Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

The big picture: If Trump were to implement his proposed tariffs upon becoming president again, it would significantly reshape the landscape of consumer electronics in the US. Economic policy discussions can often seem abstract, but it's important to understand the real-world consequences these tariffs could bring.

In June, sixteen Nobel Prize-winning economists signed a letter expressing concern that Donald Trump's proposals could reignite inflation, which is currently nearing the Federal Reserve's 2 percent target after surging to 9.1 percent in 2022.

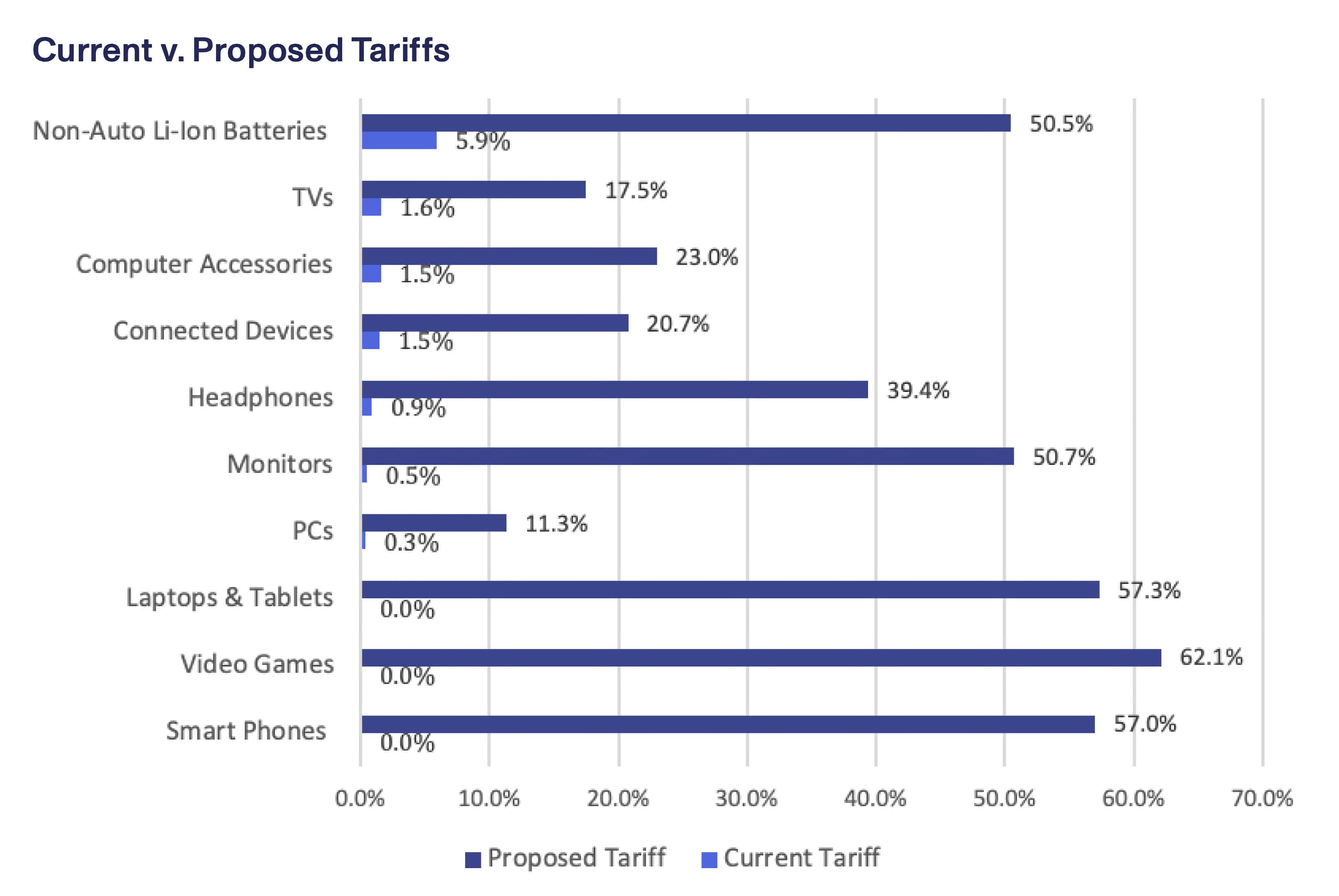

They were primarily referring to his plans to impose tariffs of 10 to 20 percent on imported goods, along with a special 60 percent tariff on imports from China, aimed at encouraging the return of manufacturing to the US.

It is unclear whether manufacturers would pull up stakes and move back to the US in response, but what is certain is that these tariffs will lead to higher prices on imports, and that includes electronic products such as laptops, smartphones, monitors, desktop computers and TVs, most of which are primarily manufactured in China.

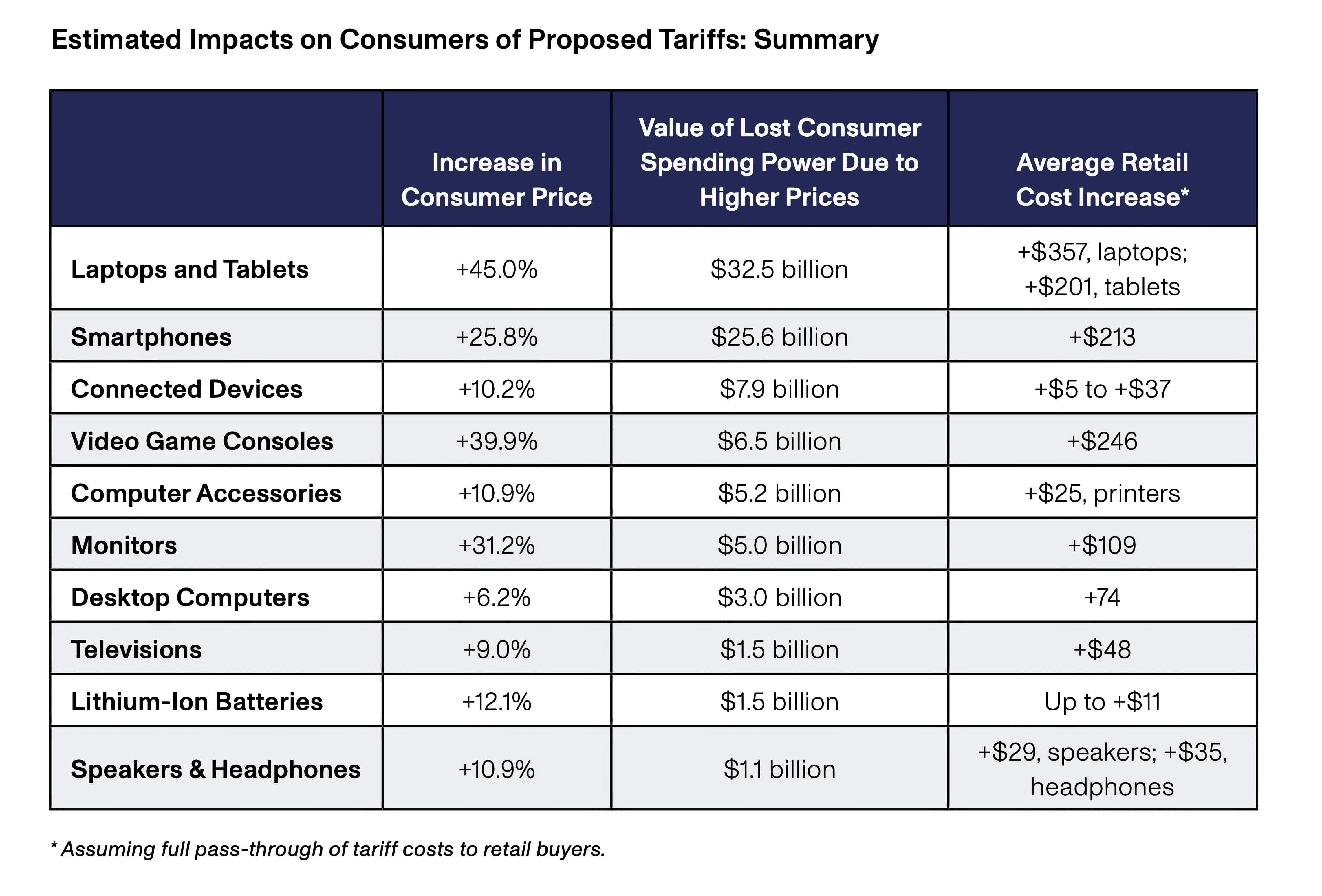

According to a recent Consumer Technology Association (CTA) report, a 10 percent global tariff combined with a 60 percent China-specific tariff could increase laptop prices by 45 percent. For instance, a laptop currently priced at $793 would cost consumers an additional $357. Premium models could see even greater increases, adding $450 for every $1,000 of current pricing.

The CTA, in partnership with Trade Partnership Worldwide (TPW), has projected significant price hikes across a wide range of products. Smartphone costs are expected to rise by 25.8 percent, while monitors are anticipated to see a 31.2 percent increase.

Game consoles, which are primarily made in China, could experience a substantial 39.9 percent jump. In contrast, desktop PCs, which rely less on Chinese manufacturing, are projected to have a more modest rise of 6 percent. The overall cost of electronics could increase by $90 billion annually, causing sales to fall undoubtedly.

The proposed tariffs could have far-reaching effects beyond higher consumer prices. The Tax Foundation estimates that a 10 percent general tariff, plus a 60 percent China tariff, could lower GDP by 0.8% and potentially cost 1.4 million full-time jobs over time.

As is typically the case when tariffs are imposed, other countries may introduce retaliatory measures, which could further impact the US economy.

Meanwhile, it is uncertain whether Trump's stated goal of bringing manufacturing back to US shores will be accomplished through tariffs. Most experts will tell you that shifting production away from China is neither simple nor quick for manufacturers. It could take years for companies to establish new facilities and supply chains in alternative countries like India, Vietnam, or Mexico.

It's important to note that Trump could impose these tariffs with little resistance, even if Congress objected. Unlike many other economic policies, a US president can implement tariffs without requiring congressional approval.

There is, of course, the possibility that the tariff proposals are part of a broader negotiating strategy – a way to create leverage in international discussions. The threat of tariffs can be used as a bargaining chip, giving the US a stronger initial position in negotiations. During his first term, Trump often used the threat of tariffs as a negotiating tool with various countries, with mixed results.

Trump's stance on tariffs may also be a political tactic. Tough trade talk resonates with certain voter groups who feel that current trade policies have hurt American workers.

It's also possible that Trump intends to impose tariffs but at lower rates than currently proposed. By citing extreme measures like 50 percent tariffs, smaller tariffs may seem more reasonable by comparison.

:quality(85):upscale()/2024/10/31/831/n/49351773/b7bf33836723d2f0643c55.51137847_.jpg)

English (US) ·

English (US) ·