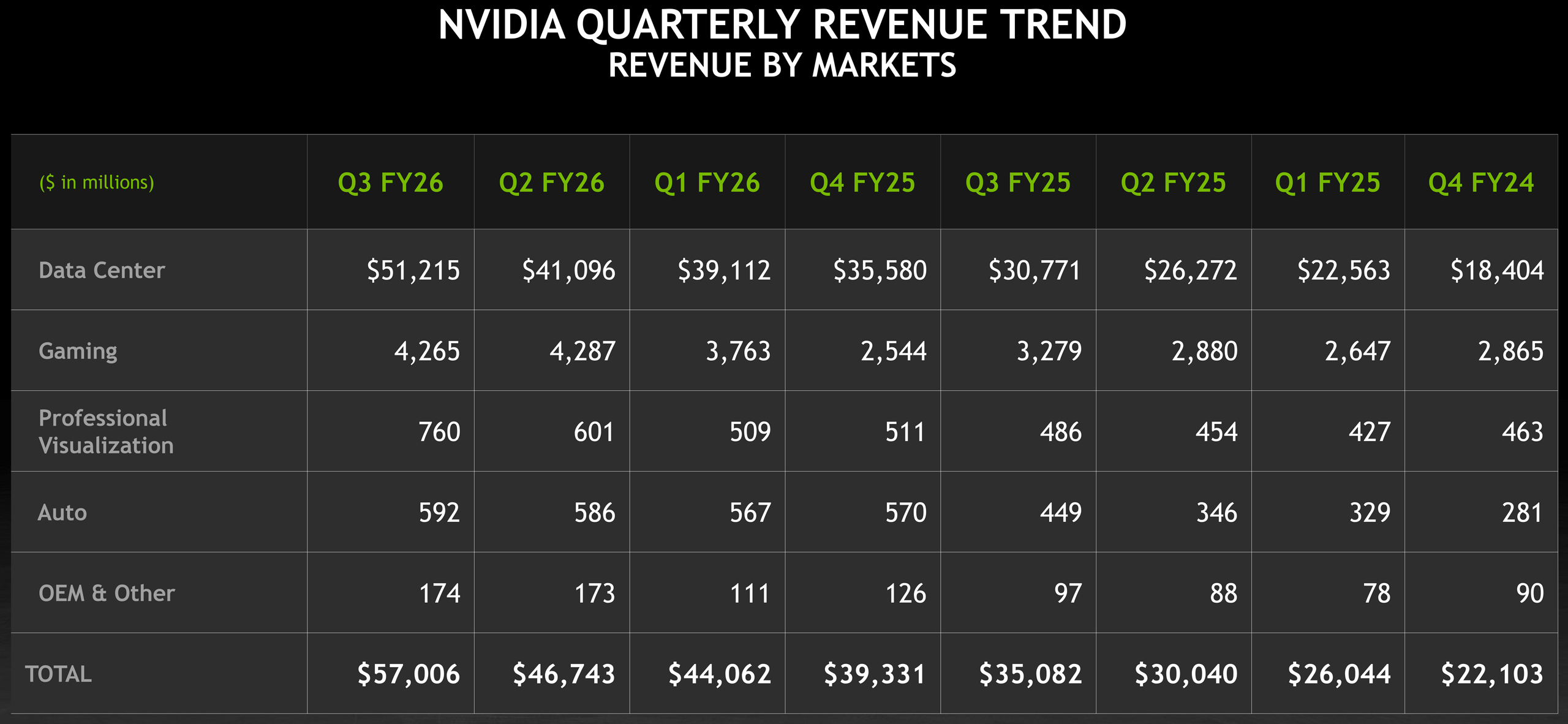

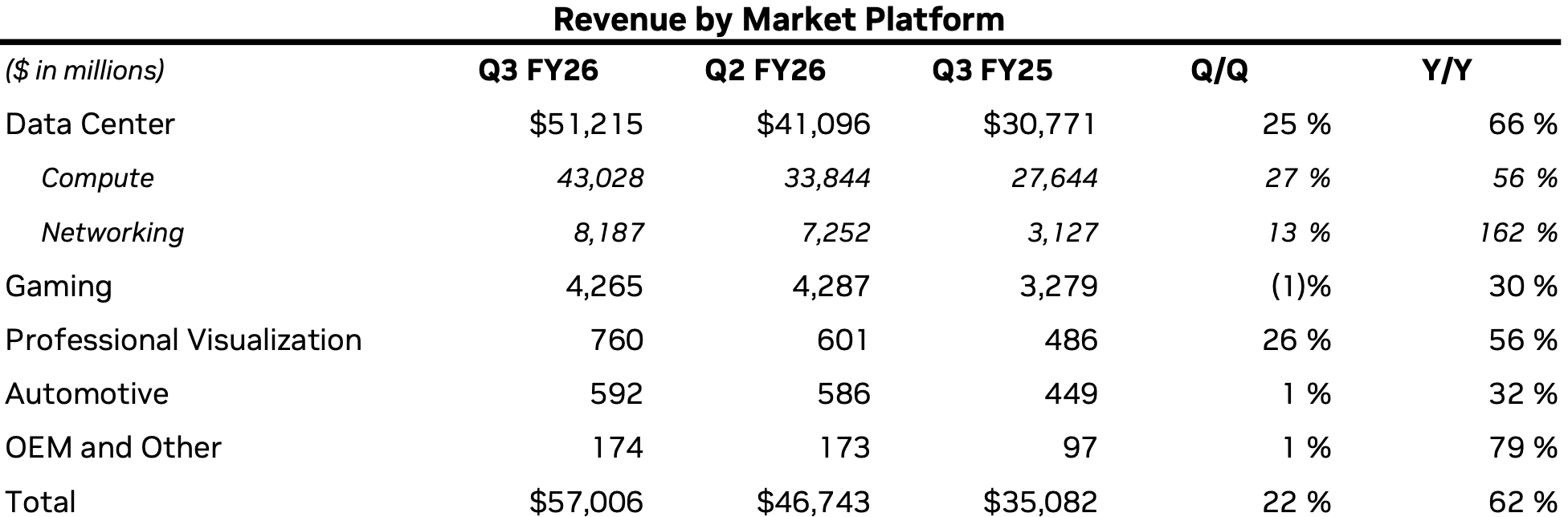

Nvidia's data center business delivered a rather whopping $51.215 billion revenue in Q3 FY2026, rising 66% year-over-year and 25% sequentially. Within the segment, compute revenue — comprising CPU and GPU sales — reached $43 billion, as the Blackwell and Blackwell Ultra platforms were adopted by all major clients, including cloud hyperscalers, enterprise AI, sovereign AI projects, and industrial. Networking revenue totaled $8.2 billion, up an extraordinary 162% year-over-year, as customers purchased more networking hardware while switching from individual AI servers to rack-scale solutions.

"Blackwell sales are off the charts, and cloud GPUs are sold out," said Jensen Huang, founder and CEO of Nvidia. "Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We have entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once."

Gaming GPUs hit their peak, whereas ProViz solutions set new record

Nvidia's gaming segment generated $4.265 billion in the third quarter of the fiscal year, rising 30% YoY but slipping 1% sequentially, which was a surprise. Nvidia said channel inventories normalized ahead of the holiday season, though GPUs are normally strongest in the third quarter, so it looks like other factors were affecting sales of graphics cards. Nonetheless, at $4.265 billion, Nvidia's Q3 of FY2025 is the company's second-best quarter for consumer GPUs ever, suggesting the market has peaked for the company at this time.

While sales of GeForce RTX graphics cards were so strong in Q2 and Q3 that they could no longer grow, sales of professional visualization solutions increased to $760 million, rising 56% year-over-year and 26% sequentially, setting an all-time record for Nvidia and likely the whole industry. The improvement was driven primarily by the launch and ramp of the DGX Spark AI workstation platform and increased demand for Blackwell-based professional GPUs used in CAD, CAM, DCC, and various emerging creative workflows.

Nvidia's Automotive and Robotics revenue reached $592 million in Q3 FY2026, increasing 32% year-over-year and 1% sequentially, which was driven by continued adoption of the company’s self-driving platforms. During the quarter, Nvidia announced that its next-generation Drive AGX Hyperion 10 Level 4-capable vehicle platform has been adopted by major partners, including Uber, so expect this segment to become even more important for the company going forward.

The OEM and Other segment recorded $174 million in revenue for the third quarter, up 79% year-over-year and 1% sequentially.

Q4 outlook: More money incoming

Nvidia expects another quarter of strong growth, so it guides revenue to $65 billion ±2% and GAAP gross margin of 74.8%. These results will be primarily driven by continued adoption of Blackwell and Blackwell Ultra platforms by various customers in the West. It is noteworthy that the company said nothing about sales of its AI GPUs to China, perhaps reflecting sentiment that this market has largely been lost for now.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

5 hours ago

8

5 hours ago

8

English (US) ·

English (US) ·