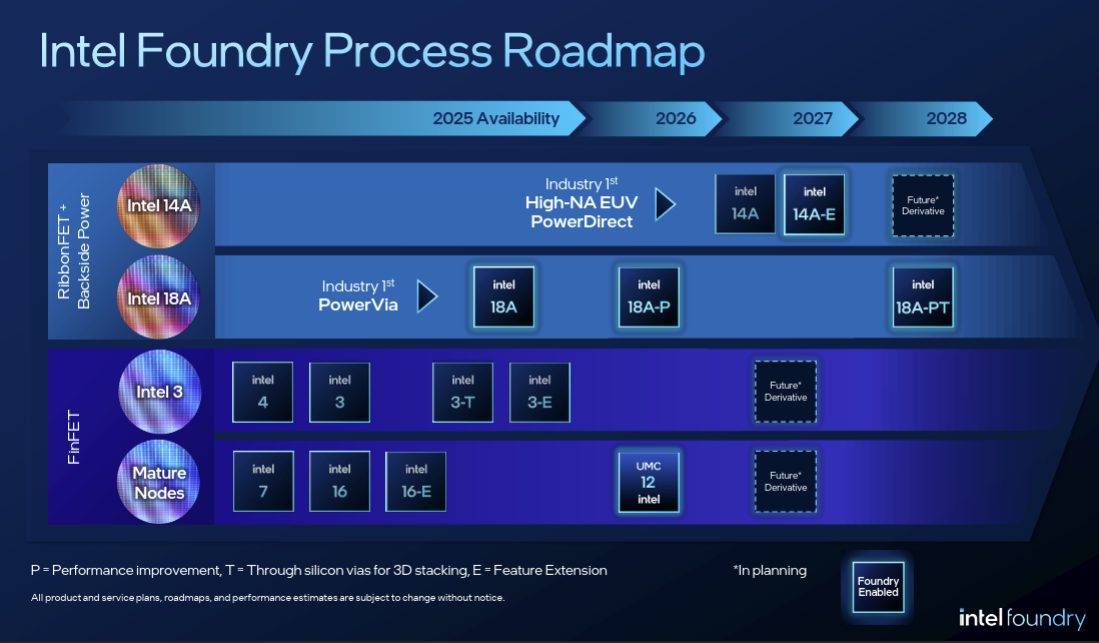

Currently, Intel's Foundry division loses billions every quarter as it invests heavily in new process technologies and production capacity. However, the company hopes that the Intel Foundry unit will break even sometime in 2027, which will coincide with the rollout out Intel's 14A manufacturing technology and production start on 18A-P node.

Intel this week reaffirmed that the first product made on its 18A (1.8nm-class) fabrication process, the client PC processor (codenamed Panther Lake), will hit the market late this year and will ramp next year. The manufacturing technology will also be adopted for Xeon 'Clearwater Forest' and some third-party products, but from Intel's Foundry business perspective, 18A is will be a proof-of-concept for external clients. If this production node is a success, more potential customers will adopt its successors, including 18A-P, and 14A (1.4nm-class).

"I think we do need to see more external volume come from 14A versus versus 18A, said David Zinsner, chief financial officer of Intel, at the J.P. Morgan Global Technology, Media and Communications Conference. "We have […] a bunch of bunch of potential customers, and then we get test chips, and then some customers fall out in the test chips, and then there is a certain amount of customers that kind of hang in there. So, committed volume is not significant right now, for sure. But, you know, I think we have got to partly prove ourselves a little bit with our own product and eat our own dog food here, and then […] we start to see some engagement around customers."

Zinsner admitted that if the company choses to use High-NA EUV lithography with its 14A process technology — as it plans to at the moment — its costs will go up initially. Intel hopes that advantages enabled by the new fab tools will outweigh those higher costs.

Like other contract chipmakers, Intel does not comment on its clients. The company also intends to produce more of its own silicon in house with its Panther Lake and Nova Lake CPUs, which will improve Intel's margins and its utilization of production capacities. As a result, Intel hopes that its Foundry unit will break even in 2027 and will be profitable from then on.

"We still feel on track to to hit breakeven sometime in 2027," Zinsner said. "You know, I think when we committed to it in 2024, we said, 'it is going to be somewhere between 2024 and 2030, most people kind of settled in that that must mean 2027, and that is generally kind of what we are thinking is we can be breakeven."

To break even, Intel Foundry only needs low- to mid-single-digit billions in annual external revenue, according to Zinsner. Most of 18A's volume will come from Intel's internal products, while 14A will require more external adoption. Intel's breakeven strategy also includes revenue from advanced packaging, mature nodes (like Intel 16), and partnerships with UMC and Tower. The company will continues to follow its 'smart capital' model, balancing internal and external wafer sourcing, and expects Foundry to compete for internal product demand to ensure efficiency and cost control.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

6 months ago

165

6 months ago

165

English (US) ·

English (US) ·