In brief

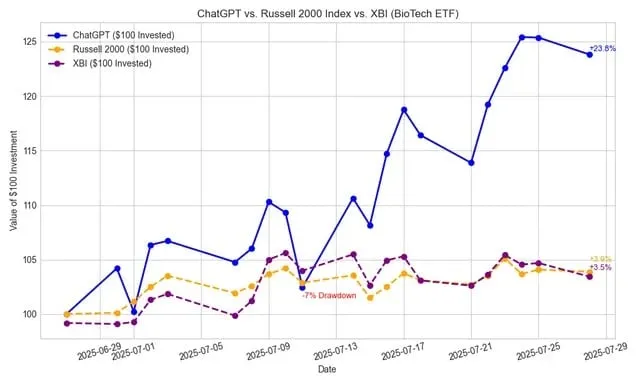

- Nathan Smith’s ChatGPT-powered micro-cap bot is up 23.8% in four weeks—blowing past the Russell 200 and pro stock pickers.

- Unlike viral AI trading claims, Smith’s experiment is fully documented, open-source, and ready for anyone to try.

- Wall Street’s bots watch their backs: Smith’s journey from rural high schooler to finance prodigy is just getting started.

A high school kid from rural Oklahoma just did what Wall Street's algorithms haven't: he let ChatGPT run wild with $100 and watched it outperform the market by a massive margin.

Nathan Smith's experiment started four weeks ago with a simple premise—give ChatGPT complete control over a small portfolio of micro-cap stocks and see what happens.

The results? A 23.8% return while the Russell 2000 and biotech ETF XBI crawled up just 3.9% and 3.5% respectively.

Image: Nathan Smith

Image: Nathan Smith"When I was watching YouTube, I was constantly getting this ad about some AI stock picker: '(the ad said) We feed our trading algorithm all stocks on the NYSE blah blah blah…'" Smith told Decrypt. "I then started doing some research and was surprised nobody had attempted a fully led LLM portfolio before."

The setup sounds deceptively simple. Smith gave ChatGPT a clear mandate: build the strongest possible stock portfolio using only full-share positions in U.S.-listed micro-cap stocks with market caps under $300 million. The objective was straightforward—generate maximum returns from June 27 to December 27, 2025.

What sets this apart from other trading algorithms is the complete autonomy.

"The AI takes care of absolutely everything. Position sizing, stop loss, etc., are none of my decisions," Smith told Decrypt in an email. The only human intervention comes when ChatGPT contradicts itself—a quirk he acknowledges as one of the system's drawbacks.

Smith recently calculated the risk metrics that professional traders obsess over.

His Sharpe ratio sits at 0.9413, indicating high risk, while the Sortino ratio of 2.0021 suggests strong upside gains with limited downside. For context, a Sharpe ratio above 1.0 is generally considered good, while anything below suggests the returns might not justify the risk.

The chatbot, which is fully open-sourced and is available on Smith's GitHub repo, has no diamond hands and seems to be pretty objective, most of the time.

One of ChatGPT’s moves involved CADL, a stock that generated roughly 50% of the portfolio's profits.

"It sold CADL without a second thought," Smith said. "I think it wisely knew that in micro-cap territory, all gains can be wiped out in an instant. Not many hedge funds could make such a decisive move."

Elegant in its complexity

Smith's system has been operating for only a month, which is not enough to backtest or assess with a high confidence level, but the positive results thus far are promising.

The technical infrastructure behind this experiment is a bit more complex than simply using your typical chatbot, but it is still straightforward to implement with a little bit of dedication.

Smith built five main functions: manual buying and selling for new picks, portfolio processing for tracking trades, daily results generation using Yahoo Finance data, and graph generation for visualizing performance against the S&P 500.

"Honestly, the setup is pretty simple," he said, describing a system that pulls benchmark prices from Yahoo Finance API into Panda’s data frames for analysis.

ChatGPT chooses stocks once per week, and always stays under the $300 million market cap limit, while Smith executes the trades and logs the results.

The teenager from a tiny Oklahoma town discovered his passion almost by accident. "I have coded a little in the past (working on Harvard's online CS course CS50), but using C didn't feel invigorating (stupid segmentation fault errors)," he told Decrypt. "Over the summer, I discovered Quantitative Finance and the beauty of Python, and I fell in love."

Oh, the things high schoolers do nowadays.

With almost 1,000 GitHub commits this past year and a good amount of followers on his newsletter, Smith has thrown himself into the world of quantitative finance. He plans to extend the experiment to a full year once it wraps in December, though he admits balancing it with ACT studying and self-studying for AP Psychology will be challenging.

"I really think I've found my passion in life and hope to continue this as a real job one day," Smith said.

Generally Intelligent Newsletter

A weekly AI journey narrated by Gen, a generative AI model.

4 months ago

38

4 months ago

38

English (US) ·

English (US) ·