The global server market experienced an unprecedented surge to nearly $100 billion in the first quarter as companies heavily invested in AI-related infrastructure, according to IDC, and 'accelerated' servers running Arm-based processors comprise one of the most rapidly growing categories, with Arm-powered server shipments rising 70% this year.

It appears that the vast majority of these Arm-powered machines are Nvidia's GB200 NVL72 rack-scale solution, based on the Grace Blackwell platform, which features an Nvidia Grace CPU and eight B200 AI GPUs per server.

Overall server purchases totaled $95.2 billion in Q1 2025, reflecting a 134.1% increase from the same period in 2024. This figure represents the fastest quarterly growth ever observed in this market, according to IDC. The widespread deployment of GPU-accelerated AI servers is fueling momentum, including those used by hyperscalers, with Nvidia's Arm-based Grace CPUs contributing to a 70% year-over-year increase in Arm server shipments this year.

Based on this surge, the annual projection for the 2025 server market was revised upward to $366 billion, representing a 44.6% increase compared to the previous year.

Spending on servers based on the x86 instruction set architecture (ISA) is expected to grow 39.9% for the year, reaching $283.9 billion. Meanwhile, systems using Arm and other non-x86 CPUs will gain even more, at a rate of 63.7% year-over-year, with projected sales of $82 billion in 2025.

Sales of GPU-based AI and HPC servers are projected to grow by 46.7% in 2025, accounting for nearly half of all spending in this segment. This trend has been amplified by the need for massive computing power to support new AI workloads and training pipelines.

Arm-based platforms are also gaining momentum, with shipment volumes projected to rise 70.0% compared to 2024. By the end of 2025, Arm systems are expected to represent approximately 21.1% of total server units shipped worldwide. This is considerably lower than Arm's long-term expectations of 50% market penetration. However, 21.1% is still a huge slice of the pie, considering that the lion's share of these CPUs are Nvidia's Grace processors.

The market is projected to keep growing

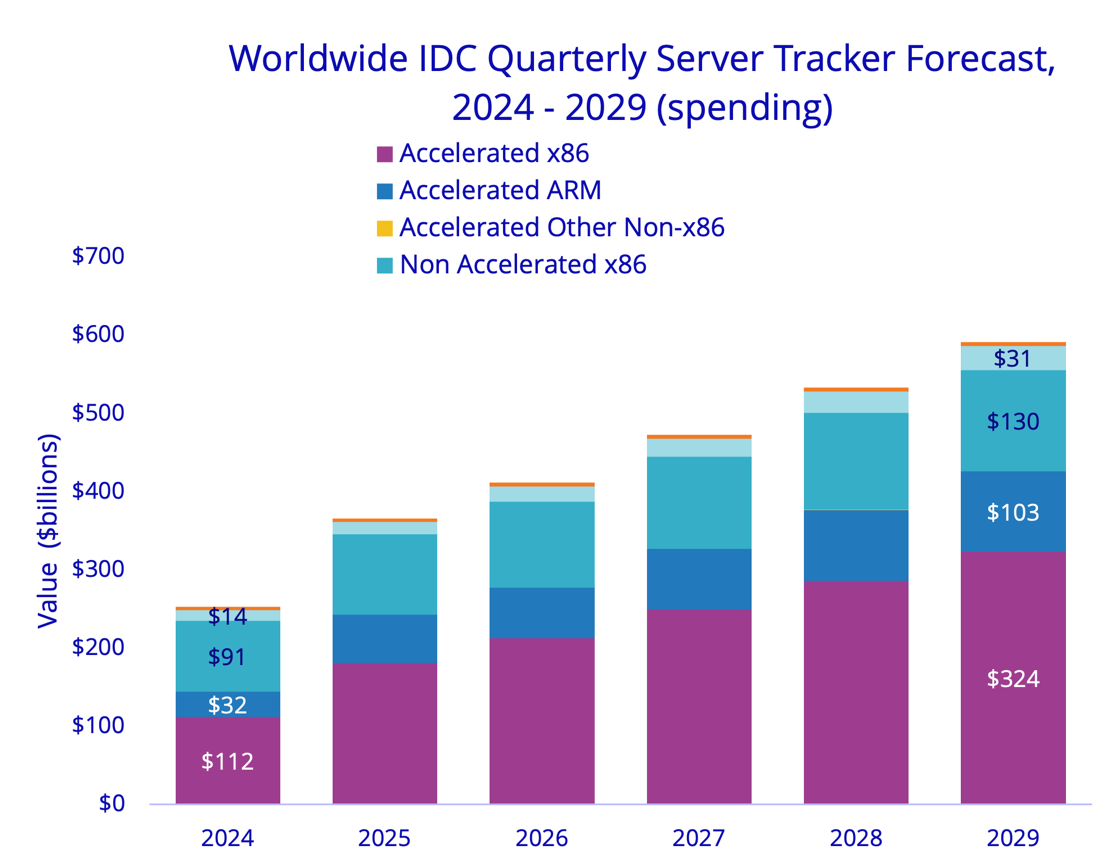

Spending on servers is expected to continue rising sharply in the coming years, starting at around $249 billion in 2024 and reaching $588 billion by 2029. The largest category in this period is Accelerated x86 (AI servers based on GPUs or AI accelerators with AMD or Intel processors), which is projected to grow from $112 billion in 2024 to $324 billion by 2029.

However, Accelerated Arm machines are also set to expand rapidly, increasing more than threefold from $32 billion to $103 billion by 2029, reflecting a rather rapid adoption of Arm-based systems for AI and cloud workloads.

Keep in mind that Accelerated Arm machines released between 2027 and 2028 can use not only Nvidia's processors, but also CPU designs from the 'NVLink Fusion camp,' such as those from Fujitsu, Marvell, MediaTek, and Qualcomm. Of course, it remains to be seen whether they will be able to capture significant market share.

Accelerated Other Non-x86 (including FPGA and ASIC servers) is also set to grow, albeit modestly, reaching $31 billion in 2029. Demand for Accelerated AI servers will be driven by more advanced LLMs and LRMs, in addition to the speculation that artificial general intelligence (AGI) is possible. AGI would require even more compute performance than today's AI technologies, according to IDC.

"The Stargate project re-announcement promised to invest up to $500 billion in AI infrastructure to help create artificial general intelligence (AGI)," said Kuba Stolarski, research vice president, Worldwide Infrastructure Research.

"Shortly thereafter, the release of DeepSeek's R1 reasoning model caused concerns about the necessity of investing in so much infrastructure. [DeepSeek] R1 needed more infrastructure than was reported, and the evolution from simple chatbots to reasoning models to agentic AI will require several orders of magnitude more processing capacity, especially for inferencing. Improvements in the efficiency of model creation were expected and, in fact, a goal in the industry. Efficient models will use fewer resources, and therefore may scale better in multi-user environments, enabling high-level reasoning and possibly eventually leading to AGI."

Meanwhile, spending on traditional servers (Non-Accelerated x86) will continue to rise steadily from $91 billion to $130 billion, but it'll become a smaller share of the overall market value. Unfortunately, IDC doesn't make forecasts about the adoption of general-purpose servers based on Arm CPUs, such as those from Arm itself, custom CPUs from hyperscale CSPs, or companies like Ampere Computing.

The U.S. leads the way

Among geographic regions, the U.S. server market is expected to show the fastest expansion, with sales projected to increase 59.7% year-over-year, accounting for approximately 62% of the total revenue in 2025. China's market is also projected to experience substantial gains of 39.5%, accounting for over 21% of the quarterly server sales. Given that America and China are in an AI arms race, and both countries are unlikely to reduce their spending, such rapid growth is not surprising.

Other areas of the world are seeing mixed results. Japan's market is projected to grow by 33.9%, while the Asia/Pacific region, excluding Japan, is expected to grow by 10.8%. Europe, the Middle East, and Africa are forecast to rise 7.0%, and Latin America will see a modest 0.7% advance. However, Canada stands out with a decline of 9.6%, as the prior year included an unusually large transaction.

The demand for servers is white-hot across the globe, and it might be a sign that Jensen Huang's 50-year plan to build out AI infrastructure is already underway.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

1 day ago

21

1 day ago

21

English (US) ·

English (US) ·