The M2 money supply is an economic measure of the total amount of a sovereign nation's fiat currency currently circulating worldwide.

Bitcoin (BTC) recently hit an all-time high of over 100,000 Canadian dollars. Dean Skurka, President and CEO of WonderFi — a digital financial services company — believes interest rate cuts in Canada and the United States, as well as the upcoming 2024 US Presidential election, will continue to drive the price of Bitcoin higher between the next 6-24 months.

In an interview with Cointelegraph, Skurka explained that the Bank of Canada's recent decision to slash interest rates by 50 basis points and the US Federal Reserve's ongoing rate cute program, which began in September 2024, would encourage retail and institutional investors to enter the market or add to already existing positions.

Current Bank of Canada interest rate. Source: WonderFi

Skurka told Cointelegraph that these rate cuts were not unique and reflected a growing, global shift in monetary policy:

"As the rest of the world continues to enter into lower interest rate environments as well, that is going to create a really compelling opportunity for the digital asset ecosystem to expand and recapture that retail excitement."The WonderFi CEO clarified that the "Signal of cuts and the idea that rates are not going higher," were enough to make investors optimistic in the short term before capital injections from reduced rates matriculate in the markets — which typically takes between 6-18 months after the cuts are announced.

Impact of the Federal Reserve’s interest rate cuts on the stock market and Bitcoin. Source: WonderFi

Related: How the US Fed thinks a Bitcoin ban could preserve deficit spending

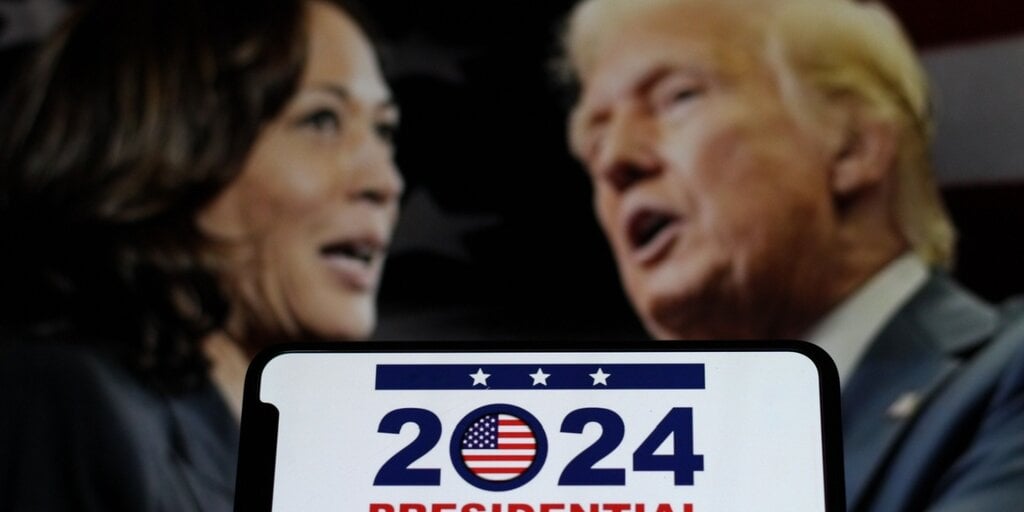

2024 US Presidential election

Skurka also highlighted the upcoming 2024 US Presidential election as a major catalyst for Bitcoin's price. The CEO noted that the crypto industry believes a Trump Presidency will be better for crypto, and a potential Harris win would likely cause a short-term price shock.

Correlation between Bitcoin’s price and Trump’s election odds on Polymarket. Source WonderFi

However, the CEO argued that the long-term price of Bitcoin will go up regardless of who wins the 2024 Presidential election and expects the regulatory climate in the US to shift following the November elections due to political pressure from industry advocacy groups:

"The net result of all these lobbying efforts should be a more positive and friendly environment on the other side of the election, regardless of who wins."According to the WonderFi CEO, these catalysts along with significant Bitcoin ETF inflows — which suggest strong and sustained institutional interest — create a "Very positive setup" for Bitcoin over the next several years.

Magazine: Bitcoin will ‘start ripping’ as Trump’s polls improve: Felix Hartmann, X Hall of Flame

2 hours ago

4

2 hours ago

4

:quality(85):upscale()/2024/10/31/801/n/49351082/b84152bf6723c91b32cc73.86821940_.jpg)

English (US) ·

English (US) ·