Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

Undoubtedly, Norton is synonymous with online consumer security and safety. In 1982, Norton LifeLock's predecessor, Symantec, was established. The brand's prominence stems from its renowned antivirus software, which comes preinstalled on many PCs. Despite potential skepticism, the Norton LifeLock identity theft protection app provides reassurance. Trusting this software with personal information is facilitated by the brand's reputation and the company's established presence.

Norton LifeLock: Plans and pricing

Norton LifeLock offers a range of plans designed to protect individuals and families from identity theft, often bundled with Norton 360's cybersecurity features. The core LifeLock plans typically include Standard, Ultimate Plus, and Advantage, each offering varying levels of identity monitoring, credit monitoring, and Million Dollar Protection Package coverage, which provides reimbursement for stolen funds, personal expense compensation, and coverage for lawyers and experts.

For individuals, these plans offer increasing benefits, from basic alerts and dark web monitoring in the Standard plan to comprehensive three-bureau credit monitoring, bank and investment account alerts, home title monitoring, and social media monitoring in the Ultimate Plus plan. Each plan is available for individuals and can also be expanded to cover Families (2 adults) or families with kids (2 adults + up to 5 kids), providing tailored protection for multiple members.

Many of these LifeLock plans can be bundled with Norton 360, which provides device security (including antivirus, VPN, password manager, cloud backup, etc.) for a specified number of devices or unlimited devices with the Ultimate Plus bundle. This creates an all-in-one cybersecurity and identity theft protection solution. Pricing for these plans varies depending on whether they are purchased monthly or annually, with annual subscriptions typically offering a discounted rate for the first year. Features like Genie Scam Protection Pro, which uses AI to detect scams in texts and emails, are also becoming integrated into these comprehensive offerings.

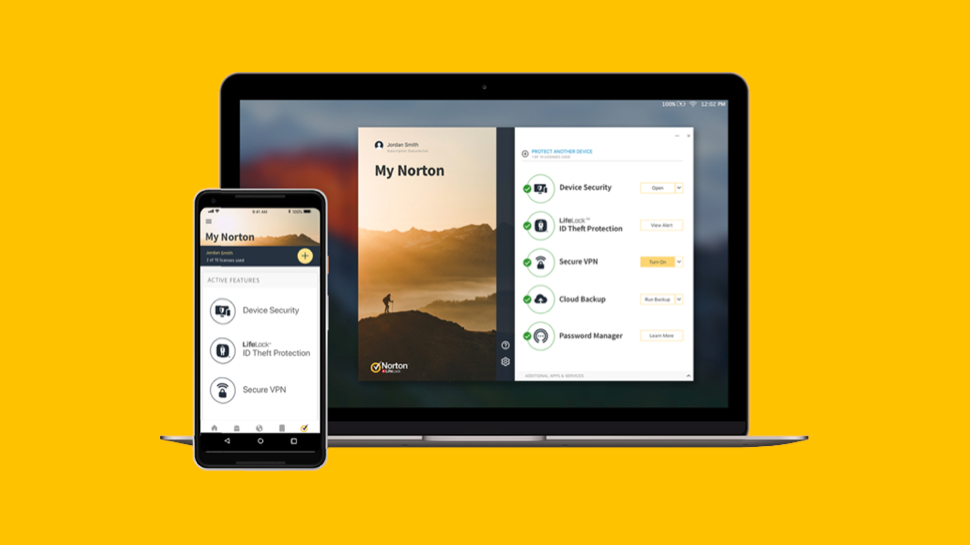

Norton LifeLock: Interface

The Norton LifeLock Standard plan is an entry-level option for identity theft protection, focusing on essential monitoring and recovery features. Key benefits include the Million Dollar Protection Package, which offers up to $1 million to lawyers and experts to help resolve identity theft, plus reimbursement of up to $25,000 for stolen funds and up to $25,000 for personal expense compensation. The plan also provides Identity and Social Security Number alerts, notifying you if your information is used for credit or service applications. Dark Web Monitoring actively patrols hard-to-find dark websites and forums to alert you if your personal information is discovered. Additionally, a Privacy Monitor helps reduce the public exposure of your data by scanning common people-search websites and assisting with opt-out requests. It also includes Utility Account Creation Monitoring, which alerts you if someone attempts to open a utility account in your name. For an individual, the LifeLock Standard plan is generally priced at $11.99 per month or a discounted $89.99 for the first year when paid annually (which averages to $7.50 per month for the first year, renewing at $124.99/year). Family plans are also available, with varying pricing for "2 adults" or "2 adults + up to 5 kids." For instance, the "2 adults" plan costs approximately $23.99 per month or $149.87 for the first year when paid annually, while the "2 adults + 5 kids" plan costs around $35.99 per month or $221.87 for the first year when paid annually. It's important to note that these prices are often introductory and may increase upon renewal.

The Norton LifeLock Advantage plan significantly builds upon the foundational protection offered by the Standard plan, providing enhanced coverage and additional monitoring features for a higher level of identity theft defense. While both plans include **Identity and Social Security Number alerts**, **Dark Web Monitoring**, **Privacy Monitor**, and **Utility Account Creation Monitoring**, the Advantage plan significantly enhances the financial safeguards.

One of the most notable differences is the increase in the Million Dollar Protection™ Package reimbursement limits. With LifeLock Advantage, the Stolen Funds Reimbursement jumps from $25,000 in the Standard plan to $100,000. Similarly, Personal Expense Compensation also increases from $25,000 to $100,000. The coverage for Lawyers and Experts remains at up to $1 million in both plans.

Beyond the financial uplift, Advantage introduces new monitoring capabilities. It adds Credit Reports & Credit Scores (One-bureau, Monthly), allowing for more frequent insights into your credit activity, whereas Standard does not include credit reports or scores. It also includes Credit Alerts, such as Phone Takeover Monitoring and Alerts on Crimes Committed in Your Name, which are not present in the Standard plan. Furthermore, LifeLock Advantage includes Identity Lock, specifically for your TransUnion credit file and payday loans, offering an active way to help prevent new accounts from being opened in your name.

In terms of pricing, the LifeLock Advantage plan is typically priced at $22.99 per month or a discounted $179.88 for the first year when paid annually (which averages to $14.99 per month for the first year, renewing at $239.99 per year). For families, the "2 adults" plan costs approximately $45.99 per month or $287.88 for the first year annually (renewing at $479.99/year). The "2 adults + 5 kids" plan is around $57.99 per month or $359.88 for the first year annually (renewing at $579.99/year). As with the Standard plan, these introductory prices are often subject to increase upon renewal.

The Norton LifeLock Ultimate Plus plan represents the pinnacle of identity theft protection offered by LifeLock, providing the most comprehensive features and the highest levels of coverage. It takes all the benefits of the Standard and Advantage plans and significantly amplifies them.

The most significant upgrade in Ultimate Plus is the Million Dollar Protection™ Package. While the Lawyers and Experts coverage remains at up to $1 million, both the Stolen Funds Reimbursement and Personal Expense Compensation are boosted dramatically to up to $1 million each. This is a substantial increase from the $25,000 in Standard and $100,000 in Advantage, offering unparalleled financial protection in the event of severe identity theft.

Beyond increased reimbursement, Ultimate Plus significantly expands monitoring capabilities. It includes Three-Bureau Credit Monitoring (Equifax, Experian, and TransUnion), along with Annual Three-Bureau Credit Reports and Scores, providing a comprehensive view of your credit health across all major bureaus. This is a significant improvement over the Advantage plan's one-bureau monitoring. Furthermore, Ultimate Plus adds 401(k) and Investment Account Alerts, as well as Home Title Monitoring, protecting these critical assets from fraudulent activity. It also offers Social Media Monitoring, which helps detect imposter accounts, inappropriate content, and potential scams involving your social media profiles. The plan also typically includes enhanced support, such as 24/7 live member support with priority access. Some newer integrations also feature Genie Scam Protection Pro, an AI-powered tool to help detect and protect against sophisticated online scams, including those delivered via email and SMS.

In terms of pricing, the LifeLock Ultimate Plus plan is generally priced at $34.99 per month or a discounted $239.88 for the first year when paid annually (averaging $19.99 per month for the first year, with a renewal rate of $339.99 per year). For families, the "2 adults" plan costs approximately $69.99 per month or $395.88 for the first year annually (renewing at $679.99/year). The "2 adults + 5 kids" plan is the most expensive, typically around $79.99 per month or $467.88 for the first year annually (renewing at $799.99/year). As with the other plans, these introductory prices are subject to substantially higher renewal costs. When bundled with Norton 360, Ultimate Plus often includes security for an unlimited number of devices and a larger amount of cloud backup storage, providing a truly all-encompassing protection suite.

Norton LifeLock: Features

LifeLock offers a suite of features designed to safeguard users' sensitive information. These features are comparable to those provided by similar programs such as IdentityForce and IDShield. However, LifeLock stands out by presenting these features within a meticulously crafted, user-friendly interface. The interface's design reflects a deep understanding of user needs and a commitment to delivering a seamless experience.

One key aspect of LifeLock's interface is its simplicity. The layout is clean and uncluttered, with each feature clearly labeled and easy to find. This simplicity makes it easy for users to navigate the program and access the tools they need quickly and efficiently.

Another strength of LifeLock's interface is its intuitiveness. The program's features are organized in a logical way that follows the natural flow of a user's thought process. This intuitiveness minimizes the need for users to refer to manuals or tutorials, making it easy for them to get started with LifeLock right away.

In addition to its simplicity and intuitiveness, LifeLock's interface is also most certainly visually appealing. The program features a modern, minimalist design that is both attractive and professional. This aesthetic appeal enhances the user experience, making it more enjoyable and satisfying to use LifeLock.

LifeLock's interface exemplifies the program's dedication to providing an exceptional user experience. By harmonizing simplicity, intuitiveness, and visual allure, LifeLock has crafted an interface that effortlessly allows users to safeguard their sensitive information, fostering peace of mind.

Furthermore, the interface of LifeLock is arguably easier to use, and also cleaner, which means you’ll often find more of the options available with less clicks.

Norton LifeLock: The competition

Similar to tech giants like Facebook and Google, Norton LifeLock stands out as a security firm with unparalleled immediate brand awareness, especially regarding consumer safety. Factors contributing to this recognition include its extensive advertising campaigns on network television and its long-standing presence in the industry. For those who have used computers during the early Windows and Mac eras, the Norton name likely holds familiarity and trust.

In the realm of identity theft protection apps, competitors must contend with the highly respected Norton brand, renowned for its cybersecurity offerings. While lesser-known options such as IdentityForce and IDShield provide similar features, they lack the widespread recognition of Norton. ADT, known for its physical home security solutions, also offers an identity theft protection app, but it falls short in terms of household recognition when compared to Norton.

LifeLock shares many similarities with IdentityForce and IDShield in terms of its features. The premium tier of LifeLock stands out with exclusive offerings such as 401K protection, crime tracking tools under your name, and monitoring across all three major credit agencies. Additionally, the Advantage plan and above provide exceptional features like TransUnion Credit Lock and PayDay Loan Lock services, making LifeLock a compelling choice for identity protection.

In the realm of identity theft protection, IDShield differentiates itself from its rival LifeLock by providing various exclusive features. Notably, IDShield's mobile application integrates social media monitoring, a crucial aspect in the current digital landscape where personal information is frequently shared publicly. This additional layer of protection empowers users to oversee their online presence and promptly respond to potential threats, ensuring enhanced security and peace of mind.

One of IDShield's strengths lies in its collaboration with criminal justice professionals. This valuable service offers users expert insights and guidance through the intricate legal system in the event of identity theft. Criminal justice professionals can provide valuable advice on effectively reporting the crime, acquiring official police reports, and assisting users in understanding the various steps involved in the legal process. This collaboration ensures that users receive comprehensive support throughout their journey to restore their identity and seek justice.

In contrast to LifeLock's premium plans, which lack monitoring and tracking features, IDShield offers these features as part of its more affordable plans. This strategic move by IDShield makes comprehensive protection accessible to a wider range of users, enabling them to enjoy robust security without exceeding their budget.

Standing out as a compelling option for individuals seeking comprehensive identity theft protection, IDShield offers competitive pricing and additional features. Its focus on social media monitoring, discussions with criminal justice professionals, and inclusive pricing plans empowers users to effectively safeguard their personal information. This sets IDShield apart from its competitors and provides users with the tools they need to protect their identity.

Norton LifeLock: Support

All LifeLock plans provide round-the-clock live support, with a toll-free number prominently displayed on their website, which we certainly appreciate. While there's no chat, email, or support portal, the top-tier plan offers higher priority support.

While there are blog articles and answers to frequently asked questions, the website lacks video content, whitepapers and webinars.

Norton LifeLock: Final verdict

Norton LifeLock operates in a highly competitive landscape, where it faces numerous challenges from various identity theft protection software providers. In this crowded market, the ability to stand out is crucial, and brand awareness plays a pivotal role in differentiating Norton LifeLock from its many rivals. Recognized as a leader in cybersecurity, Norton LifeLock benefits from a strong reputation, built over years of trust and reliability.

One notable challenge for Norton LifeLock is the complexity of its paid plans. Customers are presented with a wide array of options, each tailored to different security needs and family sizes. This multitude of choices can be overwhelming for potential users, leading to confusion about which plan best meets their specific requirements. For families or individuals unfamiliar with identity theft protection services, this complexity could be a significant deterrent, potentially driving them to seek simpler alternatives from competitors.

However, despite this potential drawback, Norton LifeLock excels in the area of user experience. Its interface is meticulously designed, characterized by a clean and intuitive layout that prioritizes user-friendliness. All features are organized logically, allowing customers to easily navigate through various tools and resources without feeling lost or frustrated. This commitment to a seamless user experience not only enhances customer satisfaction but also fosters a sense of confidence in the software’s capabilities.

Moreover, Norton LifeLock offers a range of educational resources and support materials, helping customers better understand how to protect their identities online. These resources contribute significantly to the company’s value proposition, as they empower users with knowledge and tools to safeguard their personal information proactively.

Overall, while Norton LifeLock certainly faces tough competition in the identity theft protection market, its strong brand recognition and exceptionally designed user interface serve as formidable competitive advantages. Nevertheless, simplifying the selection process for its paid plans could greatly enhance the customer experience, making it easier for potential clients to identify and choose the most suitable security solutions for their needs. By addressing this complexity, Norton LifeLock could capture a broader audience and solidify its position as a top choice for identity theft protection.

We've also featured the best identity theft protection, best antivirus and best VPN

English (US) ·

English (US) ·