Micron this month announced a renewed U.S. buildout strategy that expands investment plans to $150 million, plans to build an HBM packaging facility in Virginia, and invest some $50 billion in R&D. Micron's first new U.S. fab in years will begin operations in the second half of 2027, the company revealed this month.

Following the enactment of the CHIPS and Science Act in August 2022, Micron unveiled major plans to build new fabs worth over $115 billion in Idaho and New York with the aim of building 40% of its DRAM products in the U.S. over the next decade. Under the new plan, Micron projects investing $200 billion in U.S.-based memory production and R&D over the next 20+ years, with support from the U.S. government.

The effort includes $150 billion for manufacturing and $50 billion for R&D, with the goal of creating around 90,000 direct and indirect jobs. The new plan envisions two leading-edge DRAM fabs in Idaho, a site with four fabs in New York, and an HBM packaging facility in Virginia. Let's take a closer look at Micron's plans.

A $200 billion plan

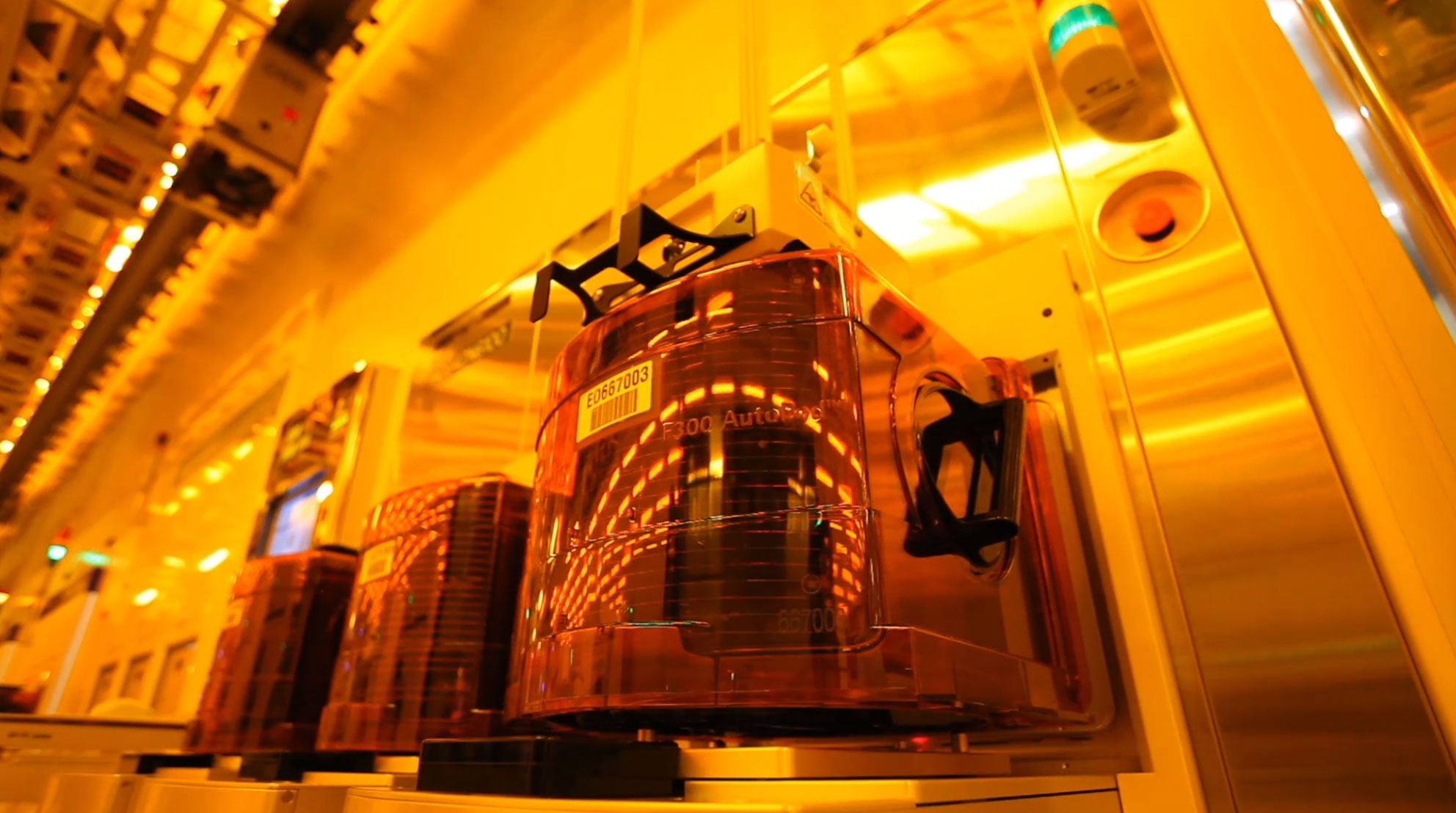

The first part of the original plan involved building one of the world's largest and most advanced DRAM production facilities near Boise, Idaho, which is now known as Fab ID1. Once fully outfitted with production equipment, the cleanroom area of ID1 will span 600,000 square feet (~55,700 square meters). This is roughly double the cleanroom capacity of GlobalFoundries’ Fab 8 and on par with the large-scale fabs operated by competitors Samsung and SK Hynix in South Korea.

Micron's first new fab in Idaho (ID1) reached a key construction milestone in June 2025 and is expected to begin wafer output in the second half of calendar 2027, with customer qualifications following thereafter, Micron announced this week. The second Idaho fab (ID2) will be built adjacent to ID1, benefiting from shared infrastructure and R&D co-location. Micron expects ID2 to enter production before the New York fab, although the company didn't elaborate on the exact timing.

However, while Micron broke ground on its new fab in Idaho and ID1 is expected to begin operations in a couple of years, the company is still struggling to start construction near Clay, New York. Micron plans to begin groundwork for its New York fab by the end of 2025, after completion of federal and state environmental reviews. Micron's New York plan is even more ambitious than the Idaho plan, as it involves four fab phases with cleanroom areas of around 600,000 square feet (approximately 55,700 square meters). While no specific production timeline has been announced for this site, it is clear that the site is a part of Micron's strategic long-term effort to establish a robust domestic manufacturing footprint in support of both commercial and national computing needs.

In addition to building brand-new fabs, Micron is set to expand its facility in Manassas, Virginia. Currently, this plant manufactures memory chips for automotive, aerospace, defense, and industrial applications. After the upgrade, the fab will gain capacity as well as advanced packaging capabilities to assemble HBM memory stacks in the U.S. However, Micron will only add HBM capability to its Virginia plant after it ramps up production of enough DRAM wafers in the U.S. at its fabs in Boise, Idaho. That said, expect Micron to build HBM5 or HBM6 in the U.S.

"As part of this $200 billion investment plan, Micron plans to […] [bring] advanced packaging capabilities to the U.S. to support our long-term HBM growth plans after we have established sufficient DRAM wafer scale in our U.S. operations," said Sanjay Mehrotra, chief executive and chairman of Micron.

"[…] Our first Idaho fab, ID1, achieved another key construction milestone in June. We expect first DRAM wafer output at ID1 to begin in the second half of calendar 2027, with customer qualifications to follow. The second Idaho fab, ID2, will benefit from manufacturing economies of scale with ID1, and add to R&D co-location benefits with greater efficiencies and faster time to market. To meet anticipated demand, ID2 will begin production before the first New York fab. We expect to begin ground preparation in New York later this year following the completion of state and federal environmental reviews," he concluded.

A great unknown

Although Micron clearly states that it plans to invest some $150 billion in its manufacturing capacities in America, it only disclosed the completion schedule for its Fab ID1, which is about to be completed, and the groundwork for the first New York facility. No schedules for other projects have been mentioned, except that Micron intends to invest $150 billion in its U.S. operations over the course of 20 years or more.

But perhaps the biggest unknown in Micron's announcement is its $50 billion R&D project. The company spent between 10% and 20% of its revenue on R&D in 2022 – 2024 (from $3.1 billion to $3.43 billion). Last year, the company invested $3.43 billion (14% of revenue) on research and development, so $50 billion is Micron's R&D budget for around 14 years. Yet, the company conducts R&D operations not only in the U.S. but also in Japan, Taiwan, and Singapore. To that end, it is unclear whether $50 billion means increase of R&D operations in the U.S. at the expense of other sites, or additional spending of $50 billion dollars on R&D in the U.S. on top of regular expenditures over the course of the next 20+ years (less than $2.5 billion per year), which would be a significant addition.

"Micron's U.S. memory manufacturing and R&D plans underscore our commitment to driving innovation and strengthening the domestic semiconductor industry," said Mehrotra. "This approximately $200 billion investment will reinforce America’s technological leadership, create tens of thousands of American jobs across the semiconductor ecosystem and secure a domestic supply of semiconductors — critical to economic and national security."

Micron expects all its U.S. projects to qualify for the Advanced Manufacturing Investment Credit (AMIC) and has secured support at the local, state, and federal levels. This includes up to $6.4 billion in CHIPS Act funding for two fabs in Idaho, two in New York, and the Virginia site upgrade.

Summary

Micron plans to spend some $150 billion to build six DRAM fab modules over the course of the next 20+ years in the U.S.: two near Boise, Idaho, and four near Clay, New York. Additionally, the company plans to invest $50 billion in R&D in the U.S. over the same period.

Micron will continue to operate and expand its DRAM fabs outside of the U.S., so it is likely that the lion's share of the company's volatile memory will still be produced in countries like Japan, Singapore, and Taiwan, which is not surprising at all.

What is noteworthy is that, for now, Micron doesn't seem to have plans to relocate NAND memory production to the U.S., perhaps because it expects to develop storage-class memory technology that will combine the performance of DRAM with the non-volatility of NAND, producing such devices in America. However, as such memory will not replace NAND for quite a while, flash memory will still be widely used for many years to come.

With Micron's DRAM and NAND fabs located outside the U.S., it appears that the largest share of the company's production will also be outside America, even after its grand plan to invest $150 billion in its U.S. capacity is completed.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

5 months ago

78

5 months ago

78

English (US) ·

English (US) ·