The digital asset market is moving through a period of deep change as February 2026 begins. For a long time, the old giants of the industry have dominated the charts. But lately, their path has become much harder to predict.

Many holders are asking if the famous names from the last few years can still deliver the same growth as before. While the market cools, a quiet rotation of capital is happening. Investors are no longer just looking for safety in large names. They are hunting for new crypto projects that offer utility and cheap entry points.

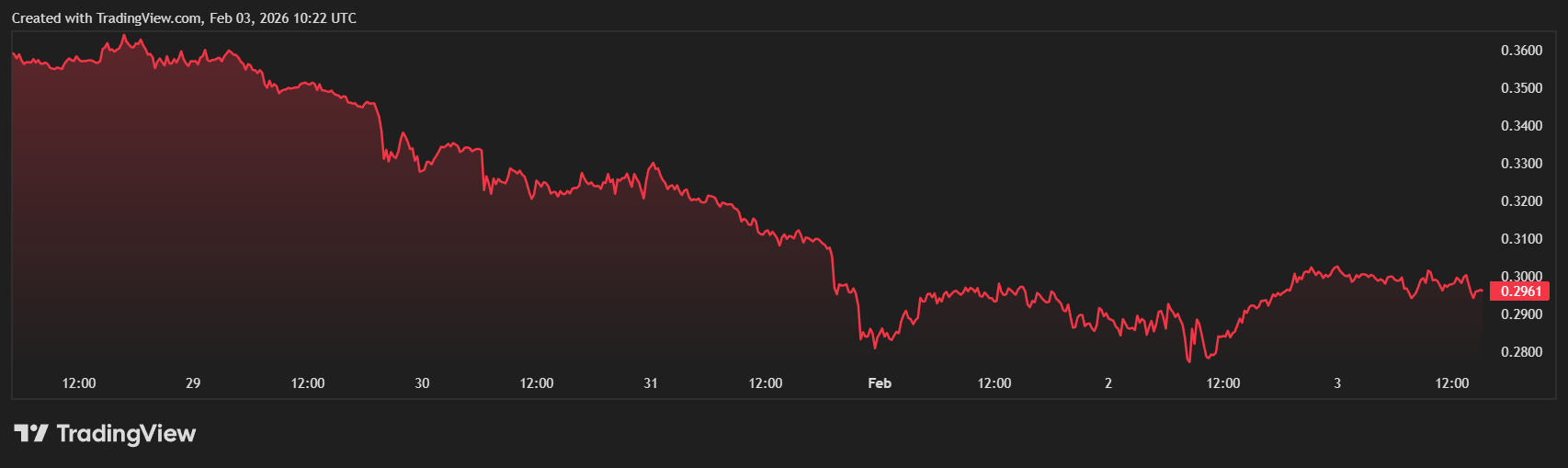

Cardano (ADA)

Cardano (ADA) has always been known for its slow and steady peer-reviewed approach to development. However, this careful pace is now being tested by a fast-moving market. Currently, ADA is trading at approximately $0.30, with a market capitalization of roughly $8.8 billion. This is a far cry from its former glory days when it was a top-three contender.

Technically, Cardano is facing heavy resistance. The charts show strong ceilings at $0.35 and $0.40. Until the bulls can push past these levels with high volume, the trend remains weak. Some analysts have issued a bad price prediction for the rest of 2026. They suggest that if ADA cannot hold its current floor, it could drop as low as $0.18.

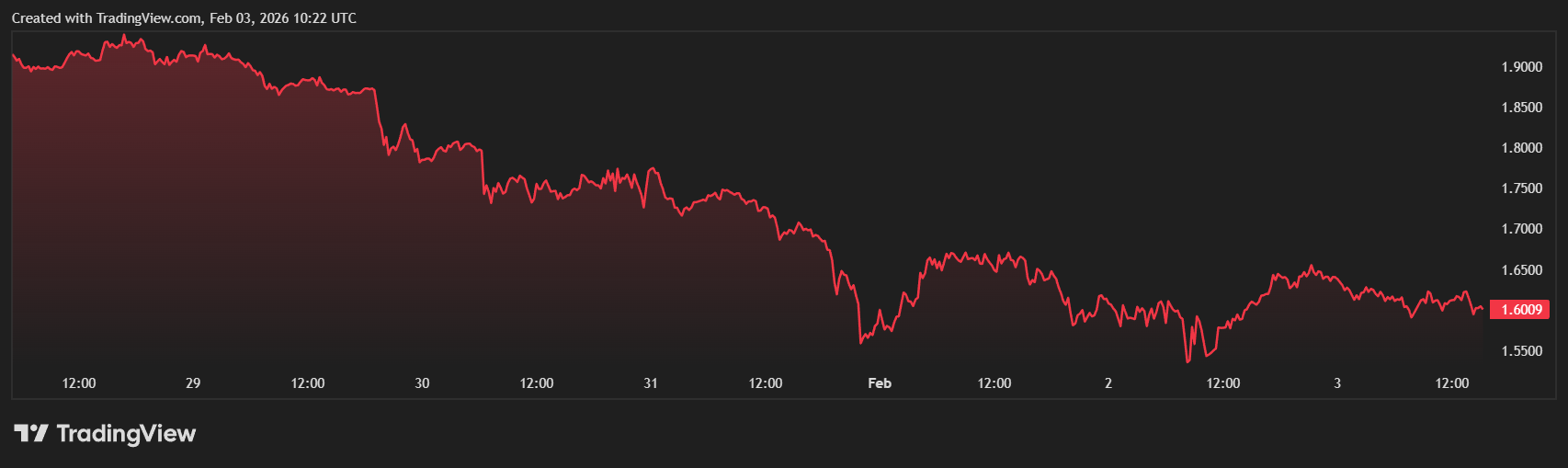

Ripple (XRP)

Ripple (XRP) remains a staple for institutional cross-border payments, but its price action has been painful for retail holders lately. XRP is currently trading around $1.60, having fallen from much higher levels just a month ago. Its market cap sits at a massive $100 billion, which means it needs billions of dollars in new money just to see a small percentage gain.

XRP is trapped under heavy resistance at the $1.75 and $1.80 marks. Every time the price nears these zones, large sellers seem to step in. A recent bad price prediction from some market models warns that XRP could slip back to $1.10 if global liquidity remains tight. The lack of native yield for simple holders is another issue.

Mutuum Finance (MUTM)

As capital flows out of ADA and XRP, Mutuum Finance (MUTM) is emerging as a top crypto opportunity for that money. This new protocol is developing a decentralized lending and borrowing protocol built on the Ethereum network. It aims to replace traditional services with transparent smart contracts. The project has built its funding through a structured distribution phase that has been incredibly successful.

To date, Mutuum Finance has raised over $20.2 million and onboarded more than 19,000 holders. The project uses a fixed-price model that rewards early participation. It is currently in Phase 7, with the token priced at $0.04. This is a 300% increase from its starting point of $0.01 in early 2025.

With a total supply of 4 billion tokens and exactly 45.5% (1.82 billion) set aside for the presale community, it has a much better growth profile than the older giants. The official launch price is confirmed at $0.06, giving current participants a clear advantage. Over 840M MUTM are already sold out.

Protocol Momentum and Growth Catalysts

The biggest news for Mutuum Finance is the official launch of its V1 protocol on the Sepolia testnet. This move proves the technology is functional and ready for use. A core part of this engine is the mtToken system.

When you deposit assets like ETH or USDT into the protocol, you receive mtTokens as a receipt. These are yield-bearing assets. As borrowers pay interest, the value of your mtTokens grows relative to the original deposit. This allows lenders to earn a passive return without any extra work.

The protocol also uses decentralized oracles like Chainlink to ensure price data is always accurate. This is vital for managing loans and protecting user collateral. Based on this technical progress, many analysts believe MUTM is undervalued. Some price predictions suggest the token could reach $0.35 to $0.55 by late 2026. This would be a massive increase compared to the stagnant performance of ADA and XRP.

Stability and Sustainable Growth

Mutuum Finance (MUTM) is built for the long term. The official whitepaper highlights a buy-and-distribute mechanism to support MUTM’s value. A portion of the protocol’s revenue is used to buy MUTM tokens from the open market. These tokens are then given back to users who participate in the staking. This creates a cycle of constant demand that older coins like XRP do not have.

The roadmap also includes a native, over-collateralized stablecoin. This will give borrowers a stable asset to use while their collateral earns yield. This is important because it makes the protocol a complete financial hub. With a full security audit by Halborn and a 90/100 score from CertiK, the safety of the system is verified. As the old guard of crypto struggles to regain its momentum, the transition to new cheap crypto projects like Mutuum Finance is becoming the main story of 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

1 hour ago

5

1 hour ago

5

English (US) ·

English (US) ·