In brief

- Anthropic’s legal AI plugin sparked an $285 billion sell-off across software and services stocks.

- Experts say AI agents will compress entry-level roles and push a shift away from seat-based pricing.

- Investors seem to be repricing SaaS as foundation model firms move into full workflow automation.

Shares of several information and professional-services companies slid sharply this week amid Anthropic's unveiling of a legal-automation tool that rattled investors’ confidence in the sector’s long-term pricing power.

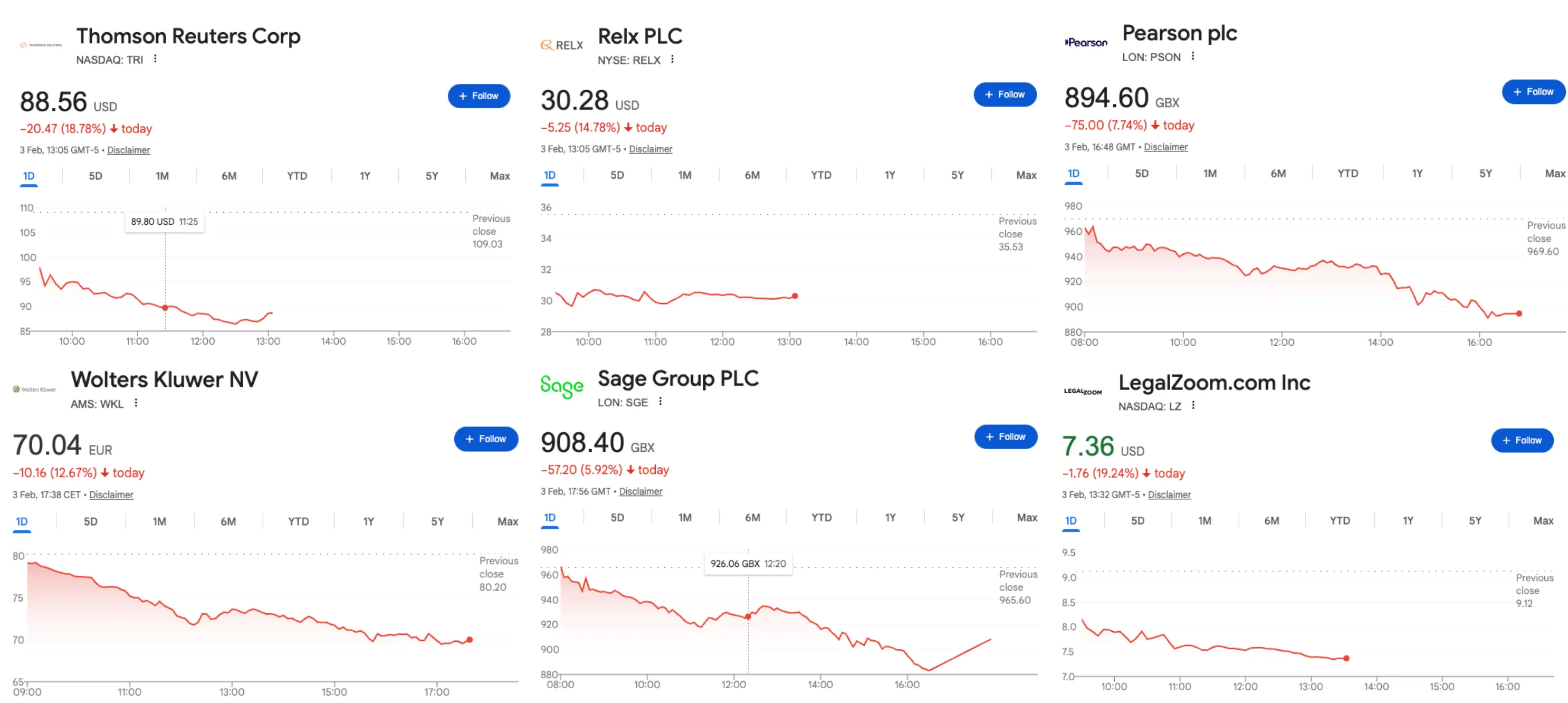

Thomson Reuters sank 18%, Pearson fell 7%, and LegalZoom dropped nearly 20%, as the selloff spread across software, financial services, and asset management stocks, erasing roughly $285 billion in market value, Bloomberg reported.

The panic began after Anthropic announced 11 open-source plugins for Claude Cowork on January 30, but focused on one in particular.

That included a legal plugin, which automates contract review, NDA triage, and compliance workflows. In a nutshell, it does the grunt work that keeps thousands of paralegals and junior associates employed.

The panic wasn't just about one plugin doing document review—it was about what the component represents: foundation model companies beginning to build full-fledged workflow products, willing to take on the enterprise software industry directly.

"The market's response was a signal, not that AI agents will immediately replace these businesses, but that investors are finally pricing in the structural risk that foundation model providers can now compete directly with the software layer," Scott Dylan, founder of Nexatech Ventures, told Decrypt. The fear isn't speculative, he said.

“That's a polite way of saying if Anthropic can build a legal workflow tool in-house, what's stopping them from doing the same for finance, procurement, or HR?” Dylan added.

If AI agents can do that, why would anyone pay per-seat pricing? That's the business model that built Salesforce, Bloomberg, and every SaaS giant.

And now cracks are beginning to appear.

Source: legaltechnology.com

Source: legaltechnology.comShort-term FUD or structural repricing?

"The selling pressure reflects a deepening structural debate," Schroders analyst Jonathan McMullan told Reuters. "Investors are aggressively repricing these areas as the historical 'visibility premium' erodes; the speed of AI advancement makes long-term valuations harder to defend, particularly as AI tools allow businesses to do more with fewer staff, threatening the traditional model of charging per software user."

Those concerns have also spread beyond legal tech.

Advertising giants Omnicom and Publicis tumbled by 11.2% and 9%, respectively. Australian cloud accounting firm Xero had its worst day since 2013, dropping 16%.

So what do the people actually doing the work think?

Asked whether advances in AI agents pose a threat to legal work, Joel Simon, founder and partner of Simon Perdue, a firm practicing across Texas and New Mexico, struck a measured note.

“We live in a world where judgment and credibility matter more than raw processing power,” Simon told Decrypt, arguing that human assessment still outweighs pure computational speed. “AI is able to comb through massive amounts of information, flag patterns, and surface issues faster than a junior associate ever could. If anything, this has been a relief because it has cleared the runway so we can focus on strategy, witness prep, storytelling, and decision-making under pressure.”

Simon said his firm has already integrated AI into day-to-day work, describing the technology as an accelerator rather than a substitute for lawyers.

It's already being used to draft outlines, condense discovery materials, and test potential lines of questioning, while attorneys retain control over judgment, narrative, and courtroom strategy. “AI doesn’t take the stand,” he said. “We do.”

In two to three years, Simon predicts, "trial attorneys who embrace AI will be more valuable, not less.

The job will look leaner with fewer hours wasted on rote work, more time spent on case theory, client counseling, and courtroom execution.

Nexatech's Scott Dylan had a less optimistic take.

"The honest answer is that AI agents are going to displace certain types of work—particularly repetitive, rules-based tasks that can be well-specified," he told Decrypt. "Contract review, NDA triage, compliance checklists. These are exactly the workflows that Anthropic is targeting, and they're performed by tens of thousands of paralegals and junior associates,"

But Dylan is not completely pessimistic. "Displacement isn't the same as elimination. What's more likely is a compression at the entry level. Junior roles that used to be training grounds—associate work at law firms, analyst tasks at consultancies, first-line customer support—will shrink," he said.

Human challenges in an agentic society

Dylan said that workers will need to learn how to adapt and overcome.

"I don't think we're heading toward a world where humans become redundant," he said. "The scenario where agents handle all knowledge work, and humans are left wondering what to do with themselves is, frankly, unlikely in any timeframe that matters.”

In the long term, human workers will prevail in “roles that require physical presence or high-touch human interaction,” such as healthcare, personal services, and skilled trades, Dylan added.

But until society adapts, there will be a painful period for everyone, and investors are already pricing in all these elements.

IDC predicted that by 2028, pure seat-based pricing will be obsolete, with 70% of software vendors shifting to consumption-based, outcome-based, or organizational capability pricing. If an agent does the work, customers expect to pay for results, not logins.

For now, enterprise software companies are experimenting with different models.

Bain & Company analyzed over 30 SaaS vendors introducing generative AI. Nearly 35% increased per-seat pricing with bundled AI features. Another 35% adopted hybrid models with usage-based add-ons.

The rest are experimenting with outcome-based pricing—charging per contract reviewed, ticket resolved, or lead generated, rather than per seat occupied.

The challenge now is asking customers to spend more before they see savings. A SaaS company pitching a $40,000 AI agent to replace an $80,000 sales rep faces a problem: in the short term, the customer needs both the employee and the agent while evaluating outcomes. That's a 50% cost increase for an undefined period.

“The issue is that most agents today rely on APIs that burn through tokens quickly, which can create costly and unpredictable bills if they’re not tightly monitored, Davis Householder, managing director of MYCO Management, told Decrypt. “In those cases, you're just replacing one SaaS subscription for another.”

“Unlike normal gen-AI's, the risk with agents isn’t occasional failure but failure at scale," Householder added.

In the next couple of years, people can likely expect major disruptions to their working lives. Layoffs, driven mostly by fear, could occur alongside more complex automation workflows as tooling matures.

The development of richer multi-agent ecosystems with better APIs and coordination protocols could present another challenge. Regulatory attention will also focus in as governments realize autonomous agents can be weaponized or generate social instability.

In the medium term, infrastructure could harden. There will be better regulations for work environments in which humans interact with agents.

We’ll likely see agent marketplaces with reputation systems, vetted skills, and standardized protocols for autonomous agent-to-agent transactions. Along the way, expect to see a few high-profile security breaches that serve as wake-up calls.

In the long term, this is likely to be a restructuring rather than an extinction event.

As AI compresses margins and commoditizes basic functionality, the strongest firms consolidate power. The real value may shift away from seat-based software and toward proprietary data, including legal databases, financial benchmarks, compliance logic, licensed into agent-driven systems. Service remains, but data becomes the core business.

What AI agents mean for jobs: Displacement or reinvention?

In the meantime, the implications are stark.

An MIT study found 11.7% of U.S. jobs could already be automated using current AI technology.

Research published by the World Economic Forum in 2025 argues that almost 60% of workers worldwide will need to undergo “reskilling” to remain relevant in the post-agent era.

“We need to address our education system and revamp the way in which we train people so they are using AI to do their jobs better rather than letting AI do their jobs entirely, which puts them at risk with employers who seek to cut costs,” Amrita Bhasin, CEO of Sotira and consultant to Fortune 500 companies, told Decrypt.

"There is no feasible way to prevent AGI," she said. "We need to support the average American worker and ensure that they have the skills, training, and ability to compete in an increasingly competitive and/or unstable job market that AI threatens.”

Companies and professionals that adapt—learning to work alongside AI agents, shifting from execution toward oversight, and anchoring their value in judgment rather than process—are likely to fare better.

Those that fail to adjust risk being revalued, much like the stocks that sold off this week.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

4 weeks ago

21

4 weeks ago

21

English (US) ·

English (US) ·