The Litecoin price has recently been on a steady rise thanks to improved fundamentals and renewed interest from institutional investors.

Potential ETF approval and increased payment utility have reignited bullish discussions around the Litecoin price, but not everyone is sticking around for the next wave. Many early holders are already cashing out after strong 50% gains, prompting questions about where the smart money is going next.

That question seems to have a clear answer. While LTC shows promise, seasoned investors appear to be moving capital into emerging DeFi opportunities like Unilabs Finance. With its growing presale momentum, Unilabs Finance is beginning to attract the kind of attention usually reserved for top cryptos.

Litecoin Price Trends Remain Strong, But Uncertainty Builds

A mix of optimism and strategic positioning is driving the current rally in the Litecoin price. ETF approval odds reported by Bloomberg to have climbed up to 90% in July, triggering a wave of massive buy-ins.

This wave of forced buying helped push LTC out of a multi-year consolidation phase, and this is an encouraging sign for long-term holders.

Litecoin’s increasing role in payments also adds weight to the recent price move. It’s now the second most-used cryptocurrency on CoinGate, showing that real-world usage is growing.

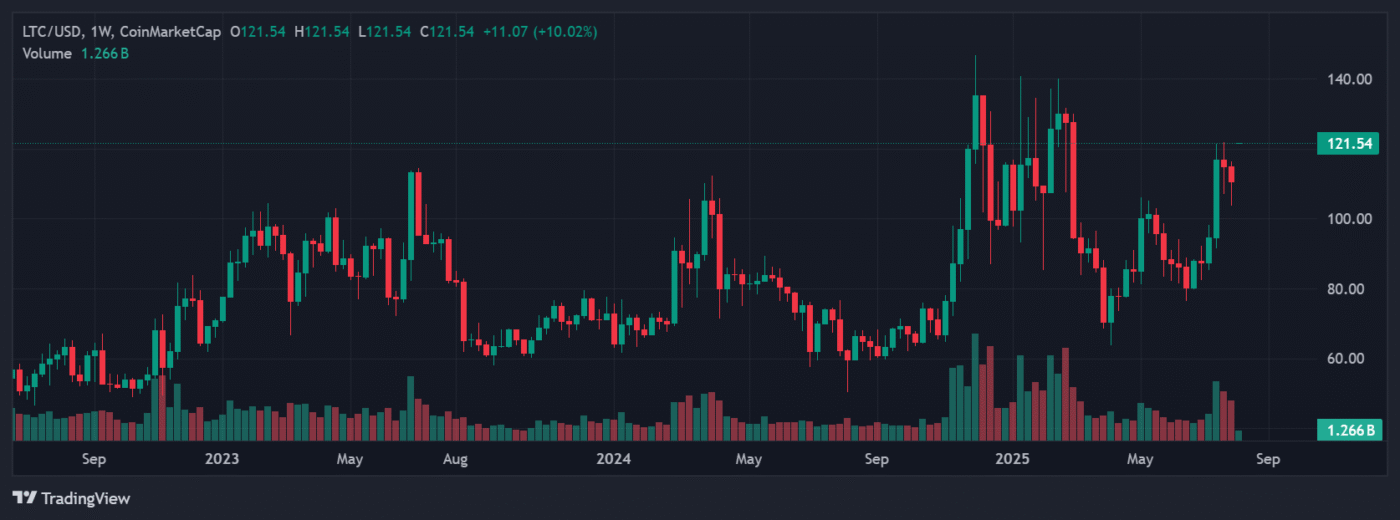

Source: TradingView

The key Litecoin price resistance sits at $129.16, while support is around $103.16. These form a narrow band of price action, and it suggests potential stalling or pullbacks.

This implies that, if LTC breaks above $124, it could climb towards a new resistance at $137. Despite this optimism, some LTC investors are already booking profits and looking to Unilabs Finance for more consistent upside.

Unilabs Finance: The Smart Investors’ Pick for Real Blockchain Strategy

While LTC holders are cashing out after recently scoring up to 50% gains on the Litecoin price, a noticeable shift is happening. Many early movers are now putting those profits into Unilabs Asset Management.

Here’s what makes Unilabs Finance stand out:

- AI-managed portfolios that can rebalance automatically based on market conditions.

- Transparent, on-chain profit sharing with no hidden processes.

- A memecoin identification tool that can filter out hype and identify serious potential.

-

A cross-chain trading hub that connects users to top rates across blockchains

Unilabs’ powerful AI can scan thousands of blockchain projects around the clock, identifying promising investments before they go mainstream.

Once it discovers a project with real potential, it thoroughly vets it by combining automated data with human insight. This process can enable LTC investors to make smarter early-stage investments with greater growth potential.

Unilabs also recently rolled out a new Portfolio Simulation Tool that would let users test different strategies and see how they might perform before risking any real capital.

The presale continues to gain momentum and the entry is still cheaply priced at $0.0097, with the next price target set at $0.0108.

Unilabs Finance is coming to CoinMarketCap very soon. To celebrate, the team is offering a 50% bonus on any purchase when you use the code CMC50.

Why Smart Money Is Moving On To Unilabs Finance

Even though the Litecoin price is still performing well, some LTC investors are choosing to rotate their gains into something that feels more forward-looking.

This isn’t about abandoning LTC entirely. It’s about balancing long-term plays with newer, smarter opportunities like Unilabs that may offer better risk-adjusted returns.

With tools that scan, analyze and invest in emerging crypto projects using a combination of machine learning and expert oversight, Unilabs Finance is redefining how digital asset management should work.

Also, Unilabs shares profits directly with UNIL holders through its blockchain-based system. Every yield, staking reward or trading win is visible and trackable.

Conclusion

There’s no denying that the Litecoin price has seen a decent surge recently. Technical indicators on LTC are solid, and the payment utility provides a real-world use case. But for many investors, the question is what comes next. The answer could be Unilabs Finance.

With over $30 million in Assets Under Management, a booming presale and a full ecosystem of AI-driven tools, Unilabs could show real promise. It could become a place where investors can act early, see everything that’s happening with their capital and access high-potential projects before the crowd catches on.

Discover the Unilabs (UNIL) presale:

Presale: https://www.unilabs.finance/

Telegram: https://t.me/unilabsofficial/

Twitter: https://x.com/unilabsofficial/

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

2 months ago

59

2 months ago

59

English (US) ·

English (US) ·