The central bank aims for price stability as tariff uncertainties cloud future inflation strategy.

Photo: Samuel Corum

Key Takeaways

- The Federal Reserve held the federal funds rate steady at 4.25% to 4.5% to assess inflation risks from tariffs.

- Proposed tariffs by Trump could increase inflationary pressures, affecting the Fed's rate decisions.

The Federal Reserve held interest rates steady on Wednesday at a range of 4.25% to 4.5% as officials continued to assess inflation risks and growing uncertainty sparked by Trump’s trade agenda.

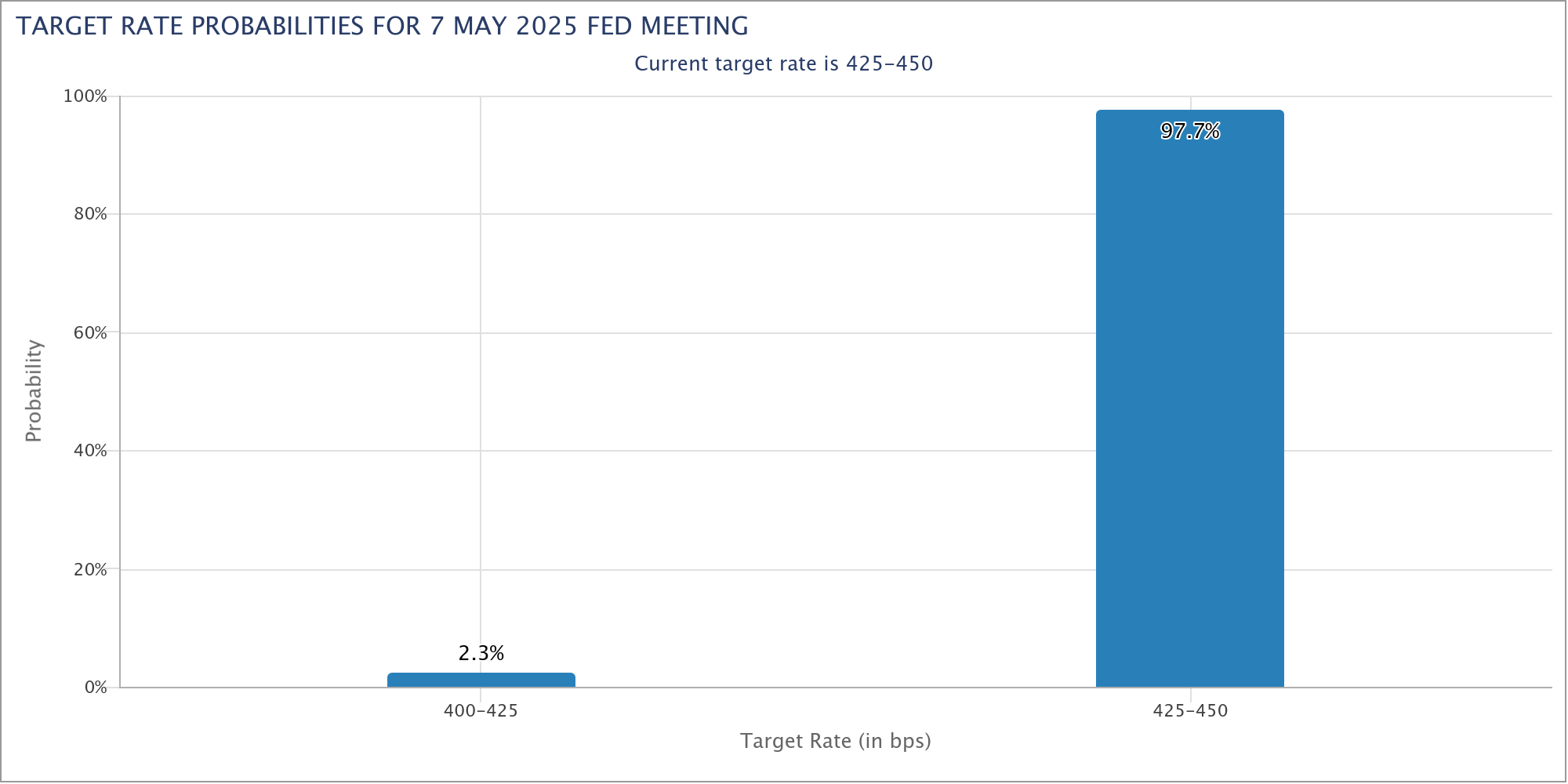

The central bank’s decision was in line with market expectations. According to data from the CME FedWatch tool, markets had priced in a nearly 98% probability that rates would remain unchanged at the Fed’s May meeting.

This marks the third consecutive pause in rate cuts since January. The central bank had previously lowered rates three times in late 2024 in response to softening employment data and easing inflation.

The latest policy stance comes on the heels of cooling price pressures and continued labor market strength. In March, the Consumer Price Index (CPI) fell 0.1% on a monthly basis, while annual inflation eased to 2.4%, down from 2.8% in February.

Meanwhile, April saw solid job gains, reinforcing the resilience of the economy despite uncertainty about Trump’s tariffs.

The combination of moderate inflation and robust employment supported the Fed’s choice to hold rates steady.

The Fed’s policy statement said that recent indicators suggest economic activity has continued to expand at a solid pace, with labor market conditions remaining strong and the unemployment rate stabilizing at low levels. However, it noted that inflation remains somewhat elevated and uncertainty about the economic outlook has increased further.

The Committee said the risks of both higher unemployment and higher inflation have risen and emphasized that future decisions will depend on incoming data and the evolving balance of risks. It also reaffirmed its commitment to reducing its balance sheet and to achieving its dual mandate of maximum employment and 2% inflation.

President Trump has persistently pressured the Fed to lower interest rates, but recent strong employment data has decreased the chances of a rate cut in June.

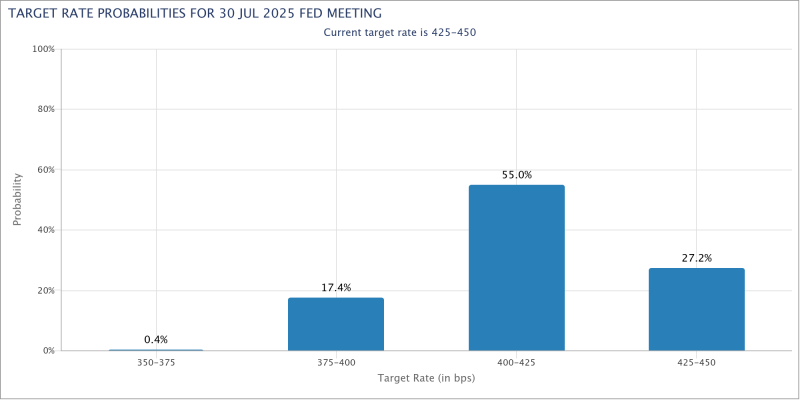

The market has shifted its expectation of rate cuts, with participants less confident about reductions going into the third quarter. Investors now anticipate the Fed will begin cutting rates in July, with two to three additional reductions projected by year-end.

Disclaimer

7 months ago

173

7 months ago

173

English (US) ·

English (US) ·