TLDR:

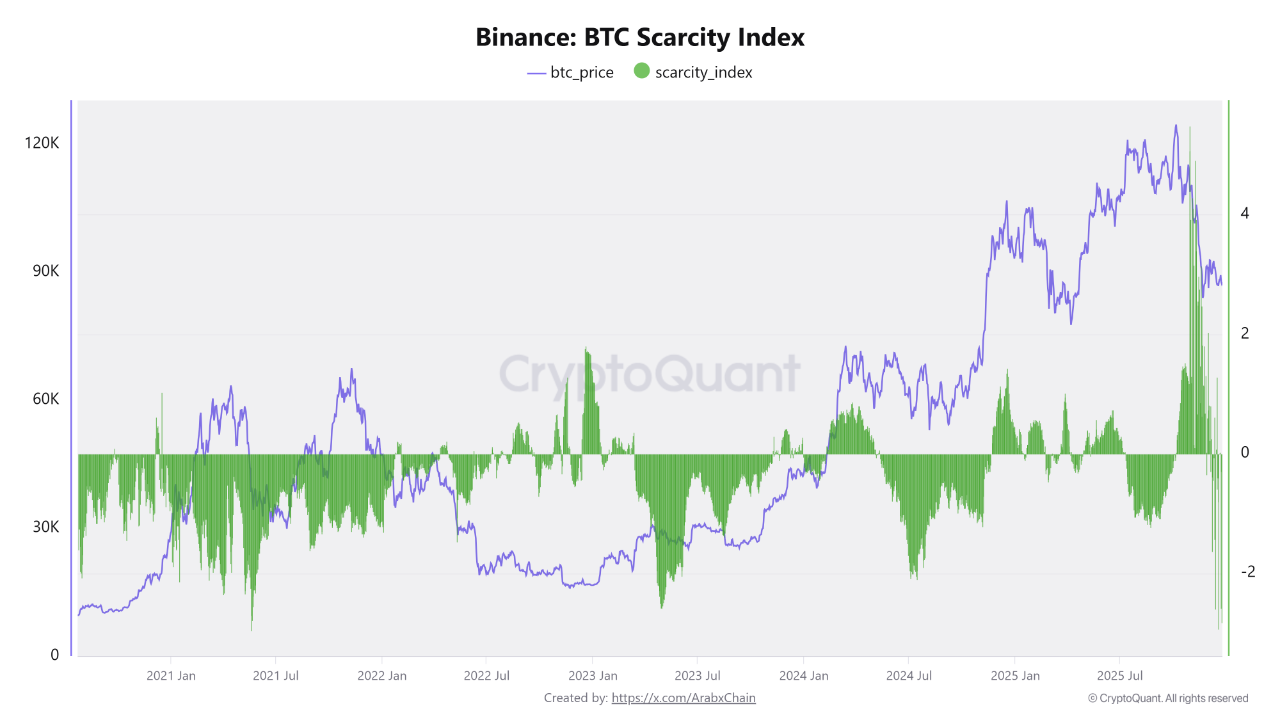

- The Binance Bitcoin Scarcity Index has fallen to approximately -2.9, marking the lowest reading since 2021.

- This extreme negative value indicates abundant supply relative to demand on Binance, despite elevated prices.

- Historical patterns show similar extreme lows in 2021 preceded major structural shifts in Bitcoin distribution.

- The reading suggests market activity is driven by liquidity and speculation rather than genuine supply tightness.

The Binance Bitcoin Scarcity Index has plunged to extreme lows, recording a reading of approximately -2.9 in recent trading sessions.

This level marks the lowest point observed since 2021, signaling a notable shift in on-exchange supply dynamics.

The extreme reading carries structural significance beyond typical market fluctuations, as similar depths were not reached even during severe corrections in previous cycles.

Extreme Negative Reading Reflects Unusual Market Conditions

The -2.9 scarcity index reading represents an unprecedented low for this market cycle. Binance data shows this extreme level surpasses the depths reached during previous aggressive sell-offs and market stress periods.

The metric’s decline to such territory indicates a fundamental shift in how supply and demand interact on the platform.

This extreme negative value points to an abundant supply situation relative to current demand levels. Despite Bitcoin maintaining prices near recent highs, the scarcity index reveals underlying pressure from available supply.

Source: Cryptoquant

The divergence between stable pricing and extreme scarcity readings suggests liquidity factors dominate current market behavior.

Historical data confirms these extreme lows rarely appear outside of major market transitions. The current reading stands out as particularly severe when compared to measurements from 2022 and 2023.

Binance’s exchange-specific data provides a window into supply conditions that broader market metrics may not capture.

2021 Comparison Offers Context for Current Extremes

The last time the Binance Bitcoin Scarcity Index touched such extreme lows occurred during the 2021 market cycle.

That period preceded significant structural changes in Bitcoin’s distribution and holder behavior. The comparison highlights how rare these extreme readings are within multi-year timeframes.

During 2021, similar extreme scarcity lows coincided with major repositioning among market participants. Large-scale supply movements occurred as the market transitioned between different phases of the cycle.

The current extreme reading may indicate a comparable repositioning phase is underway on Binance.

Market structure in 2021 eventually shifted from extreme negative scarcity toward tighter supply conditions. Exchange outflows gradually increased as holders moved Bitcoin off platforms into long-term storage.

The timeline for such transitions varied, but the extreme scarcity lows marked the beginning of those shifts.

The Binance platform’s role as a major trading venue makes its scarcity index particularly relevant. Extreme readings on this exchange reflect conditions affecting a substantial portion of daily trading volume.

Therefore, monitoring how long the index remains at these extreme lows will help determine whether current conditions represent a temporary anomaly or the start of a sustained supply dynamic shift similar to patterns observed following the 2021 extreme lows.

5 hours ago

10

5 hours ago

10

English (US) ·

English (US) ·