The mechanics of crypto derivatives

Crypto derivatives are financial instruments that derive their value from an underlying cryptocurrency.

Think of them as contracts that allow you to bet on the future price movement of a specific cryptocurrency without actually owning it.

But why use crypto derivatives?

Traders use crypto derivatives for the following reasons:

- Hedging: Protect existing investments by offsetting potential losses.

- Speculation: Profit from price fluctuations, whether upward or downward.

- Leverage: Amplify potential gains (and losses) by using borrowed capital.

Common types of crypto derivatives

- Futures contracts: These agreements obligate the buyer or seller to buy or sell a certain quantity of cryptocurrencies at a certain price at a later time.

- Options contracts: These agreements grant the buyer the right, but not the obligation, to purchase (call option) or sell (put option) cryptocurrencies on or before a given date (the expiration date) at a particular price (the strike price).

- Perpetual contracts: These agreements lack an expiration date yet resemble futures contracts. They are common for long-term strategies because they enable traders to keep holdings indefinitely.

The table below summarizes how these contracts differ:

Did you know? Perpetual contracts often utilize funding fees, periodic payments exchanged between long and short positions, ensuring the contract price stays close to the underlying asset’s spot price.

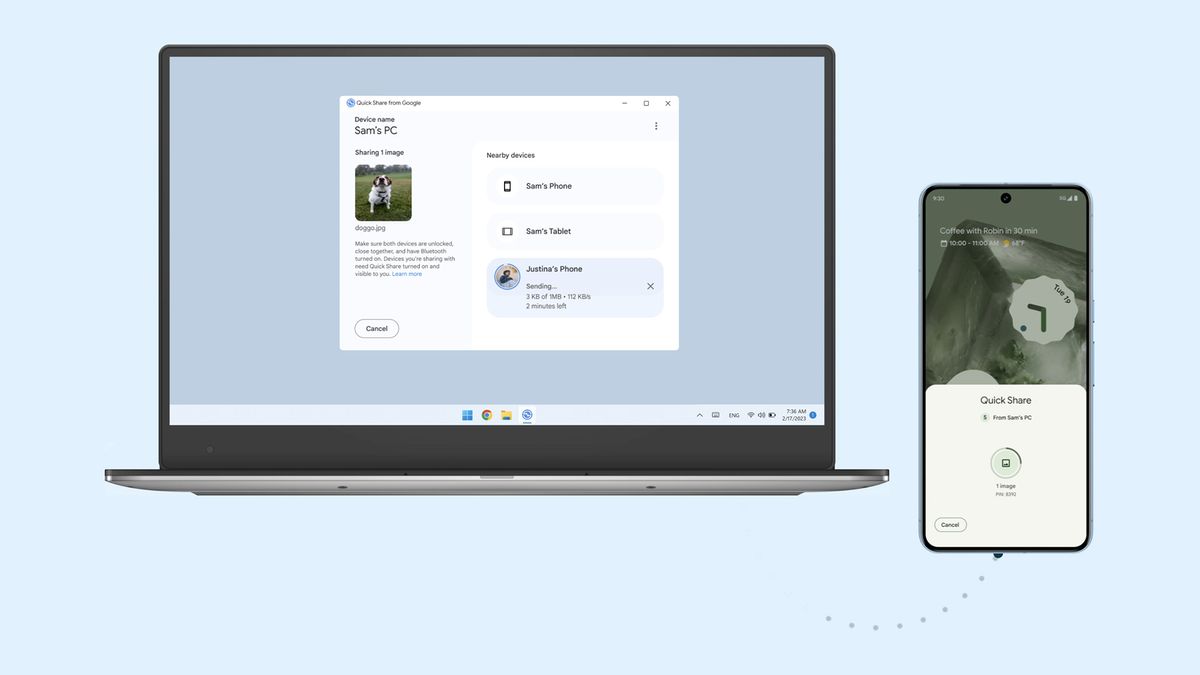

How to trade crypto derivatives: A step-by-step guide

Trading crypto derivatives involves choosing an exchange, using leverage cautiously and monitoring trades to manage risk and potential profits.

Let’s walk through a simple example of trading a Bitcoin perpetual contract with leverage:

- Know what you’re getting into: Imagine you’re interested in a Bitcoin (BTC) perpetual contract, which lets you speculate on Bitcoin’s price without actually owning Bitcoin. You could make money if Bitcoin’s price goes up — or even if it drops — by trading based on your market prediction.

- Pick a reliable exchange: Say you decide to trade on Binance. After creating an account and verifying your identity, you explore their derivatives section and find Bitcoin perpetual contracts, noticing they offer various leverage options and a user-friendly setup.

- Fund your account: Since it’s your first time with derivatives, you want to keep the initial investment small. Suppose you deposit $200 to start. Binance accepts fiat and crypto deposits, so you transfer $200 from your bank. Still, funding methods may vary depending on one’s jurisdiction.

- Get the basics of leverage and margin: You choose a 5x leverage, meaning your $200 lets you control a $1,000 position in Bitcoin. This leverage could boost your returns if the price increases, but losses also multiply if BTC falls. With 5x, any significant price drop in Bitcoin could eat up your initial $200 quickly, so you keep an eye on the risk.

- Place your first trade and monitor it: You think that the price of Bitcoin will increase according to your current market analysis. A perpetual contract is what you purchase when you go long on Bitcoin. You set a stop-loss to limit your downside in the event of an unanticipated price decline. You choose to exit your position if the price increases by 5%, and because of the leverage, you can achieve a 25% profit on your initial $200 investment.

How crypto derivatives impact the cryptocurrency market

Crypto derivatives enhance liquidity and price discovery but can increase market volatility through leveraged trading.

Here’s how they impact the crypto market:

- Price discovery: Derivatives markets reflect traders’ expectations of future prices, helping establish more accurate price trends in the spot market and providing insight into market sentiment.

- Increased liquidity: By attracting diverse traders, derivatives increase trading volumes and help maintain price stability in the market, benefiting both spot and derivatives traders.

- Hedging opportunities: Derivatives offer a way to manage risk, allowing traders and companies to secure prices and limit losses against crypto’s price fluctuations.

- Amplified volatility: Leveraged positions in derivatives can lead to more dramatic price swings, especially in volatile markets, affecting both derivatives and underlying assets.

- Institutional participation: Derivatives provide tools for managing large investments, encouraging institutions to enter the crypto market, which enhances liquidity and stability but adds complexity.

Did you know? Traders in crypto derivatives must maintain a margin, a set amount of capital reserved to cover potential losses. If the market moves against their position, this margin is used to offset losses. However, if the margin falls below a specific threshold, traders may face a margin call, compelling them to add more funds to their account or risk having their position liquidated.

Risks associated with crypto derivatives

Crypto derivatives carry risks such as leverage, market volatility, counterparty failures, regulatory changes, complexity and technical issues, which can lead to significant financial losses.

Here are the key risks to look for:

- Complexity: Because derivatives can be complicated instruments, a lack of knowledge can result in poor trading decisions and losses.

- Market volatility: Rapid price swings brought on by the inherent volatility of cryptocurrency markets may cause leveraged holdings to be liquidated abruptly. Bitcoin’s price dropped more than 30% in a single day in May 2021, leading to billions of dollars in liquidations on different derivatives markets.

- Technical risks: Technical malfunctions or system outages may make it impossible for traders to execute trades or efficiently manage their positions.

- Leverage risk: If the market moves against a trader’s position, high leverage can magnify both wins and losses, with significant financial repercussions.

- Counterparty risk: Traders risk losing money if the platform or exchange they use goes bankrupt or develops other financial difficulties. Customers lost billions of dollars when FTX collapsed in late 2022, making it impossible for them to withdraw their holdings.

- Regulatory risk: Regulatory changes can impact the legality and operation of derivatives trading, leading to disruptions in the market. In 2021, China’s crackdown on cryptocurrency trading forced exchanges to halt services, causing significant price drops and uncertainty.

To mitigate risks associated with crypto derivatives, traders should prioritize education to understand how these instruments work. Implementing risk management strategies like stop-loss orders and maintaining smaller positions can help limit potential losses. Diversifying investments and staying updated on market news and regulatory changes further reduces risk exposure.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

4 days ago

6

4 days ago

6

:quality(85):upscale()/2024/10/31/801/n/49351082/b84152bf6723c91b32cc73.86821940_.jpg)

English (US) ·

English (US) ·