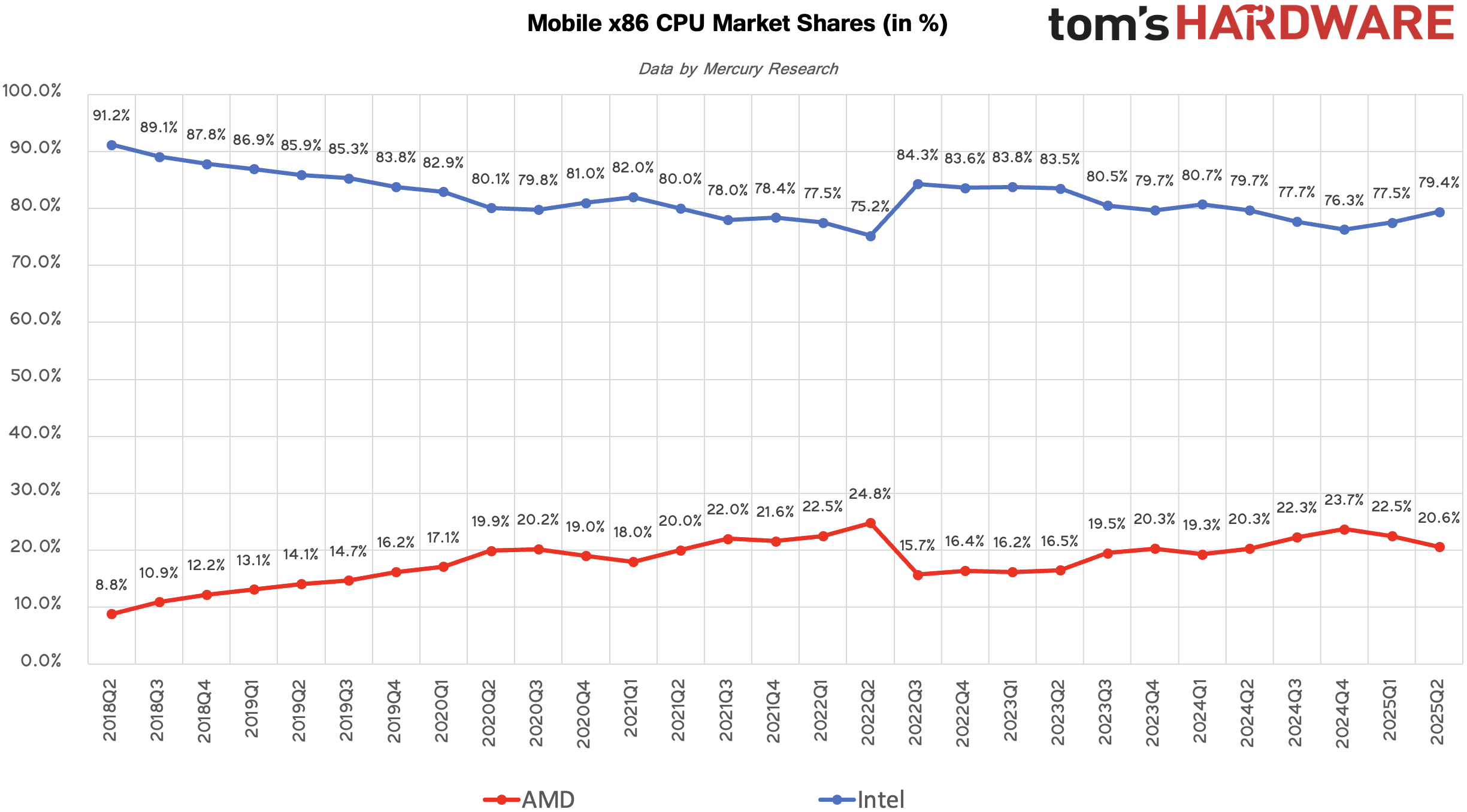

AMD continued to win CPU market share from Intel on the desktop PC and server fronts in the first half of the year, but its position on the mobile CPU front got significantly weaker than it was in the second half of last year. However, when it comes to revenue share, AMD has every reason to celebrate as its Q2 2025 results demonstrate spectacular gains compared to the same period a year before, according to recently released data by Mercury Research that was provided by AMD.

While Intel faces all kinds of troubles, it still sells by far more consumer (client) CPUs than everyone else in the industry. In Q2 2025, Intel saw a slight rebound in consumer CPU unit share, gaining around 0.2% sequentially, but this small uptick was overshadowed by a notable 2.8% decline compared to Q2 2024, indicating that Intel continues to face long-term competitive pressure in the consumer PC space.

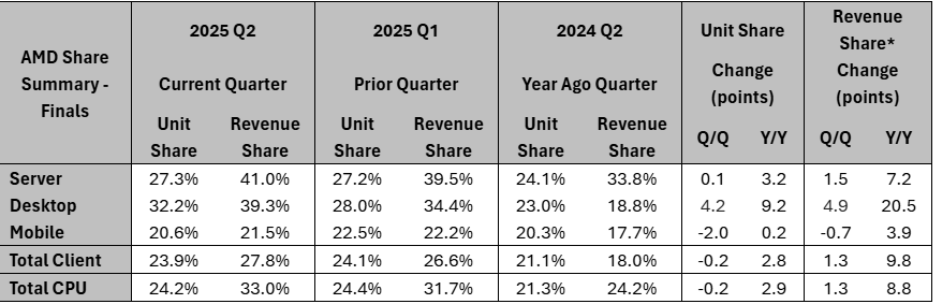

AMD’s total consumer CPU unit share stood at 23.9% in the second quarter of 2025, down 0.2% quarter-over-quarter (QoQ), but still up 2.8% year-over-year (YoY). However, when compared to Q3 and Q4 2024, it looks like AMD's unit share has been stagnating, or even getting lower.

However, AMD's total consumer CPU revenue share rose to 27.8% in Q2 2025, up 1.3% from Q1 and a whopping 9.8% increase compared to the same quarter a year ago, which suggests that AMD is not necessarily shipping more CPUs in volume but is selling more high-end or higher-margin products. By contrast, while Intel maintains its unit share at around 75%, sales of its higher-end processors are lower than usual as AMD gains in the high-end segments.

Desktop CPUs: AMD triumphs

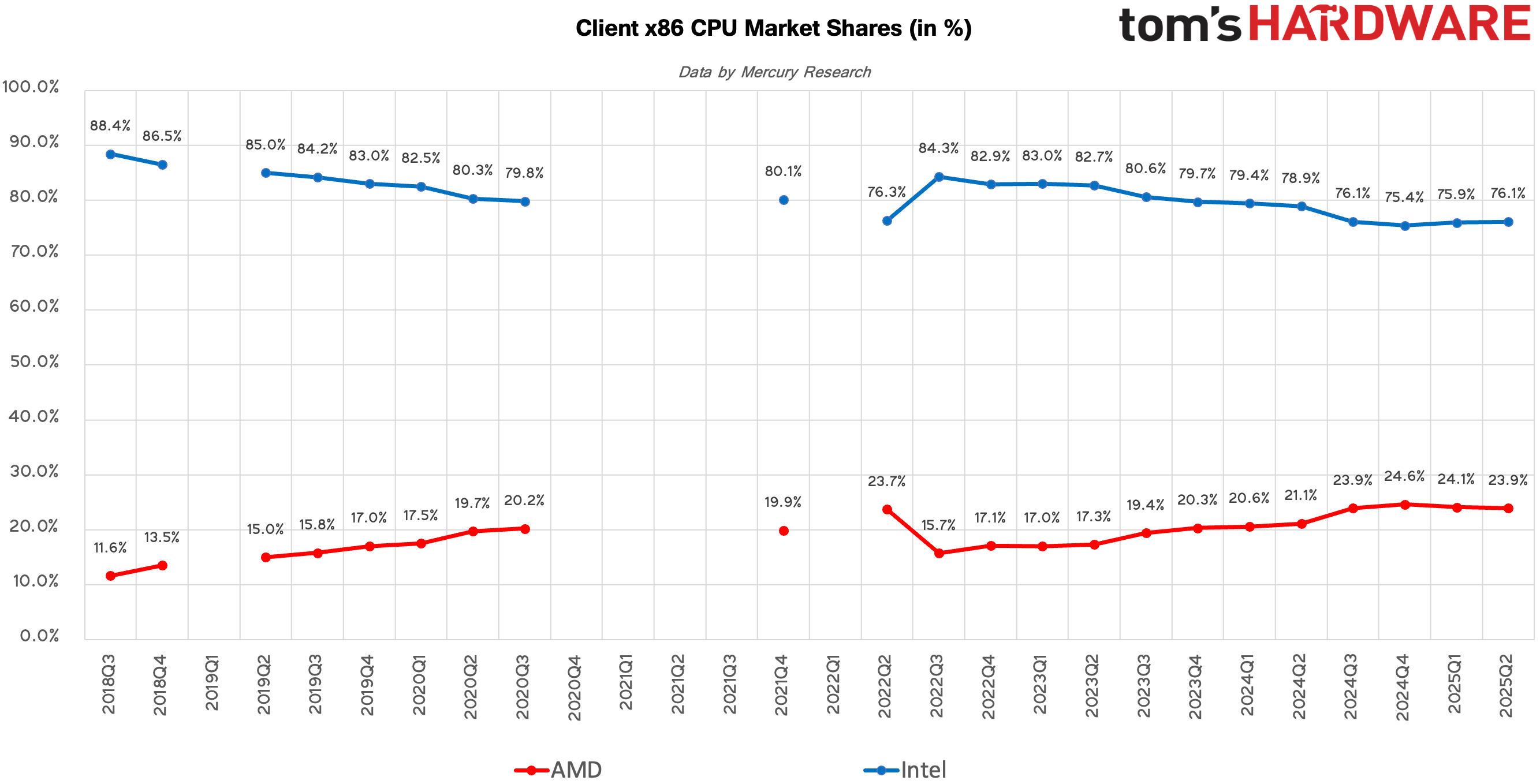

While unit-wise Intel continues to outsell AMD in the desktop PC market, this is where AMD boasts spectacular gains. In Q2 2025, AMD’s desktop CPU unit share rose to 32.2%, a gain of 4.2% sequentially and a robust 9.2% YoY. For Intel, the Q2 2025 desktop CPU unit share stood at 67.8%, down both QoQ and YoY, which means that Intel now outsells AMD 2:1, down from 8:2 in 2023 and 9:1 in 2016 – 2018.

This marks one of AMD’s strongest year-over-year gains in recent years for desktops, reflecting the success of its latest Ryzen 9000-series processors and growing traction in both consumer and commercial systems. While Intel still maintains the majority of the desktop CPU market, these declines highlight a continuing shift toward AMD, particularly in the enthusiast and performance segments.

On the revenue side, AMD made even more dramatic gains. The company's desktop CPU revenue share climbed to 39.3%, an increase of 4.9% sequentially and an incredible 20.5% YoY. This shows that AMD is not only shipping more desktop processors but also selling higher-value models, likely driven by strong demand for its premium SKUs, such as Ryzen 7 and Ryzen 9, as well as Ryzen X3D models. Conversely, Intel's revenue share fell by roughly the same amount as its Core Ultra 200-series CPU for enthusiasts is not really popular.

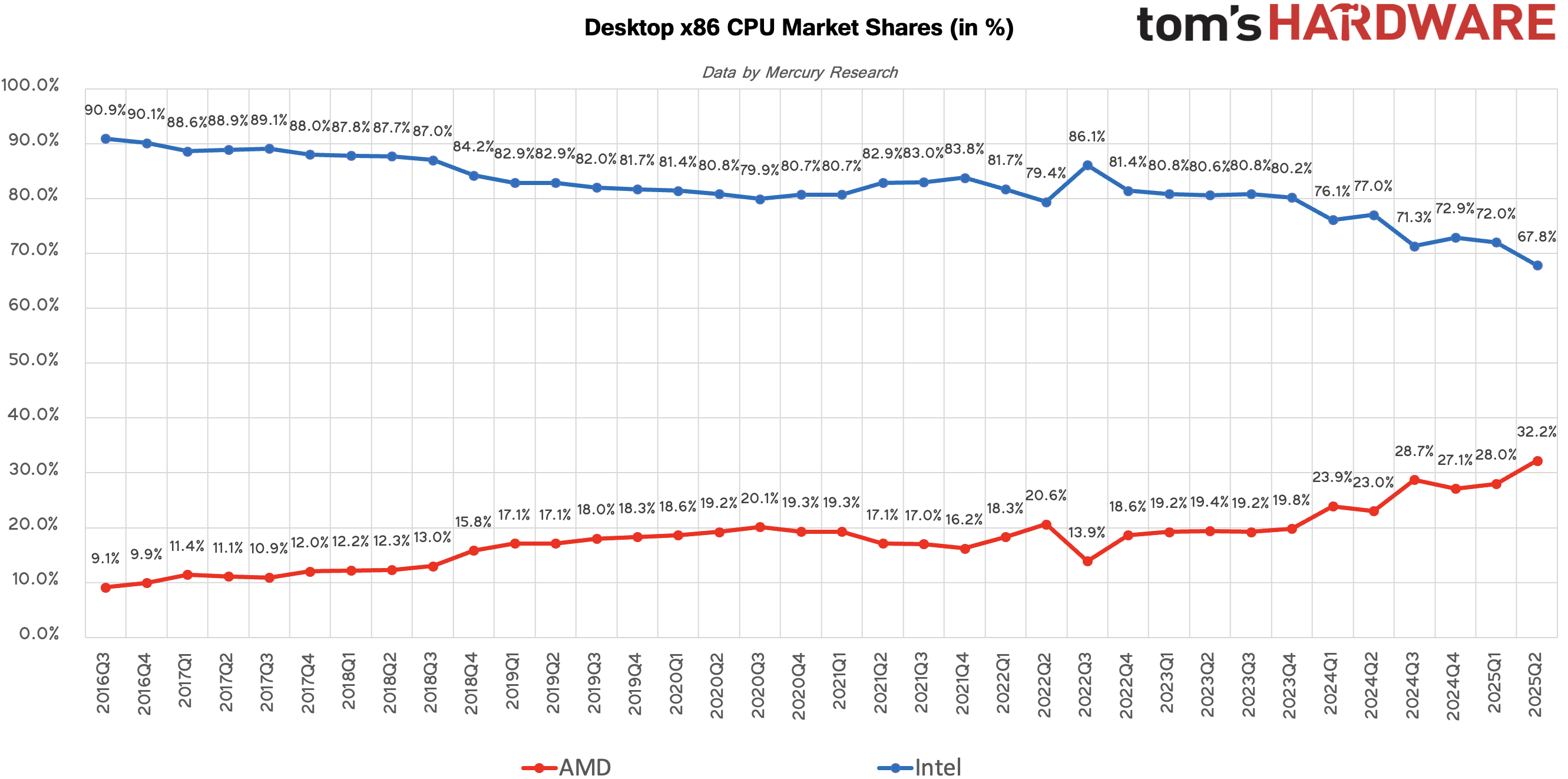

Intel maintained a strong lead in mobile PCs with a unit share of 79.4% in Q2 2025, which is up 1.9% from the previous quarter, but a drop of 0.3% from the same quarter a year ago. AMD's mobile CPU unit share came in at 20.6%, down 1.9% QoQ but still up 0.3% year-over-year. Given how competitive AMD's higher-end Ryzen AI processors for laptops are, we can only wonder how Intel manages to win market share from its small rival, but the numbers speak for themselves and show that AMD has lost market share for two consecutive quarters.

From a revenue perspective, AMD's mobile CPU revenue share came at 21.5% in Q2 2025, down 0.7% from Q1 but still up 3.9% YoY. This indicates that AMD is selling a higher proportion of mid-range to premium notebook processors compared to a year ago, even if unit volumes dipped. For Intel, the revenue share decline matches AMD's gain — meaning that despite holding the lion's share of units, Intel is losing some ground in higher-end segments of the mobile market, where AMD's offerings look more competitive.

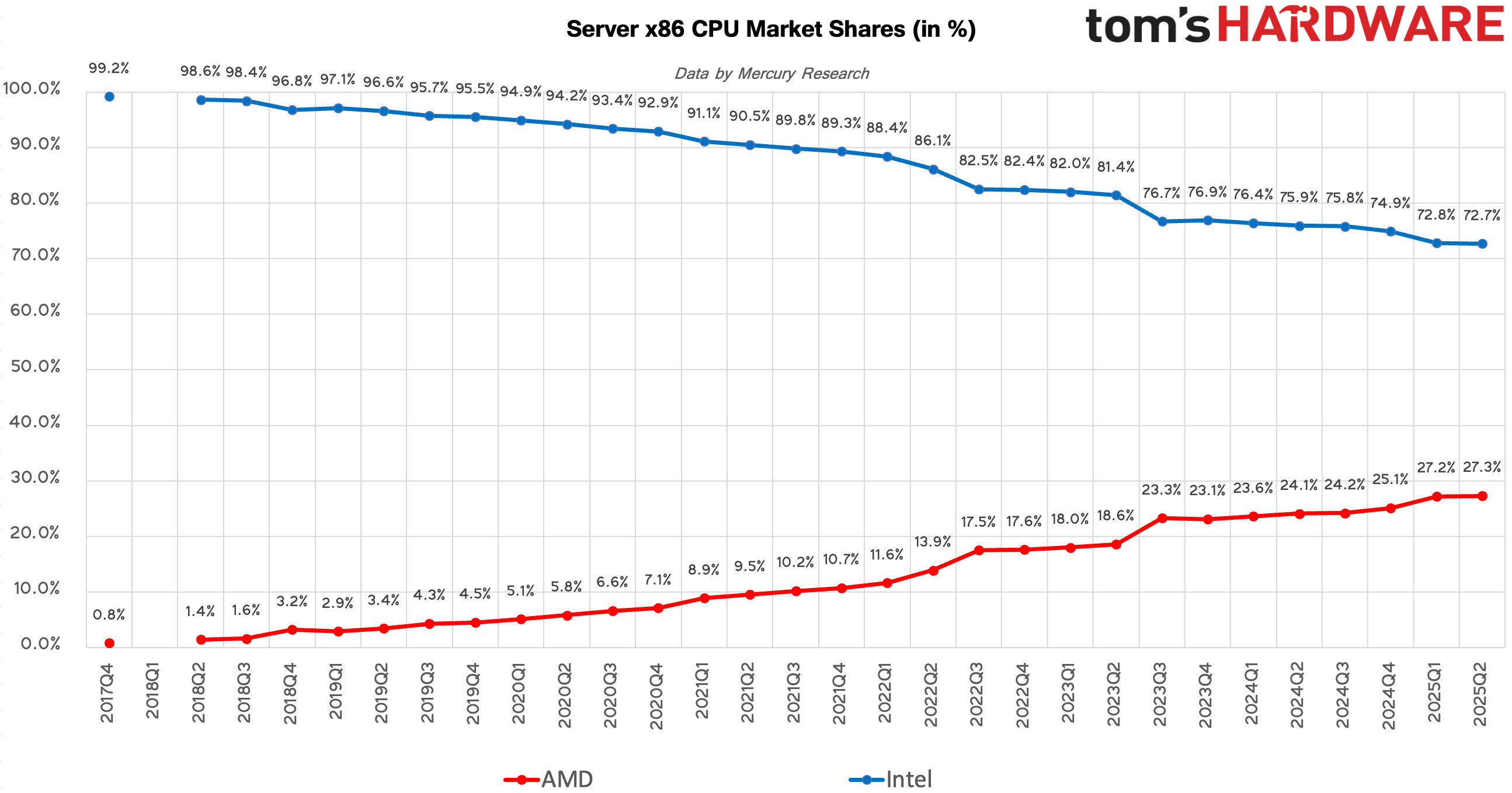

Intel retained the majority of server CPU shipments with a unit share of 72.7% in Q2 2025. 3.2% YoY, which highlights the company's long-term challenges in this segment. By contrast, AMD made a strong 3.6% year-over-year and 2.1% quarter-over-quarter unit share gain in the first quarter of 2025 due to the latest EPYC platform ramp. In the second quarter, the company's unit share reached 27.3%, which is a tiny 0.1% gain.

The steady rise in unit share reflects growing demand for EPYC processors, driven by performance, efficiency, and competitive total cost of ownership. Nonetheless, stagnation of AMD unit share gains in Q2 may indicate that Intel has managed to find the right balance of performance, efficiency, TCO, and price with its Xeon 6 offerings.

From a revenue standpoint, AMD's share climbed to 41% in Q2 2025, a substantial 1.5% increase QoQ and an even larger 7.2% gain YoY. This growth in revenue share suggests AMD is capturing a share of the higher-end server CPU market with its high core-count offerings. Equally, Intel's revenue share fell by the same amounts, highlighting that while it still outsells its rival 7:3, AMD is increasingly competitive in the most profitable segments of the server CPU market.

Summary

AMD expanded its unit share in desktops and servers over the past year, narrowing Intel's lead in both segments, but its position in mobile CPUs weakened after two consecutive quarters of declines. Intel still shipped more processors in every category, but its positions in desktops and servers loosened as AMD made steady gains in performance-focused segments. Also, Intel managed to maintain a stable unit market share in the consumer PC segment despite strong offerings from AMD.

On the revenue side, AMD posted sharp gains across all major categories, driven by strong uptake of higher-end products. In desktops and servers, the company captured a larger slice of premium sales, eroding Intel's dominance in the most profitable parts of the market despite Intel's continued volume leadership. AMD's performance on the mobile CPU segment was not as impressive in the second quarter, but it still posted a substantial year-over-year revenue share increase.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

3 months ago

76

3 months ago

76

English (US) ·

English (US) ·