OpenAI's rise to tech stardom reads like a Silicon Valley soap opera. The company that began 2024 in turmoil after Sam Altman's dramatic return has morphed from a cautious non-profit company to an AI powerhouse worth $157 billion. With a $13 billion investment from Microsoft and a deal to power Apple iPhones, the company is on track to generate $11.6 billion in revenue.

Game over for all the other suckers trying to elbow their way into the AI market? Hardly.

The money flooding into AI continued to reach tsunami proportions throughout 2024, with billions of dollars going into funding dozens of worthy competitors around the world, ranging from China’s Moonshot AI to Paris-based Mistral.

During the last week of November alone, Anthropic and Elon Musk's xAI pocketed $4 and $5 billion respectively. Investors who once saw OpenAI as the new big thing in tech are spreading their bets across a field of nimble, hungry competitors and anything ending in AI could be the next frontrunner—especially after delays from OpenAI, including Sora, its ballyhooed audio cloning tool (and, supposedly, its next GPT model.)

It seems like decades since ChatGPT burst onto the scene with its revolutionary chatbot, which users could communicate with as easily as talking to a friend. (The chatbot launched in November 2022 and added speech in September 2024.) Almost overnight it made Google search look antiquated, something that the olds use. These days, it’s probably the first thing a GenZ thinks about when someone says “AI.”

The company that sparked the AI revolution with ChatGPT pushed the boundaries of AI capabilities in 2024 after the boom of GPT-3.5, releasing its multimodal GPT-4o in May with an unprecedented 88.7% score on the MMLU benchmark. By September, its new o1 model—which is supposed to handle complex reasoning—raised the bar again, achieving 83.3% accuracy on International Mathematics Olympiad questions—a massive leap from GPT-4o's 13.4%.

With over 200 million weekly active users, OpenAI's influence ran so deep that Google, deep in the throes of the Innovator’s Dilemma, suddenly began to fear for its $160 billion search business.

But money and fame don't guarantee a happy ending, especially in tech. Anyone remember the Blackberry?

Google is all about raw power—but people love its speaking chatbots

Google certainly isn’t going the way of the Blackberry any time soon. Besides, it’s not like it was caught with its pants down. OpenAI was launched in December, 2015 and two months later, the search giant unveiled its new Gemini Ultra foundational model, with the capacity to process 2 million tokens of context—making OpenAI’s GPT-4 look light weight. AI is so integral to Google that CEO Sundar Pichai announced the company is moving from mobile to an "AI-first" strategy.

And not a second too soon: The switch to Gemini boosted the popularity of Google One—the tier that offers access to Gemini Ultra—to over 100 million subscriptions 24 hours after its release.

We just crossed 100M Google One subscribers! Looking forward to building on that momentum with our new AI Premium Plan (launched yesterday) offering AI features like Gemini Advanced, plus Gemini in Gmail, Docs + more coming soon. https://t.co/m7zAVop7P6 pic.twitter.com/sMdwJeq0iU

— Sundar Pichai (@sundarpichai) February 9, 2024

Google is not just flexing technical muscle; ChatGPT is still widely used but Google may be onto something. Its foundational model also powers its RAG, short for "retrieval augmented generation," platform NotebookLM, which was first conceived to help people handle huge amounts of information and data on big amounts of files. The product didn’t move a needle until an update changed the way people used RAG models. Welcome, Google’s podcast generators.

That feature alone was enough to boost the model’s popularity, and increase user engagement with a pretty active Reddit community, interesting social experiments and even some business applications to explore.

“I think we’ve learned a lot in the last year; what is really resonating with people, what is really useful, how they’re using it every day,” Raiza Martin, a product manager at Google Labs, told The Independent.

Meanwhile, OpenAI has given us a voice mode to talk to, still keeps its 128k token context window, and under legal threat, removed its horny Scarlett Johanson voice. The Gemini lineup has been key for Google’s outstanding performance. Since January 2023, its stock price doubled, reaching an ATH on July 10, 2024.

Anthropic: ethics + power = big money

Smaller than Google, but probably as important in terms of its role in the boom of AI chatbots this year is San Francisco-based Anthropic. Founded by former OpenAI researchers, Anthropic emerged as OpenAI's most formidable challenger in 2024, turning heads with explosive growth and deep-pocketed backers.

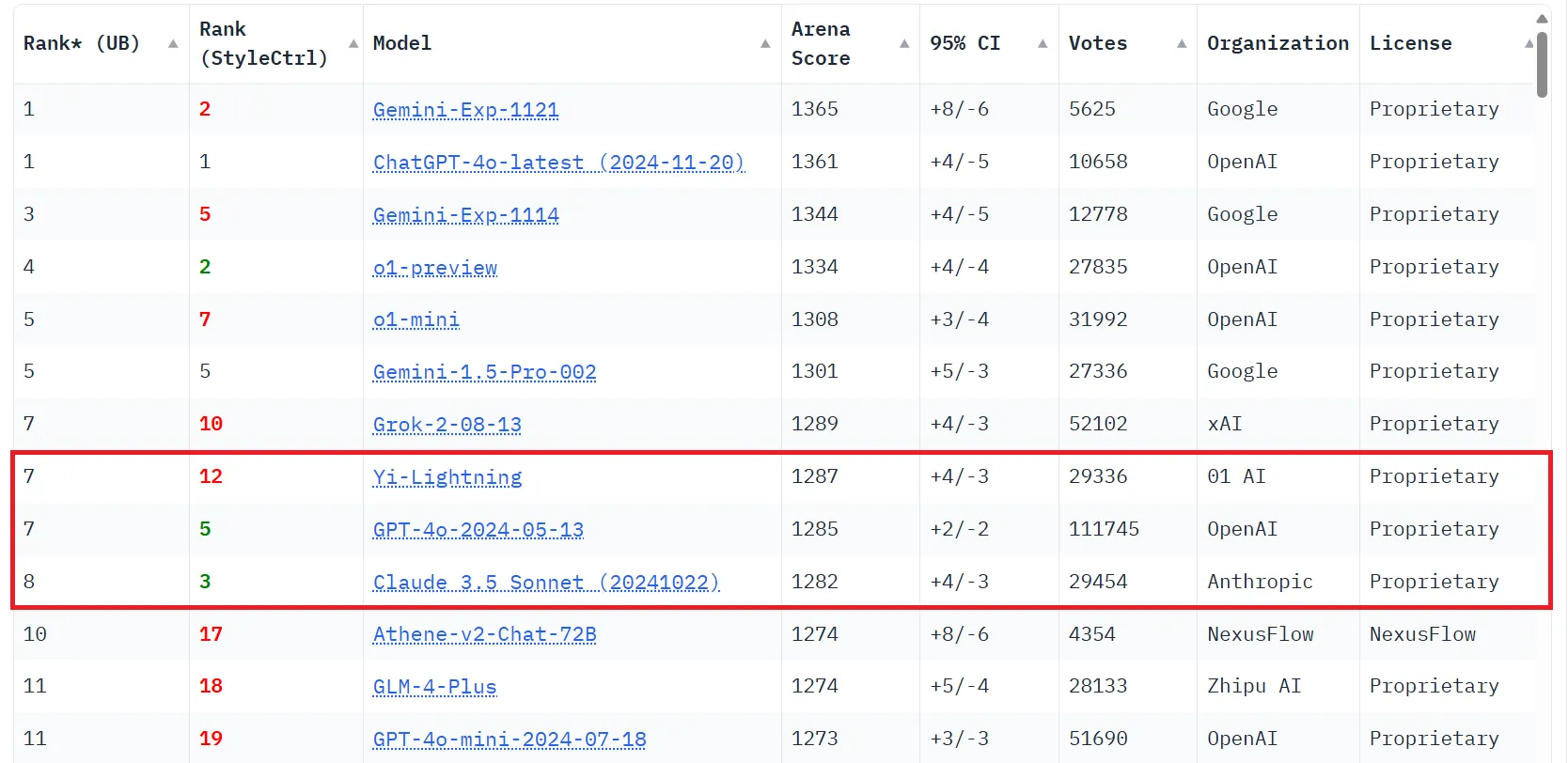

The rivalry between ChatGPT and Claude, Anthropic’s suite of large language models, is the equivalent of the Cold War in AI culture. When one company releases a feature, the other immediately strikes back. The two models are always competing for the top spot in the LLM Arena and the community is always trying to decide which one is the best.

Anthropic’s revenue grew over 1,000% this year after the launch of Claude 3.5 Sonnet in June, with a major part powered by third-party API users. Anthropic's rise mirrors the early days of OpenAI, but with an even steeper trajectory.

And the investments keep flowing in. Amazon has poured $8 billion into the startup, while Google agreed to invest up to $2 billion. These cash infusions were also probably strategic bets from tech giants hedging against OpenAI's dominance, and a mirror of a proxy war between cloud computing providers, with Microsoft supporting OpenAI to benefit Azure versus Amazon supporting Claude to benefit AWS. Anthropic and OpenAI mine the gold, whereas Microsoft and Amazon basically sell the shovels.

Anthropic's success is not just due to its models’ quality. Overall, the company pushes for a broader shift in the AI landscape. While OpenAI chased consumer popularity, Anthropic focused on specialized models that prioritized safety, betting that enterprise customers would pay premium prices for targeted solutions.

Mistral AI: making Europe relevant

In Europe, French startup Mistral AI raised eyebrows by securing $1 billion in funding and a $6 billion valuation in June. Its open-source models are matching GPT-4's capabilities at a fraction of the cost. To put this in perspective, this means, according to calculations by Trending Topics, that "Mistral AI is worth €105m per employee," making it the most valuable startup in European history.

A recent upgrade called “Le Chat,” is being positioned as Mistral’s ChatGPT killer. It offers basically everything ChatGPT does—for free. It provides good outputs, handles code, generates images, supports agents and browses the web in real time.

And Mistral is just getting started, with a planned expansion into the United States and a new office in the belly of the beast in Palo Alto, California.

China: proving sanctions cannot stop innovation

Chinese firms aren't just copying anymore—they're innovating. Even with a major embargo imposed by the United States in an attempt to stifle innovation, companies like Baidu, Alibaba, and Baichuan AI, backed by massive government support, are developing models tailored for emerging markets in Southeast Asia, the Middle East, and Africa. They're building a parallel AI ecosystem that could rival anything coming out of San Francisco.

Huawei, the massive telecom giant supported by the state, for example, released its own OS and is embedding it into its lineup of smartphones and home devices, creating a fully functional ecosystem. Another Chinese model, Yi Lightning beats GPT-4o and Claude 3.5 Sonnet in the LLM Arena, the new Deepseek has come to compete against OpenAI’s reasoning model o1, and Baidu’s Ernie reached 100 million users in December 2023 and boosted its user base to over 200 million users in April 2024

According to the World Economic Forum, China’s AI market is estimated to top $61 billion next year with VCs pouring over $120 billion into AI ecosystems.

Meta: the best redemption arc in the tech industry

Believe it or not, Meta plays the role of the good guy in this story. While competitors such as OpenAI and Anthropic fought over market share with expensive, locked-down models, Mark Zuckerberg's company took a different route: open sourcing its technology.

Llama 3.2, released in September, showcases just how far Meta's open-source strategy has come. The model processes both text and images, powers everything from augmented reality apps to visual search engines, and with Meta looking to work with U.S. government agencies to use its model on national security applications.

And beyond government and corporations, the Llama-powered Meta AI chatbot is a pretty promising ChatGPT competitor. Recently expanded into dozens of countries, the chatbot can generate images of similar or arguably better quality than Dall-e 3 and even animate them (which ChatGPT cannot), search the web, handle coding tasks, and imagine scenes on the spot. Beyond that, Meta has other generative AI models for audio generation, video editing, segmentation, drawing animation, and more

With Llama 4 around the corner in 2025, promising even better handling of text, voice, and images, Meta's betting that open beats closed every time.

The numbers back up Zuckerberg's gamble. Meta AI, the company's answer to ChatGPT, racked up 500 million monthly users, with India leading the charge. Over a million advertisers jumped on Meta's AI bandwagon in September alone, cranking out 15 million AI-generated ads. The company's revenue shot up 18.9% year-over-year to hit $40.6 billion in Q3, with ad impressions climbing 7% while prices rose 11%.

All this AI goodwill doesn't come cheap. Meta's dumping $38 billion into capital expenditure this year, mostly on AI research and the hardware to run it. That includes cramming its data centers with 350,000 of Nvidia's prized H100 AI chips by year's end. But Zuckerberg's playing the long game. By partnering with cloud giants AWS, Google Cloud, and Microsoft Azure to host Llama models, Meta's building an ecosystem that could reshape how AI technology spreads—and who profits from it.

Not bad for a company that lost almost 75% of its value when it started to focus on the "metaverse" and grew 600% since its shift to artificial intelligence as its key business model.

Diversity is key

Is OpenAI still king of the hill? Technically, maybe. At least it is the most recognizable—and valuable—AI startup in the scene. But the hill itself has changed. The race isn't about raw power anymore—it's about trust, accessibility, and real-world impact, and a few of these areas, notably trust and safety, are a bit murky right now for Sam Altman’s unicorn

OpenAI's early lead has evolved into a complex web of specialized players, each carving out their own niches. Some focus on consumer applications, others on enterprise solutions, and a few brave ones tackle the fundamental research that could unlock AGI.

For the immediate future, Sam Altman seems very confident OpenAI can reach AGI next year, which would put OpenAI on top of the hill for probably a long, long time if—and this is as “if” as it can get—they succeed.

However, other very respected and talented experts, like Meta’s chief of AI research Yan LeCun, believe such achievement is accomplishable in around 10 years or so. Whether you decide to be optimistic or pessimistic will depend on who’s your favorite rockstar.

That said, the real winner of 2024's AI race is the users. Competition drives innovation, but it also forces companies to address concerns about safety, privacy, and accessibility. This is why the Amodei brothers left OpenAI to found Anthropic and why Ilya Sutskeyver left to found Safe Superintelligence. This is why Huawei developed its own mobile OS and used domestic technology to build one of the best phones of the year, why developers come up with customized, better versions of the most popular AI models, and why AI as a technology has become a social phenomenon in the last two years.

As these AI titans battle for supremacy, they're building tools that transform everything from how we work to how we create and communicate.

And that 'one AI to rule them all'? Maybe that was the wrong question all along. In 2025's AI landscape, diversity will likely play an important role. And that might be exactly what we need.

Generally Intelligent Newsletter

A weekly AI journey narrated by Gen, a generative AI model.

16 hours ago

3

16 hours ago

3

English (US) ·

English (US) ·