Elon Musk's Starlink is facing growing competition from China’s state-backed satellite internet initiatives and Amazon’s Project Kuiper, intensifying the race for dominance in space-based connectivity. As China rapidly develops its low-Earth orbit (LEO) satellite network, concerns are emerging over potential data security risks.

Shanghai-based SpaceSail, one of China’s leading satellite internet companies, is aggressively expanding into international markets. According to a report by Reuters, the company has signed agreements to provide services in Brazil and Kazakhstan, with discussions underway in more than 30 other countries. SpaceSail aims to deploy 648 LEO satellites this year and expand to a total of 15,000 by 2030, potentially rivaling Starlink’s global reach. It is claimed that the company has state-backed funding from Shanghai Spacecom Satellite Technology (SSST).

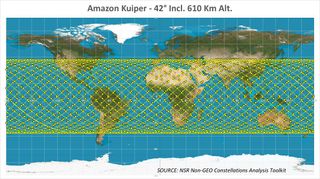

Amazon's Project Kuiper, led by Jeff Bezos, is also entering the satellite broadband industry, with a projected investment of $16 billion. The project is expected to spend up to $3.5 billion on satellite launches by 2025, aiming to provide widespread internet access and integrate with Amazon Web Services (AWS). However, Project Kuiper faces an uphill battle against Starlink, which already has a strong market presence and brand recognition.

As of February 2025, Starlink, operated by SpaceX, has established a significant global presence. It offers satellite internet services in over 100 countries, including the United States, the United Kingdom, and various nations across Europe, South America, and Asia.

In contrast, Amazon's Project Kuiper is still in the developmental phase. The initiative plans to deploy its first production satellites in early 2025, to commence broadband services later in the year. While specific service regions have not been officially announced, Amazon aims to deliver high-speed, low-latency broadband to unserved and underserved communities worldwide.

China’s rapid satellite expansion raises concerns about potential data security risks, echoing past controversies. Western governments previously flagged Huawei’s telecom infrastructure as a potential cybersecurity threat, leading to bans and restrictions in multiple countries. Similarly, TikTok has faced scrutiny over alleged data-sharing practices with the Chinese government.

Unlike commercial competitors, Chinese internet providers operate under strict government oversight, which could enable Beijing to exert control over global communications infrastructure. This also raises questions about whether data transmitted via Chinese satellites could be accessed or monitored by authorities, potentially compromising user privacy.

As competition in satellite internet heats up, data security and geopolitical risks will become central issues in the industry. The expansion of Chinese satellite services could lead to further scrutiny from Western governments, especially as more nations adopt LEO-based connectivity solutions.

9 months ago

93

9 months ago

93

English (US) ·

English (US) ·