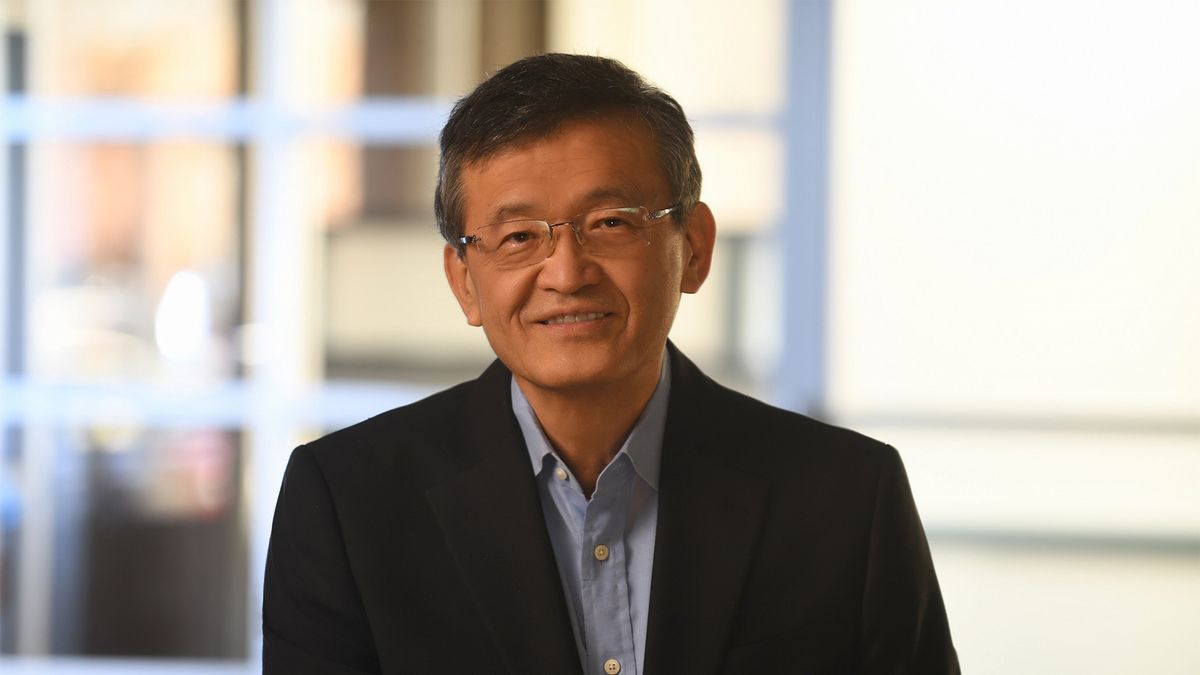

The appointment of Lip-Bu Tan as Intel's chief executive has generally pleased investors and financial analysts, but employees expressed mixed feelings following Tan's initial address, in which he hinted at tough decisions ahead but offered limited clarity on his strategic vision, reports Oregon Live.

Tan, who reportedly stepped down from Intel's board last August because he expected then-CEO Pat Gelsinger to make Intel leaner, is widely expected to make significant job cuts to reduce costs.

Not enough clarity

During his introductory video call, Tan — Intel's first external CEO in its 57-year history —emphasized satisfying customers and shareholders. However, his appearance sparked some criticism, as he wore a shirt from his former company, Cadence Design Systems, instead of one carrying the Intel logo. He cautioned employees — many still unsettled by the recent job and spending cuts — that more difficult decisions were incoming. There are concerns that Tan, who reportedly stepped down from Intel's board last year due to frustration with internal inefficiencies, may push for more job cuts.

One major topic Tan avoided was whether Intel would separate its manufacturing operations from its chip design division. This issue has been a central debate among analysts and former board members. Instead, Tan reiterated his commitment to maintaining Intel's engineering strength as part of the company’s broader turnaround efforts. However, in a letter to employees preceding the call, he emphasized plans to work hard and build a world-class foundry, which may imply that Tan intends to keep the company unified for now.

"Together, we will work hard to restore Intel’s position as a world-class products company, establish ourselves as a world-class foundry and delight our customers like never before," Tan wrote. "That is what this moment demands of us as we remake Intel for the future."

Some employees felt that Tan's remarks lacked enthusiasm and specificity. They had hoped for a clearer strategic plan and stronger reassurance regarding the company's future direction, especially considering his alleged role on Intel's board of directors, which he left in August 2024.

Left with discontent

Tan joined Intel's board in 2022 as part of the company's effort to reclaim its position as a global leader in CPU design and manufacturing. Over time, his role expanded to include oversight of manufacturing operations.

However, eventually, Tan grew increasingly discontent with the company's 'bloated' workforce, which he felt was inefficient and overly bureaucratic, according to Reuters. One of Tan’s major concerns was Intel's approach to layoffs. While Intel announced cuts affecting over 15% of its workforce, Tan believed the reductions were insufficient and should have targeted middle management, which he viewed as a barrier to innovation. He was particularly frustrated that, despite the layoffs, Intel's workforce remained significantly larger than that of competitors like Nvidia and TSMC combined.

Another point of contention was Intel's foundry business. Tan was disappointed by the lack of progress in this area, particularly after a $5.4 billion deal to acquire Tower Semiconductor fell through due to regulatory hurdles in China. Without Tower, Intel lacks the expertise to succeed in contract manufacturing, where it has historically struggled. As a former CEO of Cadence who led the company for 12 years, Tan knows what fabless chip designers need, so now Intel has more chances in the area.

In addition to workforce and foundry issues, Tan was critical of Intel's lagging efforts in AI. Despite multiple attempts and acquisitions to strengthen its AI capabilities, Intel could not keep pace with Nvidia, which became a trillion-dollar company capitalizing on the AI boom.

Analysts and investors cheer

Despite internal worries, investors reacted positively to Tan's appointment. Intel's stock price surged by 15%, opening at $23.80 the following day. Analysts like Stacy Rasgon from Bernstein noted that Tan's longstanding experience in the semiconductor sector lends him significant credibility and could signal hope for Intel's recovery.

Industry analysts believe that Tan's deep-rooted connections and industry knowledge uniquely position him to make the decisions required for Intel's revival. That said, his leadership is seen as a potential catalyst for positive changes, though the path forward may need significant restructuring.

8 months ago

107

8 months ago

107

English (US) ·

English (US) ·