TLDR:

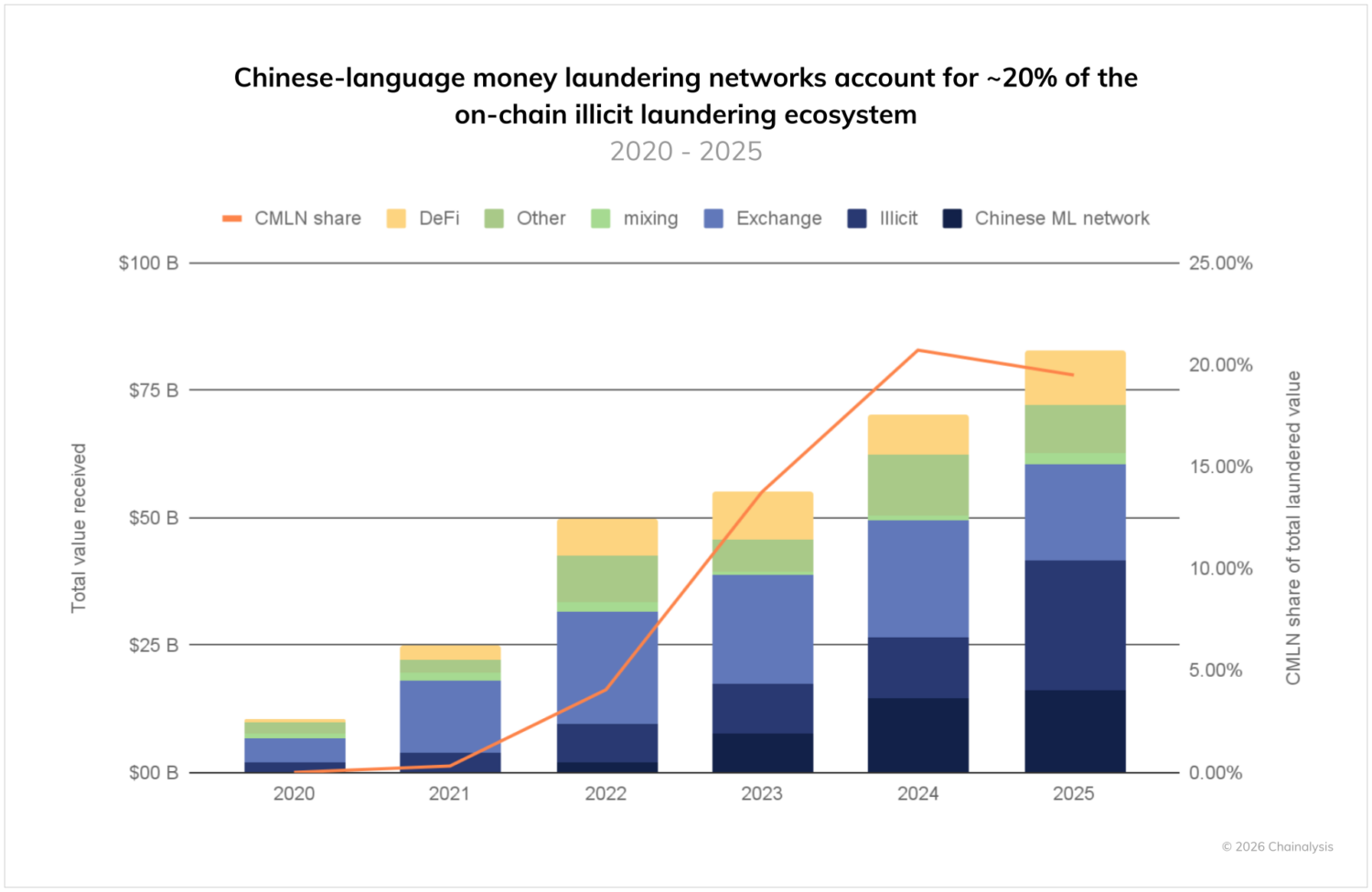

- Chinese-language networks processed $16.1 billion in illicit crypto funds throughout 2025 operations.

- Network growth outpaced centralized exchanges by 7,325 times since 2020, capturing 20% market share.

- Black U services process high-value transactions in 1.6 minutes using automated laundering systems.

- Six distinct service types form comprehensive infrastructure from entry points to final integration.

Chinese-language money laundering networks have emerged as dominant players in cryptocurrency laundering operations.

These networks processed $16.1 billion in illicit funds during 2025, accounting for roughly 20% of all known crypto money laundering activity.

The operations span 1,799 active wallets and process approximately $44 million daily, according to blockchain analytics firm Chainalysis.

Rapid Growth Outpaces Traditional Laundering Channels

The expansion of Chinese-language money laundering networks has accelerated at unprecedented rates since 2020. Growth in fund flows to these networks exceeded traditional channels by substantial margins. Compared to centralized exchanges, the networks grew 7,325 times faster over the past five years.

Decentralized finance platforms saw growth rates 1,810 times slower than these networks. Even illicit on-chain transfers between criminal entities grew 2,190 times slower. This rapid scaling demonstrates the efficiency and appeal of these services within criminal ecosystems.

The overall illicit laundering landscape expanded from $10 billion in 2020 to over $82 billion in 2025. Chinese-language networks captured an increasing share of this activity. Their prominence coincides with the declining use of centralized exchanges for laundering purposes.

Tom Keatinge, Director at the Centre for Finance & Security at RUSI, offered insights into this phenomenon. “Very rapidly, these networks have developed into multi-billion dollar cross-border operations offering efficient, value-for-money laundering services,” he stated.

The operations suit transnational organized crime groups across Europe and North America, according to Keatinge.

Capital Controls Drive Unprecedented Network Development

Keatinge attributed the rapid development to an unforeseen consequence of capital controls in China. “Wealthy individuals seeking to move money out of China and evade these controls provide the impetus,” he explained.

This liquidity pool services organized crime groups based in Western countries through professional enablers.

The transition from traditional methods has been dramatic in recent years. Chris Urben, Managing Director at Nardello & Co, described the shift occurring within these networks. “The biggest change in Chinese money laundering networks in recent years is a rapid transition to crypto,” he noted.

Traditional informal value transfer systems like Black Market Peso faced displacement by cryptocurrency. Urben explained that crypto offers an efficient way to discreetly move funds across borders.

The technology eliminates reliance on complex manual networks of informal ledgers in various countries.

Black U services reached $1 billion in processing volume within just 236 days of initial operations. Running point brokers required 843 days while over-the-counter services needed 1,136 days for the same milestone. Money mules took 1,277 days to process their first billion dollars in illicit funds.

Six Service Types Form Comprehensive Laundering Infrastructure

Running point brokers serve as entry channels for illicit funds into the financial system. These operators recruit individuals to rent out bank accounts and digital wallets.

The accounts receive fraudulent proceeds and forward them through the laundering network.

Money mule operations orchestrate complex layering schemes through multiple accounts and transactions. These services advertise capabilities spanning African countries and global payment methods. Vendors emphasize speed and discretion to prevent fund freezes by authorities.

Informal over-the-counter desks circumvent regulatory controls and verification requirements. These services charge premium rates above market prices for unmonitored transfers. Despite advertising “clean funds,” on-chain analysis reveals extensive connections to criminal ecosystems.

Black U services specialize in cryptocurrency from hacking, scams, and theft at discounted rates. Buyers purchase illicit assets 10-20% below market value.

Gambling platforms and money movement services complete the infrastructure through mixing and swapping capabilities.

Enforcement Actions Disrupt Operations But Networks Persist

Recent regulatory actions targeted major facilitators within these networks. The U.S. Treasury sanctioned the Prince Group while FinCEN designated Huione Group as a primary money laundering concern. UK authorities similarly sanctioned entities facilitating these operations.

Enforcement disrupted guarantee platforms that serve as marketplaces connecting vendors and customers. Telegram removed some accounts associated with Huione operations.

However, vendors quickly migrated to alternative platforms without operational interruption.

Keatinge addressed the capabilities gap between criminals and law enforcement regarding cryptocurrency use. “There is a chasm in most countries between the capabilities of criminals and law enforcement,” he stated. Nationally-based laws, border barriers, and poor information sharing create challenges for authorities.

Urben outlined effective investigative strategies for detecting these money laundering networks. “The most effective investigative strategy is to match your investigative tools against the operational approach,” he emphasized.

Open source intelligence combined with blockchain analysis helps investigators map networks and match players to currency movements.

4 weeks ago

23

4 weeks ago

23

English (US) ·

English (US) ·