Tom's Hardware Premium Roadmaps

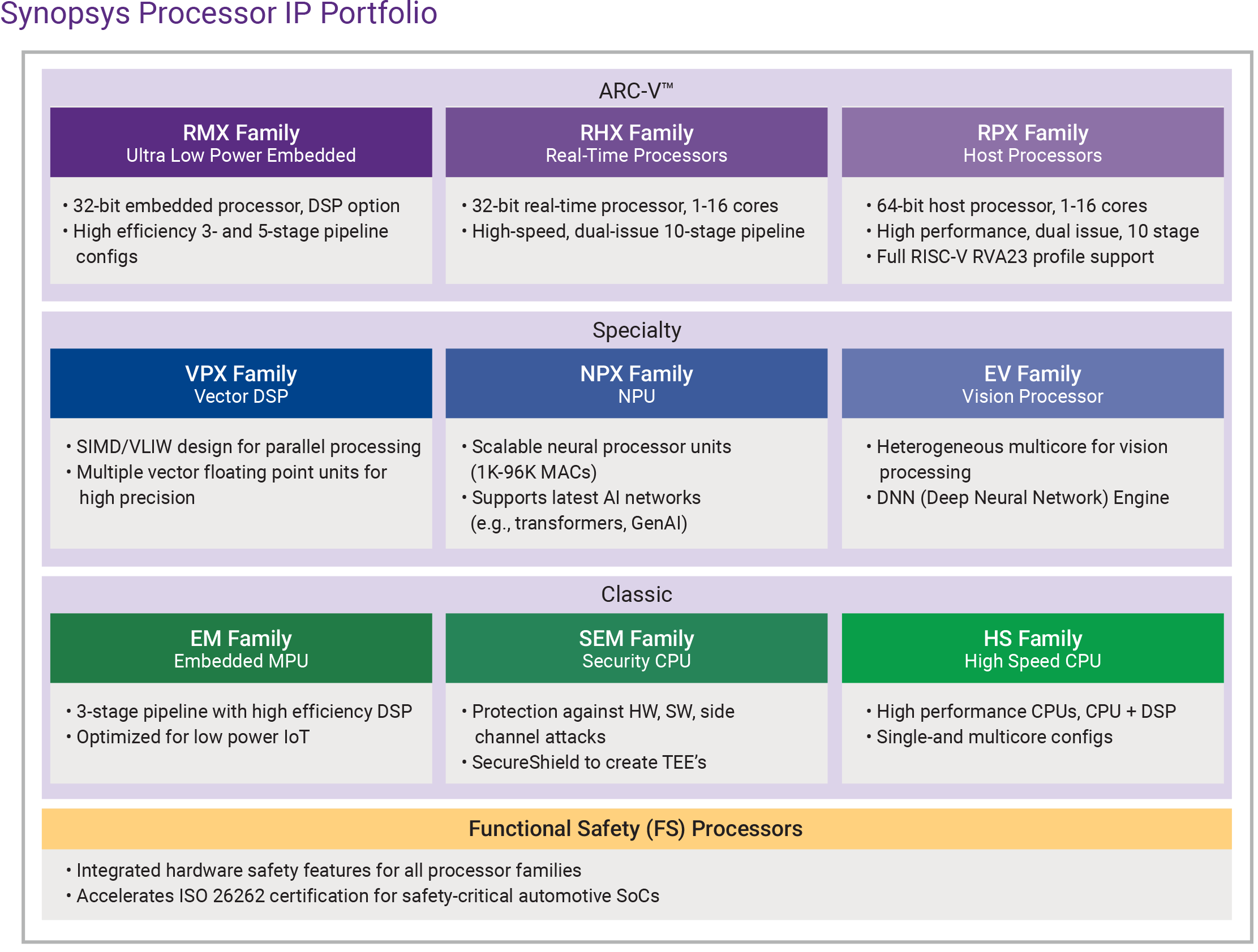

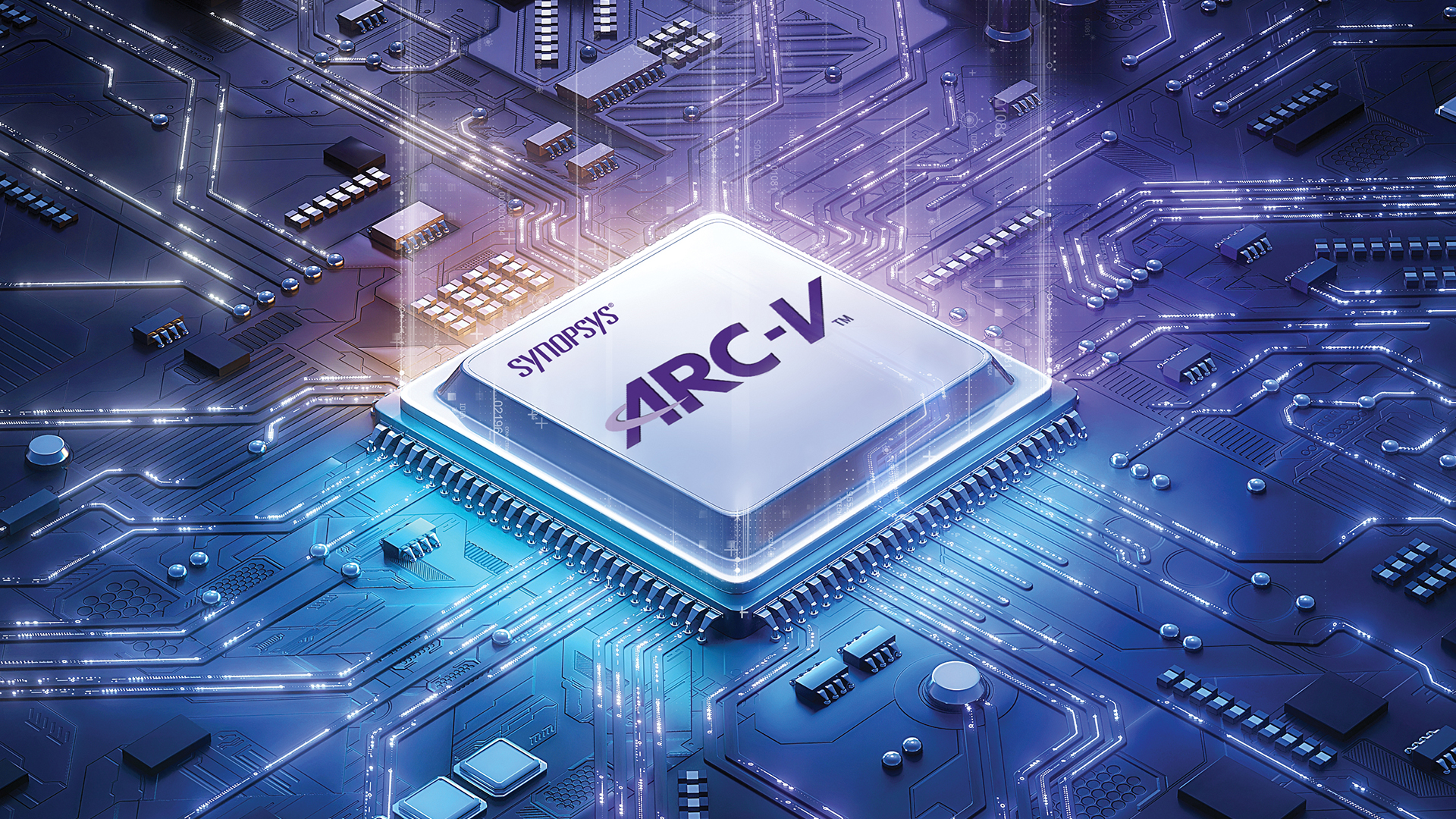

GlobalFoundries this week announced that it had reached a definitive agreement to acquire Processor IP Solutions business from Synopsys, its second acquisition of a CPU IP business in less than a year, and its fifth major acquisition in one-and-a-half years. Synopsys's portfolio of ARC and RISC-V processor IPs will complement GloFo's technologies obtained with the MIPS acquisition. This will enable the company to broaden its offerings across automotive, embedded, industrial, wearables, and other emerging applications, which benefit from standard CPU IP and customized accelerators.

GlobalFoundries gets more CPU IP

As a result of the deal, GlobalFoundries will take over processor IP assets that include ARC-V (RISC-V), classic ARC CPU cores, DSP, and NPU IP that use the ARC framework. It will also benefit from the associated software ecosystem, such as the ARC MetaWare development toolkits. The acquisition also includes Synopsys's ASIP Designer and ASIP Programmer toolchains, which automate the development and deployment of application-specific instruction-set processors (ASIPs) that integrate base CPU cores with bespoke instructions, pipelines, or accelerators immediately supported by a compiler.

The terms and conditions of the deal, expected to be closed in the second half of the year, have not yet been disclosed. Both companies have committed to a coordinated transition plan to ensure existing Processor IP customers continue to receive uninterrupted support, so Synopsys's customers will not be forced to migrate to other technologies due to the acquisition.

Upon closing the transaction, all the assets that are part of the Synopsys Processor IP Solutions (we will call it 'ARC' for the sake of simplicity) as well as 'expert teams' will become a part of MIPS, which operates like a separate company within GlobalFoundries (e.g., it can work with other foundries and license IP to companies that do not use GF's manufacturing services).

As a result, MIPS will control a vast range of IPs, such as MIPS RISC-V cores, as well as IP from Synopsys, which includes ARC-based CPU, DSP, and NPU cores, as well as ARC-V offerings featuring the RISC-V instruction set architecture (ISA).

RISC-V & ARC

With RISC-V, GlobalFoundries can offer an extensible ISA, open-source software, and compatibility with a growing ecosystem. The value of ARC lies in its configurability, which enables developers to build ASIPs, processors with a custom ISA and features. Building system-on-chips (SoCs) with RISC-V general-purpose cores and bespoke ARC accelerators could provide an edge for GlobalFoundries' customers, as the technology benefits from burgeoning market penetration.

For those unfamiliar with ARC, these processors use the 16/32/64-bit ARCompact compressed ISA originally developed in the 1990s for graphics processing purposes. Instead of a fixed microarchitecture, ARC allows designers to add custom instructions, bespoke accelerators, and modify datapaths while the software toolchain (compilers, debuggers, profilers) automatically adjusts to match the hardware. This makes ARC fundamentally different from general-purpose CPUs, as the final ASIP is shaped around a specific workload rather than optimized to run a wide range of applications. As a result, ARC excels in applications where specialization matters more than peak performance. As a result, specially-tailored Application-specific instruction set processors (ASIPs) can offer higher performance-per-watt efficiency and predictable performance than SoCs based on off-the-shelf CPU cores and IPs.

Building its own IP ecosystem

The goal set by GlobalFoundries is to 'deliver a comprehensive processor IP suite' that spans from RISC-V general-purpose cores to special-purpose DSPs, NPUs, and other accelerators. Ultimately, this will increase its customer lock-in through lower adoption barriers, a faster-time-to-market, accelerated development of custom silicon, as well as IP licensing and embedded software.

Once GlobalFoundries integrates the Processor IP Solutions into MIPS, it will inevitably align ARC and MIPS designs with its own process technologies, packaging options, and verification/qualification flows, which is something that must be done to accelerate development of custom solutions as well as speed up time-to-market.

This alignment will reduce incompatibilities between architectural intent and physical implementation, as both will come from a singular company. As a result, GlobalFoundries' customers will be able to pick up a wide range of silicon-proven IP blocks, integrate them into their own differentiating IP (or even develop one based on the ARC ISA from scratch) into their upcoming chip, and greatly fast-track their path from Register-Transfer level design (RTL), to mass production while taking advantage of power, performance, and area-optimized IPs with predictable yields.

For embedded designs with a very long lifecycle, that predictability, along with cost-cutting and time-to-market, matters more than chasing leading-edge density or the highest performance. In fact, many fabless companies among those building custom silicon for emerging applications lack internal resources to assemble a full compute stack from scratch. Traditionally, these customers would license CPU IP from one vendor, DSP or AI blocks from another, and only then begin mapping the design onto a foundry's process technology. With TSMC's OIP and Arm's portfolio of IPs, the path to silicon is rather straightforward, as the ecosystems are vast.

With the takeover of MIPS and ARC, GlobalFoundries can offer its clients a bundle of silicon-proven IPs from one shop, which means even faster time to market, greater flexibility with RISC-V and ARC, and perhaps a lower price. While GlobalFoundries avoids explicitly marketing this as vertical integration, the technical implication the company revealed earlier this year in an interview with Tom's Hardware made clear: processor IP, software tools, and fabrication are now coordinated inside a single organization.

Changing the role of pure-play foundry

GlobalFoundries is deliberately reshaping its role in the semiconductor value chain by combining its manufacturing capability with in-house processor IP — built around RISC-V and the newly acquired Synopsys ARC portfolio, as well as silicon photonics and optical connectivity enabled by Advanced Micro Foundry (AMF) and InfiniLink acquisitions — to offer customers a tightly integrated path from architecture to silicon. The strategy targets a wide range of emerging applications across a variety of verticals, including automotive, embedded, industrial, and physical AI markets.

For GlobalFoundries's customers, the ARC + RISC-V combination provides a standards-based ISA for general-purpose compute, paired with the ability to introduce workload-specific instructions and accelerators without negotiating changes with the owner of a proprietary architecture, such as Arm.

This might open GlobalFoundries some additional business opportunities with newly established fabless chip designers with limited budgets, clients with requirements for sovereign chip designs without massive upfront investments, and customers operating under export controls and looking for a partner with policy-resilient IP and manufacturing. Keeping in mind location of GloFo's fabs in Asia, Europe, and the U.S., the strengthened IP portfolio makes even more sense.

What's next for GlobalFoundries?

With two CPU IP-related acquisitions in less than a year, we can now only wonder what is next for GlobalFoundries: will it focus on integration of MIPS and ARC into its organization, or it will pursue more M&A activities?

If the company is looking forward to more acquisitions, the most logical thing to do would be to pursue adjacent technologies, enabling M&A that deepens its platform without turning it into an Integrated Device Manufacturer or putting it in conflict with customers or partners. Among the most probable scenarios for the company would be to obtain controller, connectivity, and security IP to further simplify the development of chips for its clients. Another move could be acquiring an IP focused on advanced packaging.

A less likely move is to purchase an accelerator or domain-specific IP to address specific applications. So far, GlobalFoundries has focused on general IP, which can be deployed broadly.

Another option for the company could be taking over software or middleware assets for automotive, embedded, or industrial applications. Software certification is a long process, so offering customers a solution that includes both silicon-proven hardware and functionally safe software and middleware could produce another layer of opportunities for GlobalFoundries.

A calculated expansion

The acquisitions of MIPS and ARC represent a calculated expansion of GlobalFoundries's value proposition that extends beyond silicon manufacturing production and now spans to the level of physical IP and software.

To a large degree, GlobalFoundries is about to become a platform partner for its clients as it not only makes and packages chips, but also defines IP that is inside. This strengthens GloFo's competitive position against other foundries as well as against TSMC, whose OIP ecosystem serves the same purposes as GlobalFoundries's in-house IP.

For customers, the ARC + MIPS integration will offer faster time-to-market, deeper customization, increased efficiency, and safeguards against geopolitically motivated limitations.

5 hours ago

4

5 hours ago

4

English (US) ·

English (US) ·