FreshBooks is a one-stop, cloud-based accounting software package that for a relatively small outlay can provide you with an easy-to-use package that ticks most boxes.

Within its browser-based design you’ll find a whole host of options that cover any and all aspects of running a business. It doesn't matter if you're a lone freelancer or someone who’s growing a business and employing staff.

FreshBooks is a doddle to use, has the capacity to expand with your business needs and, thankfully, keeps those stress levels low as you build up your accounting profile. New features for this year include advanced search, the ability to download your own statements, Dropbox connectivity, new keyboard shortcuts and much more.

In the UK, Freshbooks has teamed up with Barclays to offer joint bookkeeping solutions for customers, offering new ways to help with invoicing and wider business management tasks. It's now possible to integrate Barclaycard Payments into FreshBooks, providing extra convenience for business customers.

Competitors in this software area include QuickBooks, Xero, Sage Business Cloud Accounting, Kashoo, Zoho Books and Kashflow.

- Want to try FreshBooks Check out the website here

FreshBooks: Pricing

FreshBooks comes with a selection of package and payment options that should provide a solution for most, but like most other companies in any industry, prices have climbed in recent years. Still, FreshBooks can justify that with feature improvements and other ways to find value for money, and there are often promotions on to get you through the door for less money.

Lite is the entry-level tier, which costs $21 per month. This and Plus ($38/month) are where FreshBooks envisions attracting most freelancers, but self-employed workers who have a bit more income and more complex needs could toss a coin between Plus or the more feature-packed Premium ($65/month).

Any requirements over and above this selection and you’re best advised to contact FreshBooks for a custom deal, which the company calls its Select plan.

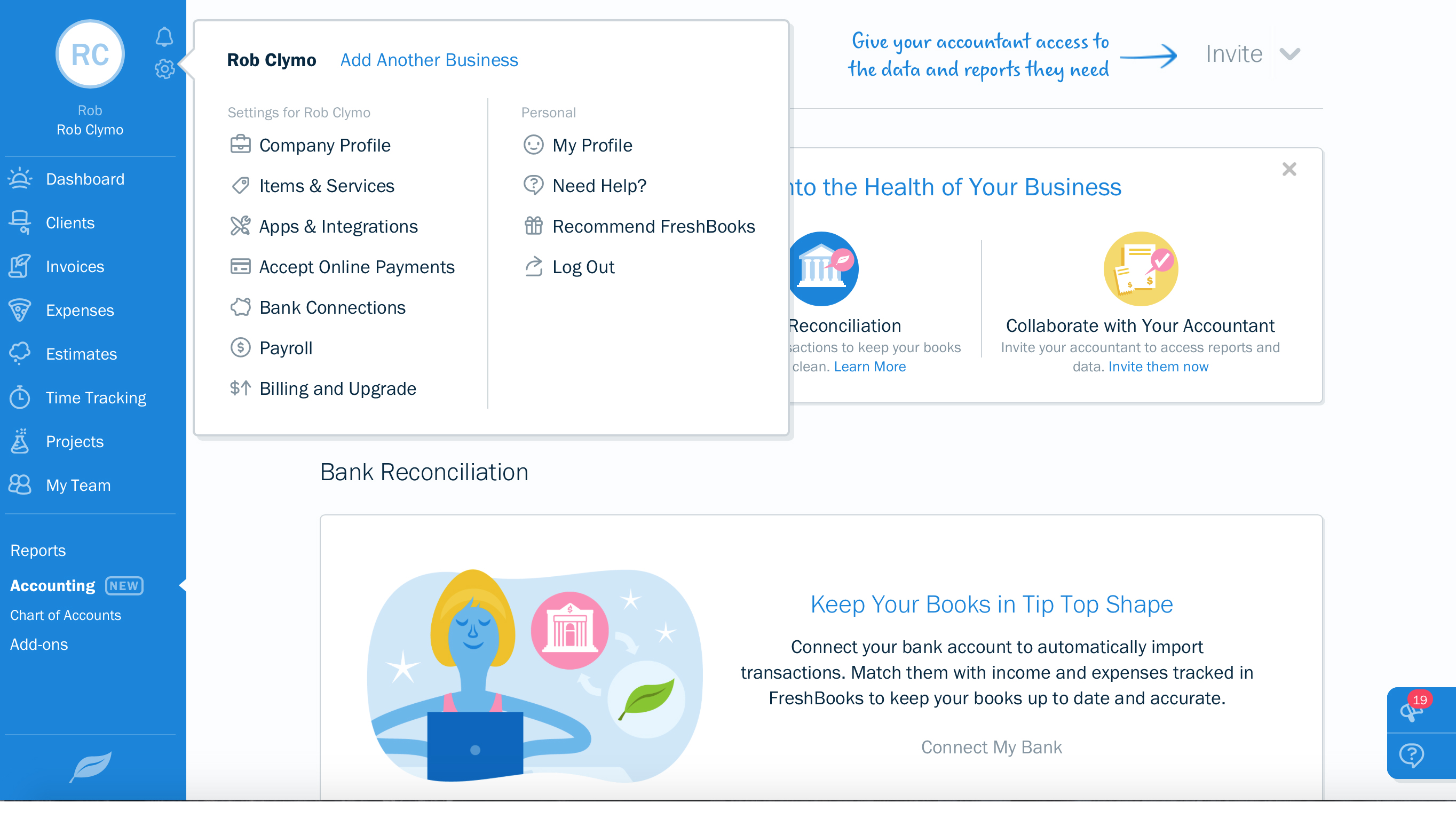

All of the plans are pretty customizable, including options for additional team members ($11/month), online payment accepting ($20/month) and Payroll, which costs $40 per month plus $6 monthly per user. All of this means the costs can quite quickly add up compared with other plans, and while we've criticized others for offering too many plans to make sense of, we're worried FreshBooks' approach can make the costs climb quickly.

FreshBooks also gets a thumbs up for its try-free option, which lets you explore the package and cancel within 30 days if it’s not right for your needs.

FreshBooks: Features

FreshBooks comes with an impressive array of features no matter which of the package options you adopt. Even the Lite edition sparkles with the capacity for unlimited and customizable invoices, unlimited expense entries, the ability to accept credit card payments online and ACH bank transfers too.

However, the limits come in areas. For example, you can only work with five clients or you'll need to upgrade.

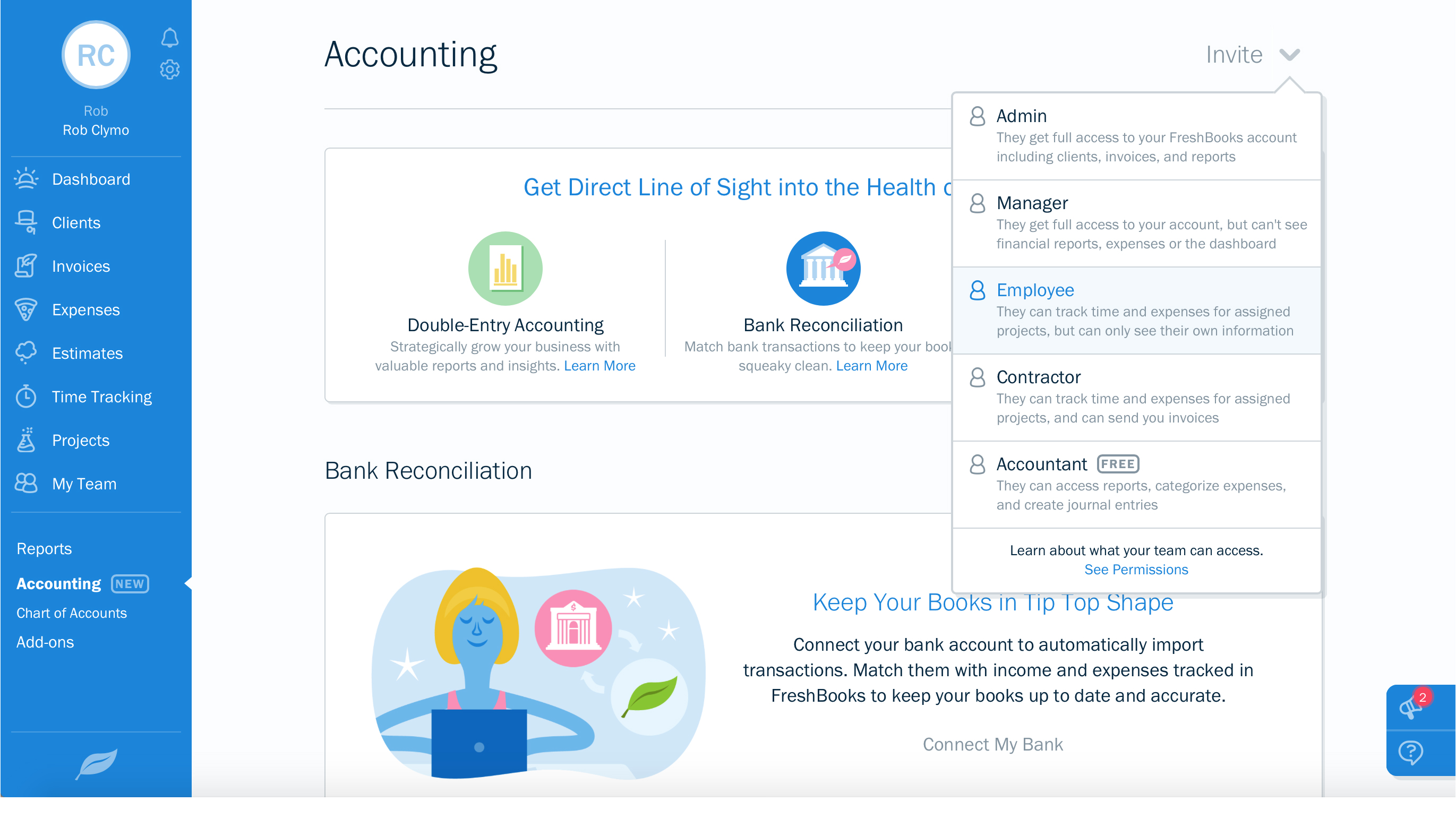

Naturally, the beefier the package the more features you get, so Plus adds to the Lite feature set with up to 50 clients, unlimited proposals, automated recurring invoices, double entry accounting reports and more besides.

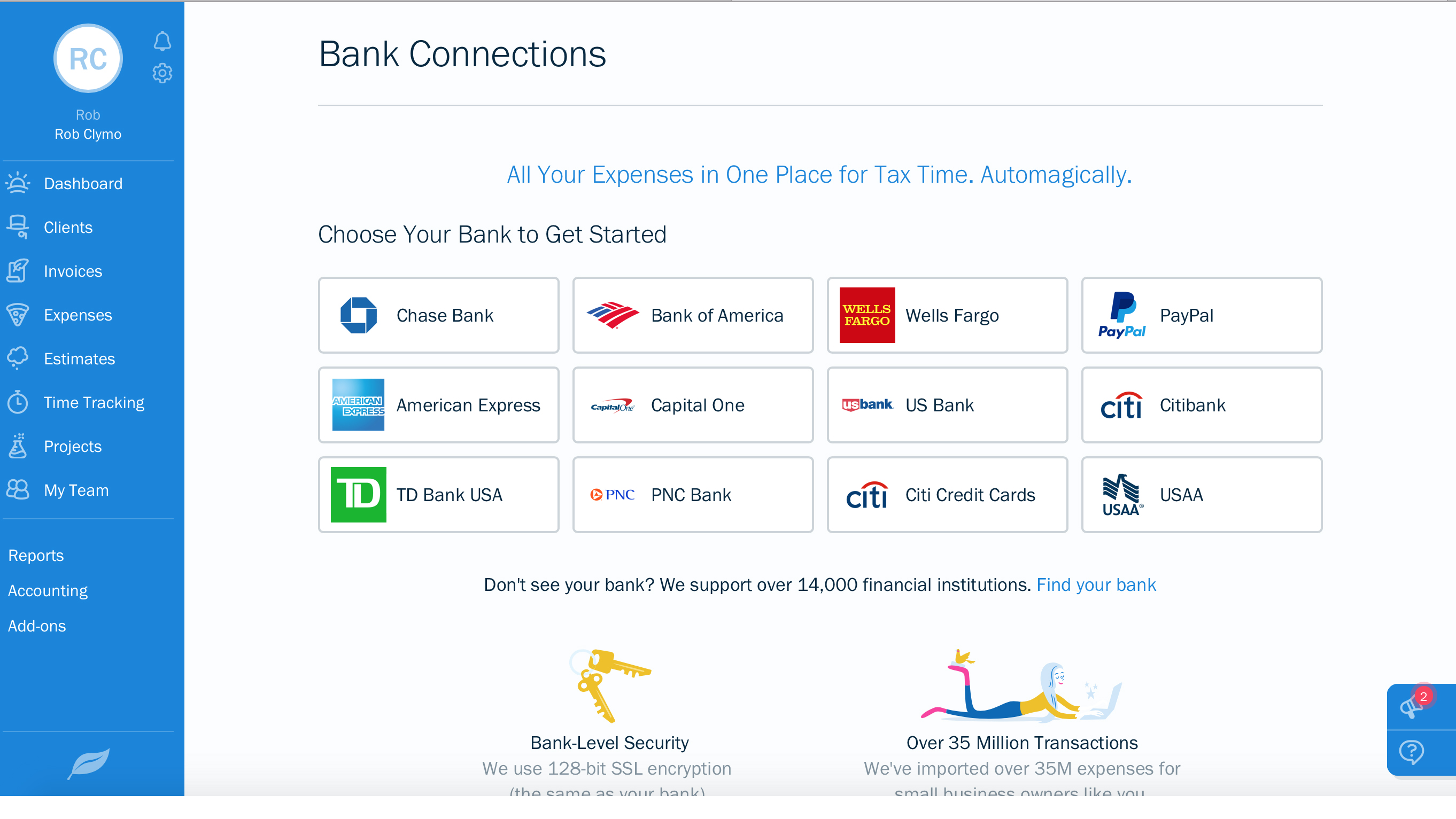

For us, Plus might be the most cost-effective plan, with other features extending to e-signature support, bank reconciliation and slicker receipt and expense tracking.

Similarly, Premium gets all the Lite and Plus features along with an unlimited client capacity (up from 500 previously) and customizable email templates, which means you could pretty much manage most of your financing from the single platform.

Anyone with a custom-priced deal can also enjoy a personal account manager, personal FreshBooks training for you and your team along with other value-added features.

FreshBooks: Performance

FreshBooks has had plenty of time to perfect its operation and this cloud-based system is one that works with little to worry about. The service delivers a neat experience depending on what kind of business you run, and if you’re a one-man-band then there’s very little to go wrong it seems.

Even if you’re operating a large or expanding business FreshBooks seems nicely engineered and rolls with the punches if you’re dealing with large chunks of customer data.

Freshbooks is also available for iOS or Android and the app edition is a clever supplement to the desktop arrangement. Not everyone wants to do everything on their app, especially if that involves large reams of numbers, but this is a great option if you’re keeping track of things on the go.

Updates in early and mid 2025 added manual bank imports and flexible reconciliation options, so if you live in a region where bank connections can be unreliable or your bank doesn't support this feature, then at least you can find another way to connect your expenses.

It's updates like these that speak volumes about a company, and it's promising to know that FreshBooks is making these changes and upping quotas (as mentioned above regarding client capacity) to continue adding value to its products even when prices climb.

FreshBooks: Ease of use

Accounting software can be a long and arduous journey if you’re not au fait with its different sensibilities, let alone the work involved in mastering a new system. However, FreshBooks has been honed and fine-tuned over the years and is now an inviting option, especially if you’re starting out in business.

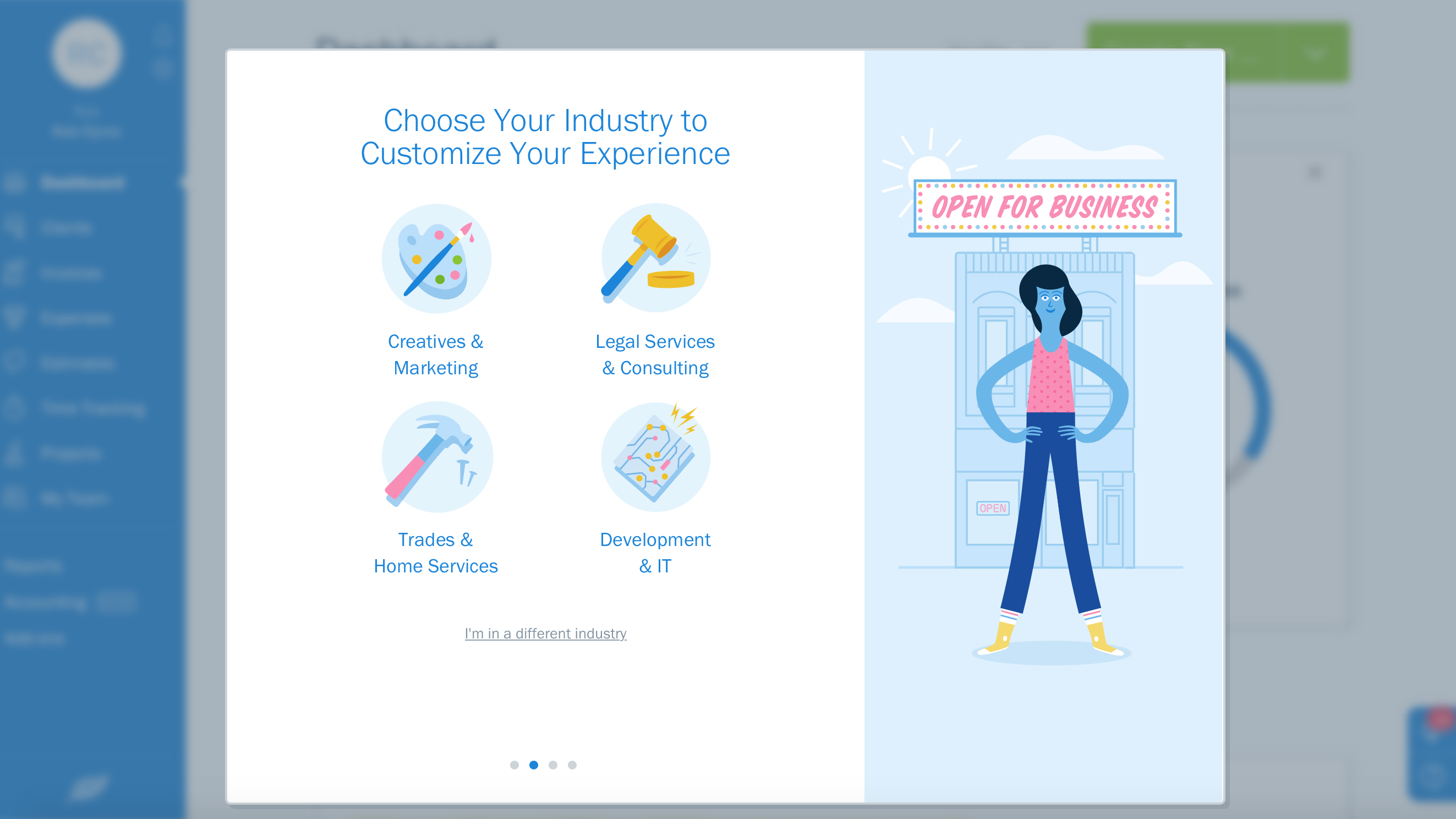

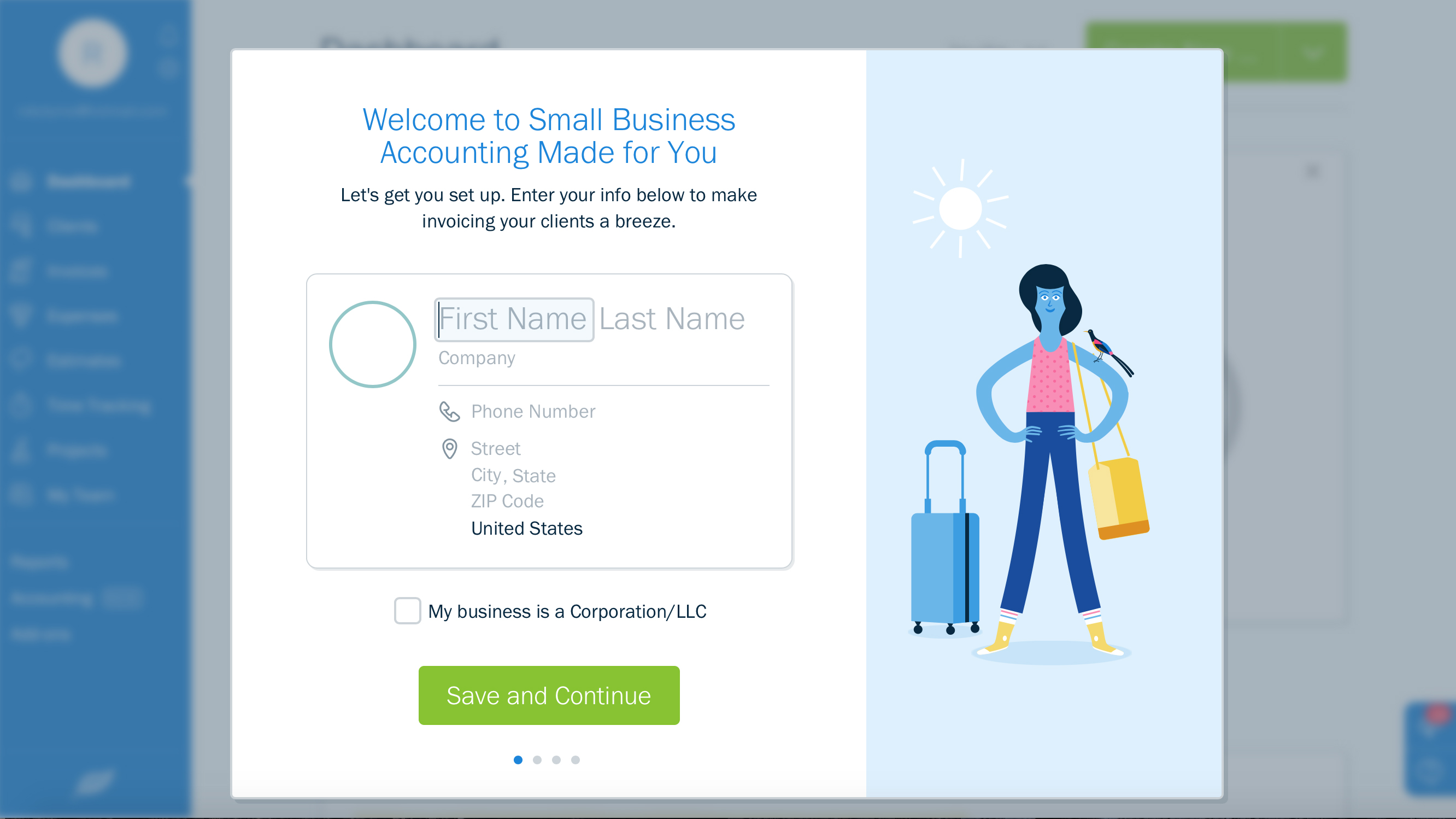

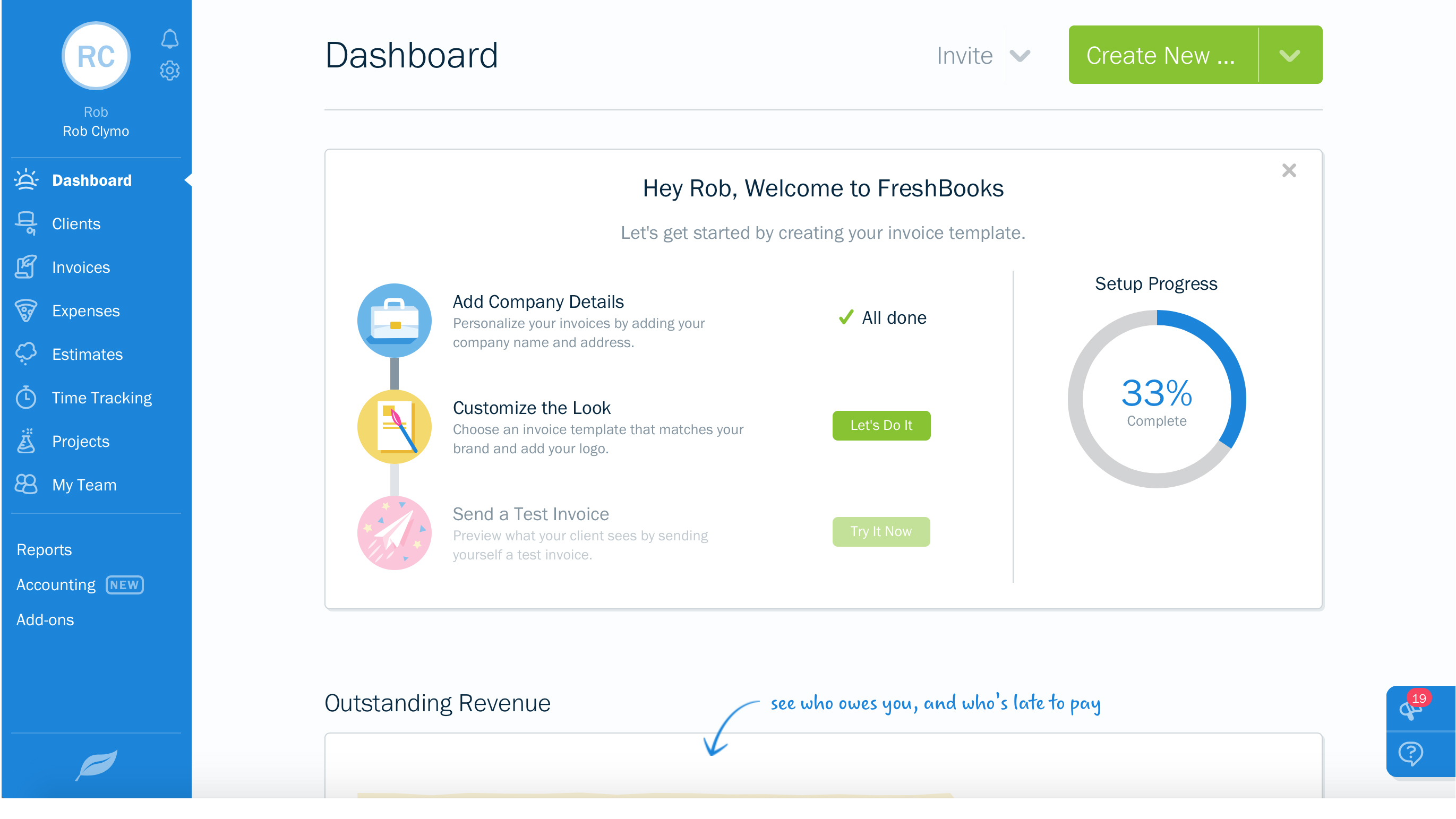

In fact, FreshBooks is refreshing in its set-by-step setup, with initial manoeuvres involving little more than picking a package and following the email address and password route so common with cloud-based operations.

On the whole, we found the experience clean, simple and jargon-free. The simple setup and onboard process also makes it a welcoming place, given how daunting finance software can be for new starters.

Ease-of-use is enhanced as the system can be adapted to suit what type of user you are. Larger concerns, for example, allows team members to be added. Freelancers and self-employed sole trader-types have it even easier.

FreshBooks: Support

FreshBooks has a dependable and well-established support system that goes back as long as it has been operating. To start, there’s an excellent online area of the FreshBooks site that offers up a delicious selection of quick fix answers.

There are top categories too, such as dashboard and settings, invoicing and payments or handling online payments, which cover the majority of newbie enquiries.

Support extends beyond how to use the platform to discuss broader topics, like MTD explanations for smaller businesses who will soon be affected by the changes.

However, for the more unusual requests you may have, or indeed if you prefer a human to advise you, then there’s an easy-to-find phone number in the same section of the site. Live support is available from Monday to Friday, 8am to 8pm EDT (Excluding Holidays) in the US. Alternatively, FreshBooks has a support email address to beef up the contact and support options.

Like other businesses, you can use the chatbot to help you find the right support article 24/7, but you'll still need to wait for a human to come online if you need further assistance.

FreshBooks: Final Verdict

We’re really pleased with the way the latest incarnation of FreshBooks looks and performs. It’s been around for a while now and that is obviously a strength as the FreshBooks folks have refined the essence of the accounts package, but the best part is how polished it has become, making what can be a regular, tedious and complex task a joy to complete.

Its strongest suits include invoicing, expense management and tax-ready reporting, which it handles with ease, and it’s easy to setup and configure, the menu systems and sections are plain and simple, plus there’s plenty of power behind it to ensure things keep on ticking even if you’re asking a lot of it.

All told, FreshBooks seems like a mighty fine way to do your accounting and, depending on your requirements, is actually pretty cost-effective. We just worry that it could be seen as more of a premium product, with higher tiers and add-ons quickly making it a more expensive option than some others.

- We've also highlighted the best budgeting software

English (US) ·

English (US) ·