The artificial intelligence supercycle is reshaping the semiconductor and electronics industries, as the scale of the AI infrastructure buildout strains the entire supply chain. While developers of AI accelerators like Nvidia are cashing in on the AI boom, it's memory makers that will earn the most cash, according to estimates from TrendForce. Arguably, this is a result of the different business models and expansion strategies memory makers use compared to foundries, in addition to the behavior of the commodity market.

Demand outstrips supply

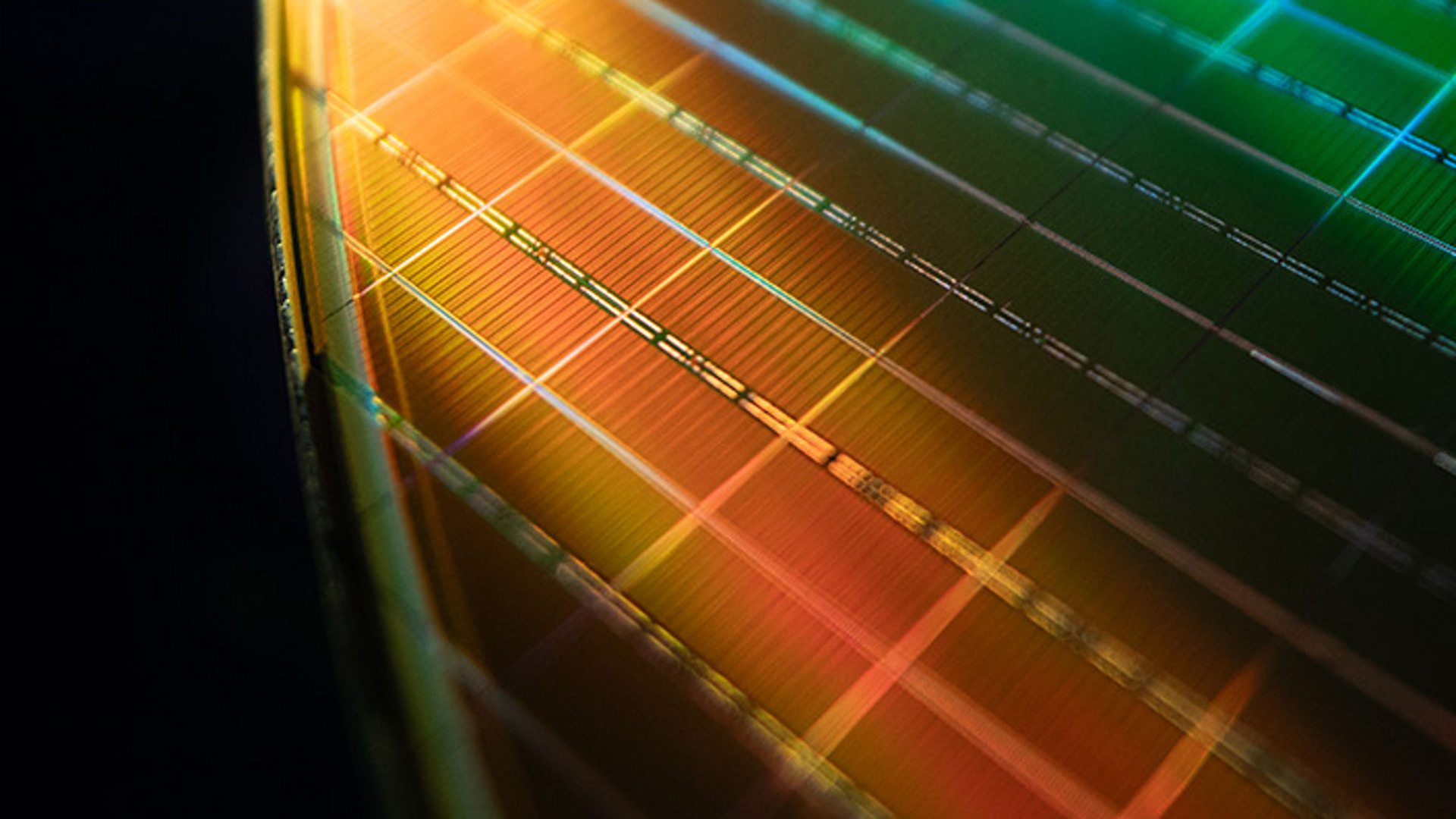

Indeed, the spot price of a 16 Gb DDR5 chip at DRAMeXchange was $38 on average, with a daily high of $53 and a daily low of $25. By contrast, the very same chip used to cost $4.75 on average just one year ago ($3.70 session low, $6.60 session high). Similar changes occurred to the prices of 3D NAND memory in recent quarters.

Fundamental differences

Just like some other analyst firms, TrendForce calls the AI megatrend a 'supercycle,' indicating its overwhelming ubiquity, which affects multiple industries, and its potential length.

There were two periods in the last few decades when revenue of memory makers grew significantly year-over-year for two years in a row: in 2017 – 2018, when hyperscalers built their vast data centers (+62% in 2017 and +27% in 2018), and in 2020 – 2021, when people increased purchases of PCs amid the COVID-19 pandemic. In both cases, memory makers increased capacity to meet demand and maintain their market share, which caused sharp drops in revenue back in 2019 and 2022.

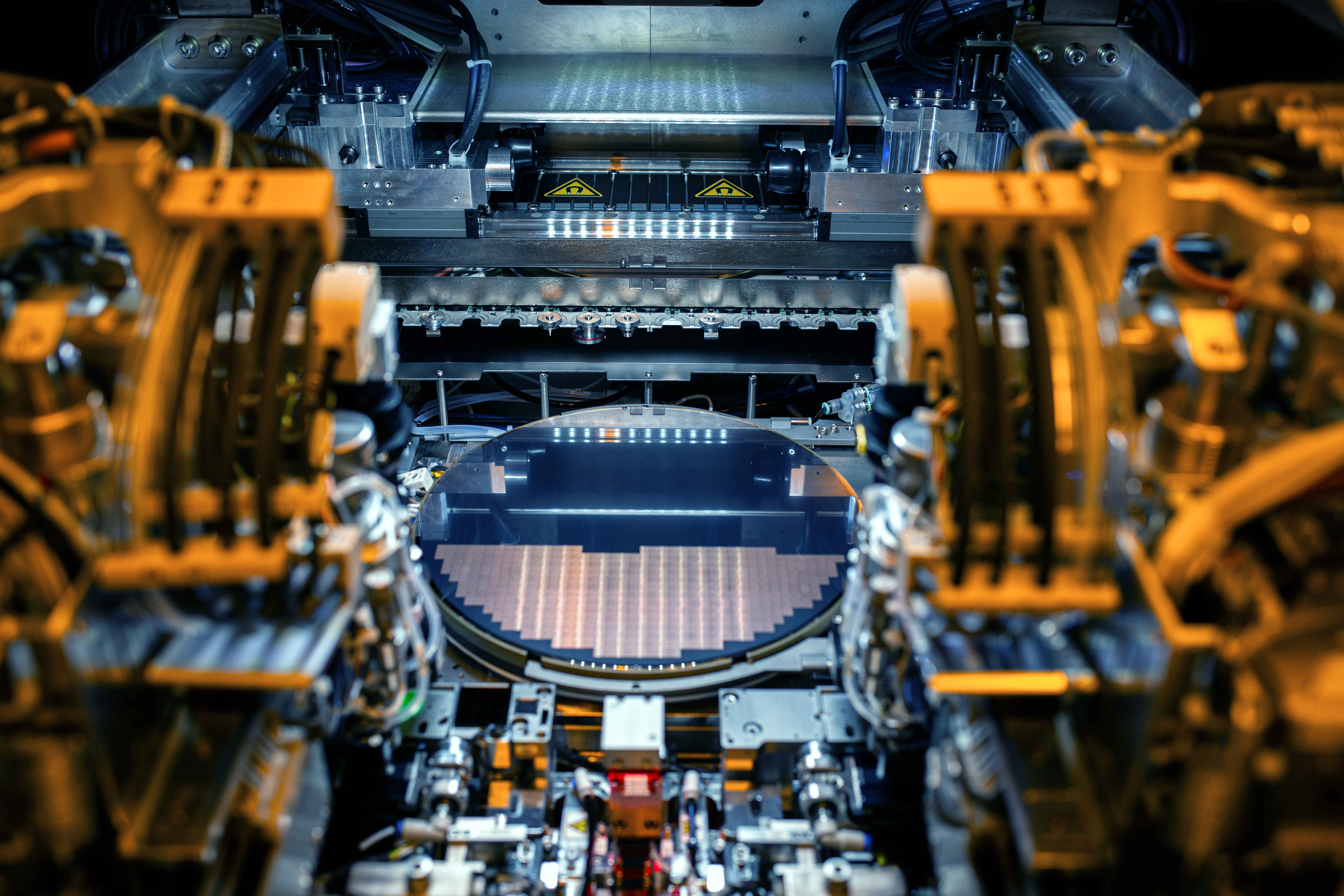

The foundry industry — which is much more capital-intensive than the 3D NAND or DRAM industries — uses fabs that are harder and longer to build, and only suffered a year-over-year revenue decline in 2023.

The situation today is vastly different. On the one hand, leading developers of frontier AI models need the most powerful clusters to train their models, therefore creating demand for leading-edge hardware with expensive HBM3E memory and plenty of storage. On the other hand, these companies and their clients need more powerful inference systems to use those models. Therefore, demand for CPUs, AI accelerators, memory, and storage does not decline over time. Meanwhile, buyers like cloud service providers (CSPs) tend to be less sensitive to price increases, which is why 3D NAND and DRAM suppliers are expected to raise average selling prices more aggressively than in the past cycles.

Foundry vs. Commodity

3D NAND and DRAM are commodities, so their prices behave like prices of commodities, almost immediately reacting to tightening supply, increasing demand, or sentiment among buyers. While large PC makers purchase their memory at prices agreed upon every six months, a significant portion of memory is sold on the spot market.

This dynamic is reflected in TrendForce's projections that show memory revenue growth accelerating after the downturn of 2022 – 2023, including an expected 80% increase in 2024, followed by 46% growth in 2025, and a projected 134% surge in 2026.

By contrast, foundries tend to operate under long-term agreements that smooth price fluctuations, which prevents sharp swings that characterize memory markets. Even during periods of strong demand, foundry pricing adjustments occur gradually, which means slower revenue growth compared to memory vendors.

TrendForce models that following a 19% year-over-year revenue increase in 2024, the foundry market grew 25% in 2025 and will grow another 25% this year.

As a result, boosted by the AI supercycle and not constrained by long-term agreements, memory vendors will earn more than two times more this year alone compared to producers of logic, which have to adhere to their long-term contracts.

The biggest question

With HBM4 memory devices using four times more silicon than typical DRAM ICs, it is obvious that memory makers cannot meet all the demand that exists because of insufficient capacity, which results in price adjustments. However, the biggest question is how significantly current commodity 3D NAND and DRAM prices are influenced by insufficient supply, and how significantly they are influenced by typical commodity memory market behavior that dictates that customers buy more memory when it is getting more expensive, as it may get even more expensive in the future?

3 weeks ago

40

3 weeks ago

40

English (US) ·

English (US) ·