GlobalFoundries is mulling a possible merger with Taiwanese semiconductor producer United Microelectronics Corp. to strengthen their shared role in making chips using mature and specialty process technologies, according to an assessment document reviewed by Tom's Hardware. The document outlines plans for 'Project Ultron,' which is meant to create a powerhouse controlling a significant share of the global production of chips. However, the plan will likely face major financial, political, and regulatory challenges. Nikkei has also reported on the matter, citing that it has reviewed an assessment plan. UMC has denied involvement, saying it is not currently conducting a merger.

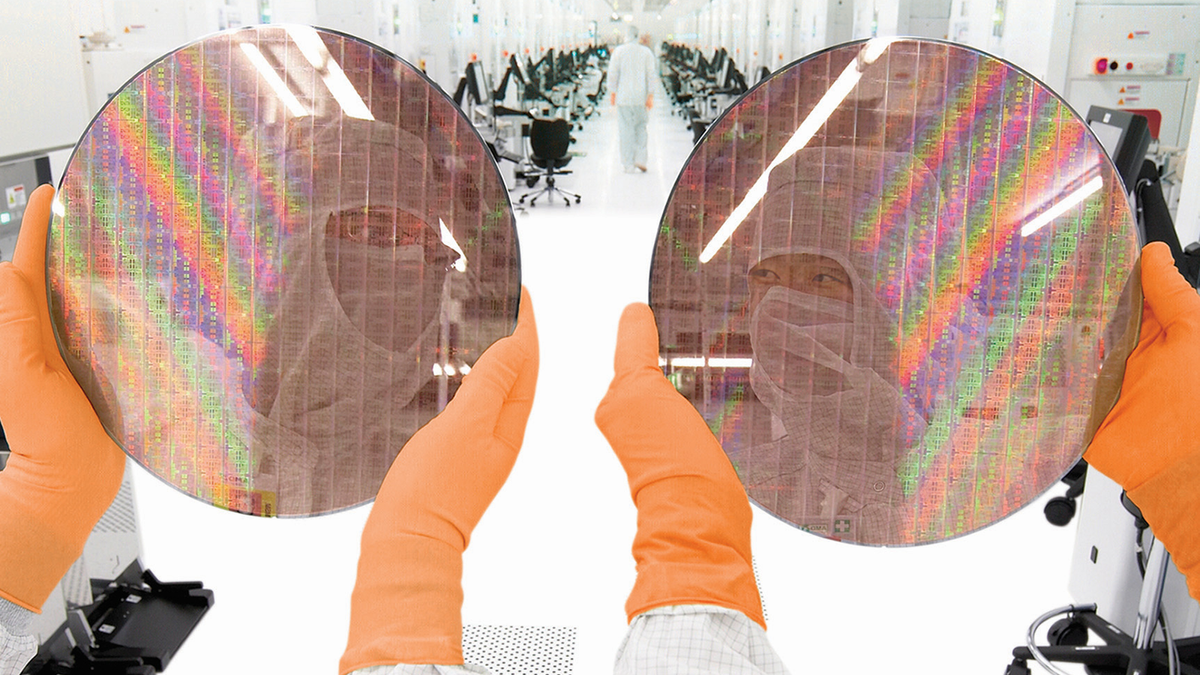

After ceasing to develop leading-edge process technologies in the late 2010s, GlobalFoundries and UMC focused on specialty and mature process technologies. Avoiding competition with TSMC, Intel, and Samsung Foundry enabled the companies to focus on profitability and growth. However, the semiconductor market in general, and the foundry market in particular, have changed significantly in recent years. SMIC has become a much bigger competitor than it was seven or eight years ago, and China has invested tens of billions of dollars into fabs that use mature process technologies. By contrast, GlobalFoundries's revenue has declined since 2022, whereas UMC's revenue has stagnated in recent years after peaking in 2022.

Tim Breen, named GlobalFoundries's next chief executive in February, will take over in April and is considering acquiring UMC, one of GF's main rivals. Combining two major foundries would create a stronger competitor in the mature-node segment (e.g., 28nm and above), essential for automotive, industrial, and legacy applications. The combined company is expected to control around 28% of the mainstream node foundry revenue, and a greater scale would enable better pricing power, operational efficiency, and stronger negotiating leverage with customers. The GF-UMC, if combined, will still be smaller than TSMC, which controls 44% of the mainstream node share.

There is a rationale for GlobalFoundries to buy its rival and for UMC to become a part of GF. The mature-node segment is increasingly threatened by low-cost Chinese fabs, and a combined GF-UMC entity could consolidate global capacity and better compete on cost, scale, and reliability. Also, UMC and GF have different but complementary customer sets, so a merger could enable cross-selling, better utilization of fabs, and more diversified revenue streams, reducing business risks.

Also, UMC is heavily concentrated in Taiwan, while GF operates fabs in the U.S., Germany, and Singapore, so a merger would spread geographic risk, reduce reliance on Taiwan, and appeal to customers and governments looking for supply chain resilience. Taiwan would still lead with 40% of capacity (UMC), followed by Singapore with 25% (shared by both), and smaller shares in China (11%), Germany (9%), the USA (9%), and Japan (6%). Growth is expected in the USA, Germany, and Singapore, while capacity in China and Taiwan is projected to decline.

Last but not least, GlobalFoundries – UMC will have the scale to develop new 'single-digit nanometer' process technologies, which will open doors to new applications and design wins for the combined company, according to the document. However, it remains to be seen whether it will invest in sub-10nm process technologies to compete against TSMC, Intel, and Samsung Foundry.

While the idea for GlobalFoundries to acquire UMC is an ambitious project that has a lot of rationale, it will be hard to accomplish. The market capitalization of GlobalFoundries is $20.41 billion, whereas the market capitalization of UMC is $16.86 billion. GF does not have the cash to acquire UMC now, so it will either have to take on debt, issue more shares, or ask its main investor, Mubadala, for cash.

However, even if funding is secured, regulatory barriers could prevent the transaction from happening. If GlobalFoundries were to take control after a deal, that outcome would likely be opposed by the Taiwanese government. Chinese approval could be hard to obtain too as the new entity will be a tough rival for Chinese mature nodes fabs. However, if the merged company commits to build additional capacity in China, this could change the mind of regulatory organizations in the People's Republic.

8 months ago

68

8 months ago

68

English (US) ·

English (US) ·