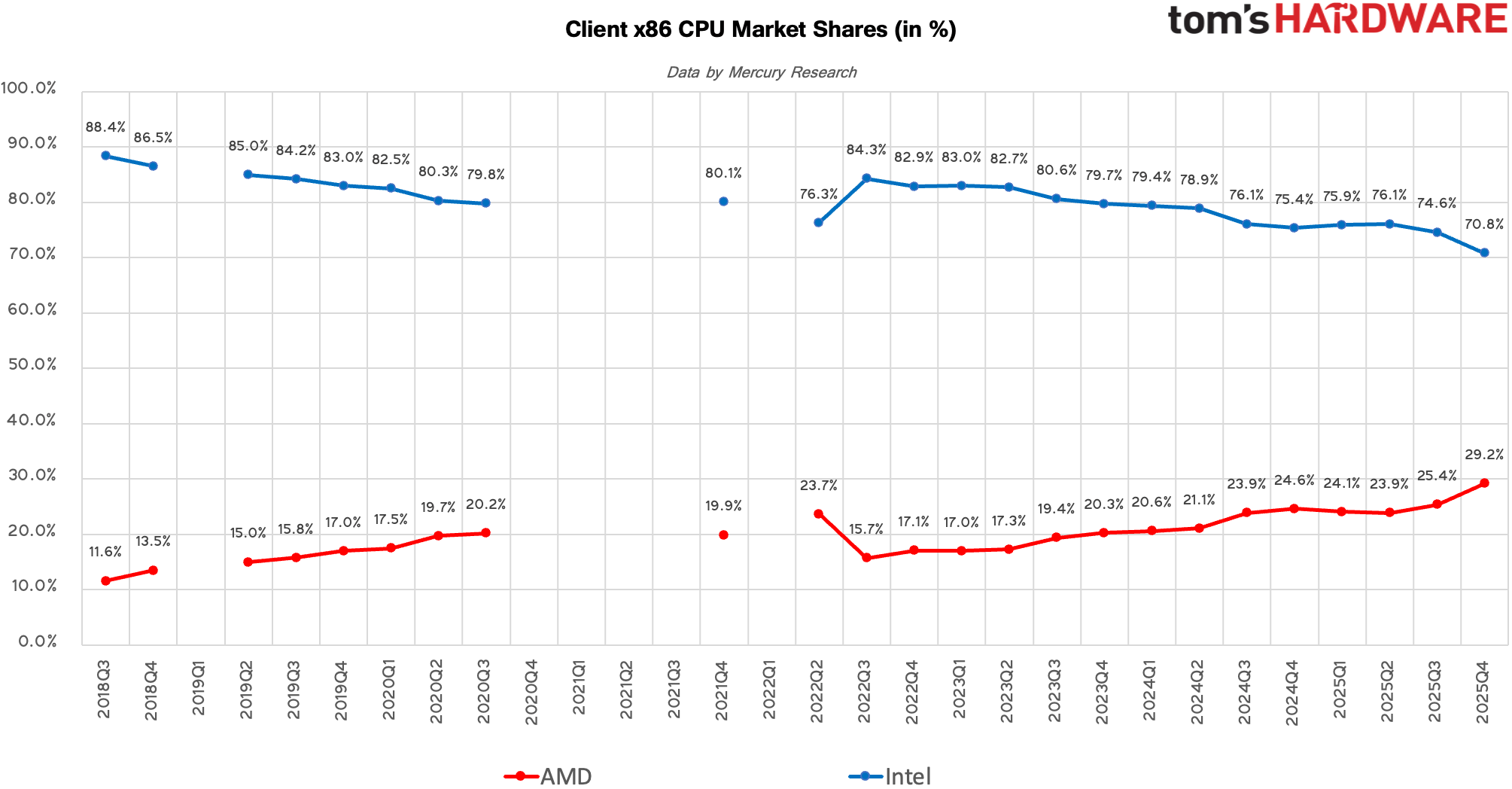

AMD ended 2025 with fanfare as it managed to increase its market shares across all major CPU product segments, according to Mercury Research, and achieved a 29.2% share of all x86 processors shipped in the fourth quarter, which is an all-time record for the company. The company now controls its highest unit share across desktop, laptop, and server CPU markets while also capturing the most lucrative parts of these markets, and now controls 35.4% of x86 CPU revenue share.

Go deeper with TH Premium: CPU

Client CPUs: AMD gains 3.8% of the market in a single quarter

In the client PC segment, AMD finished 2025 with one of its strongest quarters ever, partly because Intel struggled to get enough client silicon from its own fabs and from TSMC, but to a large degree because of highly competitive desktop CPUs and meticulously calculated mobile CPU lineup.

AMD's client CPU unit share rose to 29.2% in Q4 2025, up 3.8% quarter-over-quarter (QoQ) and 4.6% year-over-year (YoY), driven by sales of both desktop and mobile offerings.

Intel remained the clear volume leader with about 70.8% of client CPU shipments, which is a sharp decline both sequentially and compared to the same quarter a year ago, which is not surprising as Intel had to reassign its internal manufacturing capacities to produce server CPUs instead of client silicon and could not get enough silicon from TSMC.

What is perhaps more alarming for Intel is that its client PC CPU revenue share declined to 68.8%, allowing AMD to control 31.2% of the dollar share of PC processor sales, up 2.9% QoQ and 7.4% YoY. This reflects AMD's higher average selling prices (ASPs), stronger sales of premium desktop and notebook processors, and continued gains in higher-margin segments.

Intel admits that it is hard to compete against AMD with its current lineup and hopes that things will begin to change in late 2026 – 2027, which means that AMD will likely continue to enjoy eating Intel's lunch in the coming quarters.

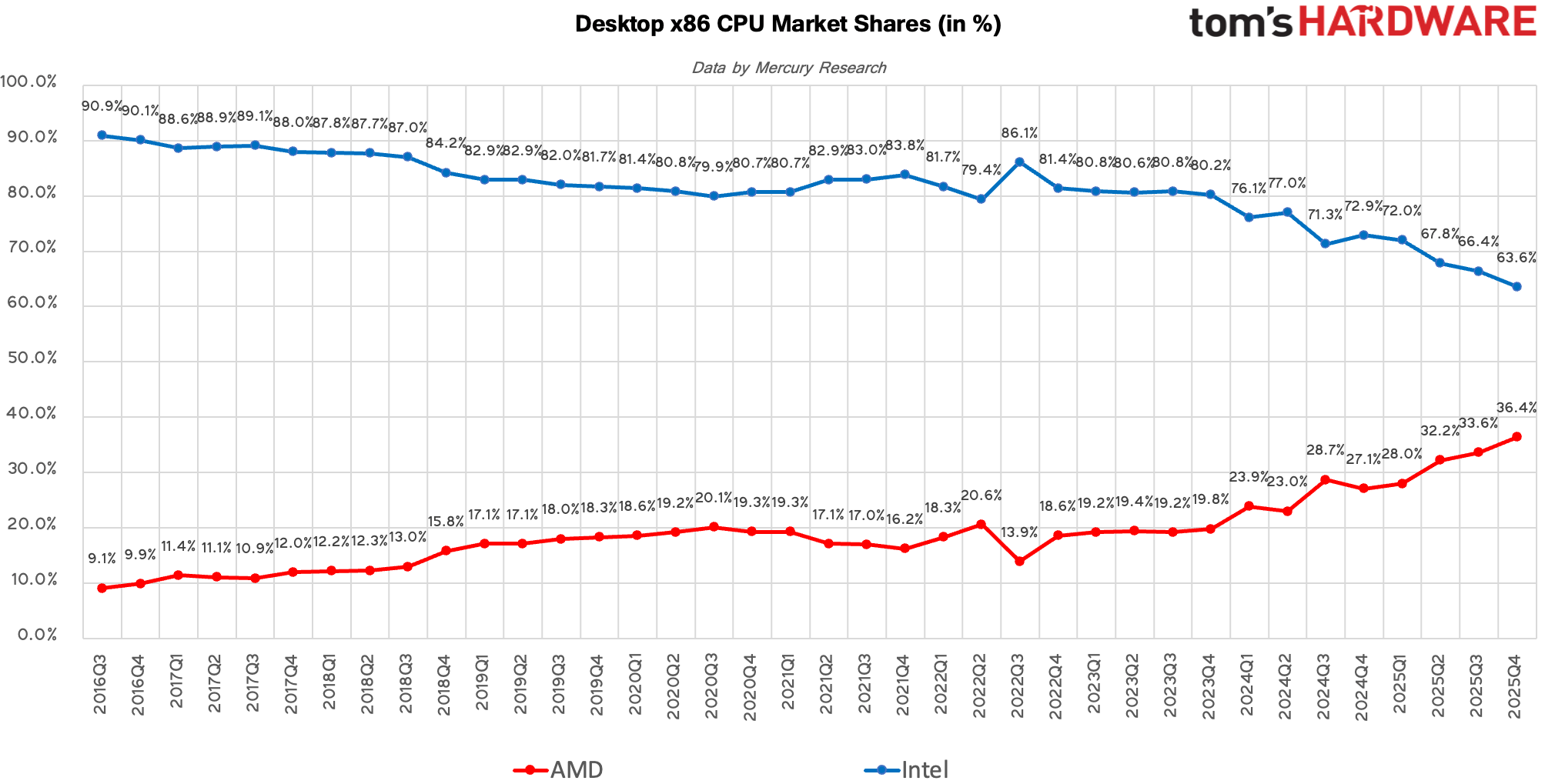

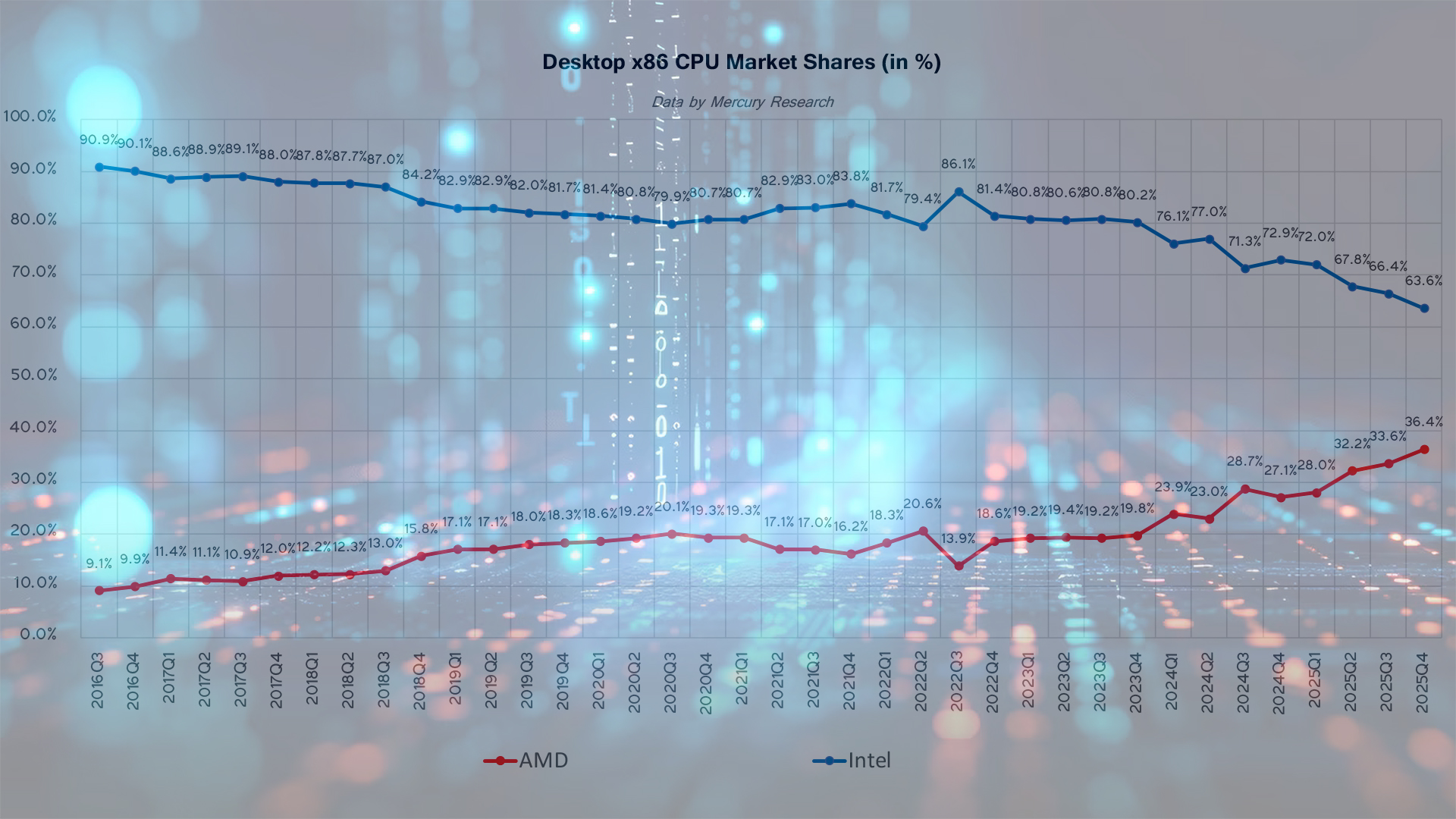

Desktop CPUs: A new record set by AMD

Given AMD's strong Ryzen 9000 lineup, Intel's inability to ship enough 14th Generation Core, and lack of Core 2 Ultra refresh in the fourth quarter, AMD was poised to win market share away from Intel in Q4, which is exactly what happened.

AMD's desktop CPU unit share climbed to 36.4%, increasing both sequentially and year-over-year as demand for its latest Ryzen processors remained strong among gamers and enthusiasts. Of course, Intel retained the majority of desktop shipments with a 63.6% share, but this is down by a whopping 9.5% from the fourth quarter of 2024, a bad hit for the company. The gap between AMD's and Intel's desktop CPU market shares is still around 27%, meaning that the blue company maintains its undisputable lead, but the pace at which AMD is shrinking it looks quite formidable.

On the revenue share side of things, AMD's performance was even more notable. The company's desktop CPU revenue share reached 42.6% in Q4 2025, which clearly indicates strong sales of higher-margin processors and a favorable product mix. Intel still generated 57.4% of desktop revenue overall, but mostly due to its great relations with large PC OEMs that tend to sell mainstream systems, and where Intel is a little more flexible than AMD to win contracts.

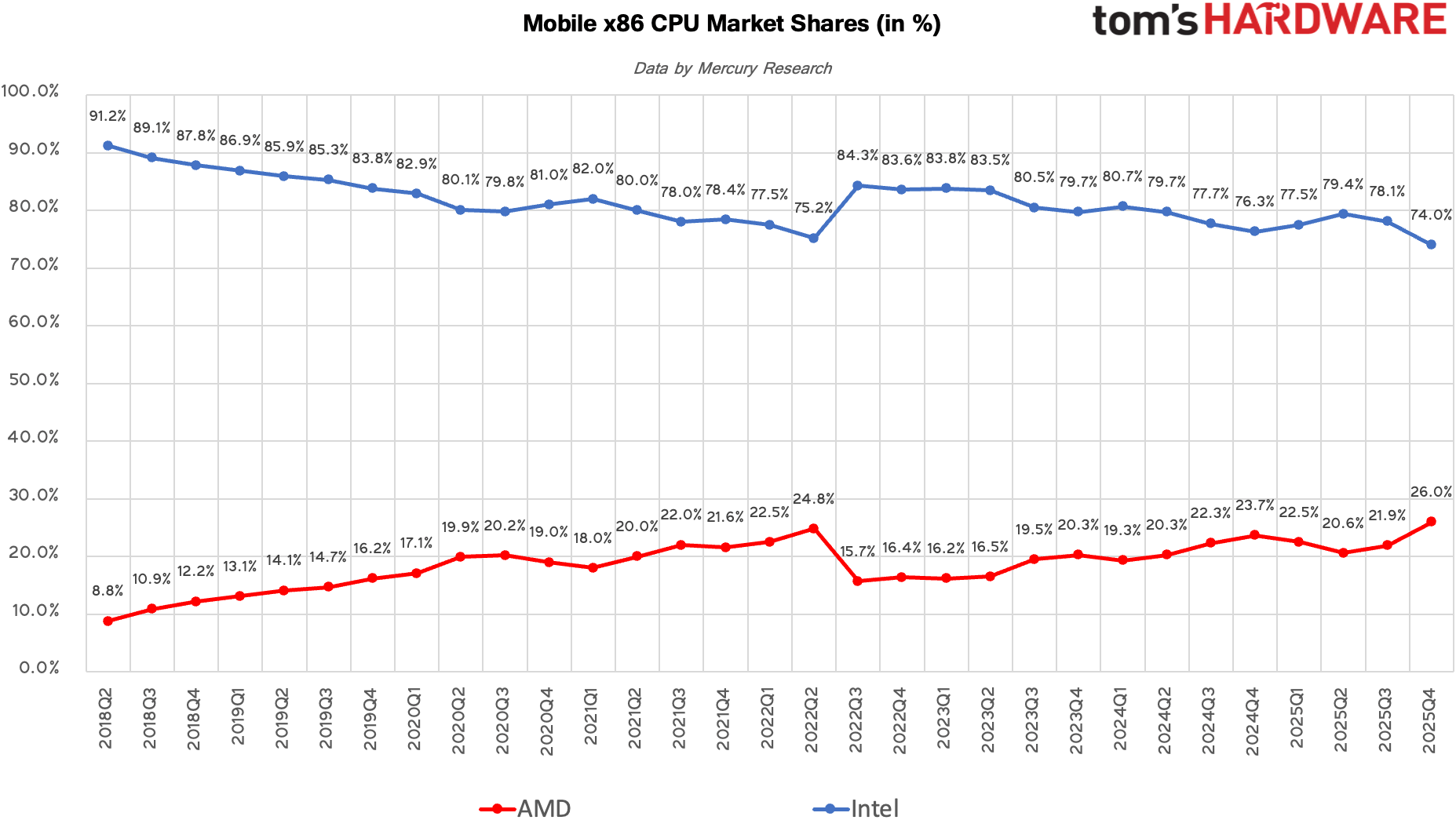

The mobile PC segment has always been Intel's stronghold as the company has traditionally offered a very wide range of CPUs that could power anything from an ultra-low-power thin and light laptop to a full-fat desktop replacement machine. Yet, it is getting harder for Intel to protect its stronghold with its Arrow Lake and Lunar Lake processors now that AMD has greatly broadened its lineup of processors for notebooks.

After floating around 22% of the market for several quarters, AMD delivered a strong recovery in Q4 2025, capturing a 26% unit share and gaining 4.1% of the market QoQ, according to Mercury Research. Intel remained the dominant supplier with 74% of the market, which represents roughly three-quarters of mobile CPU shipments. When compared to its result in the fourth quarter of 2024, Intel only lost 2.2%. However, it remains to be seen what AMD manages to do while Intel will be ramping up its Panther Lake and then Nova Lake CPUs in the coming quarters.

As far as revenue share is concerned, AMD also posted meaningful 3.3% sequential and year-over-year gains as its mobile CPU revenue share reached 24.9%. Intel continued to generate the majority of mobile CPU revenue, a little over 75%, but AMD's progress clearly indicates that the company is getting increasingly competitive not only in the high-volume laptop CPU segment, but also in higher-margin segments of the notebook market.

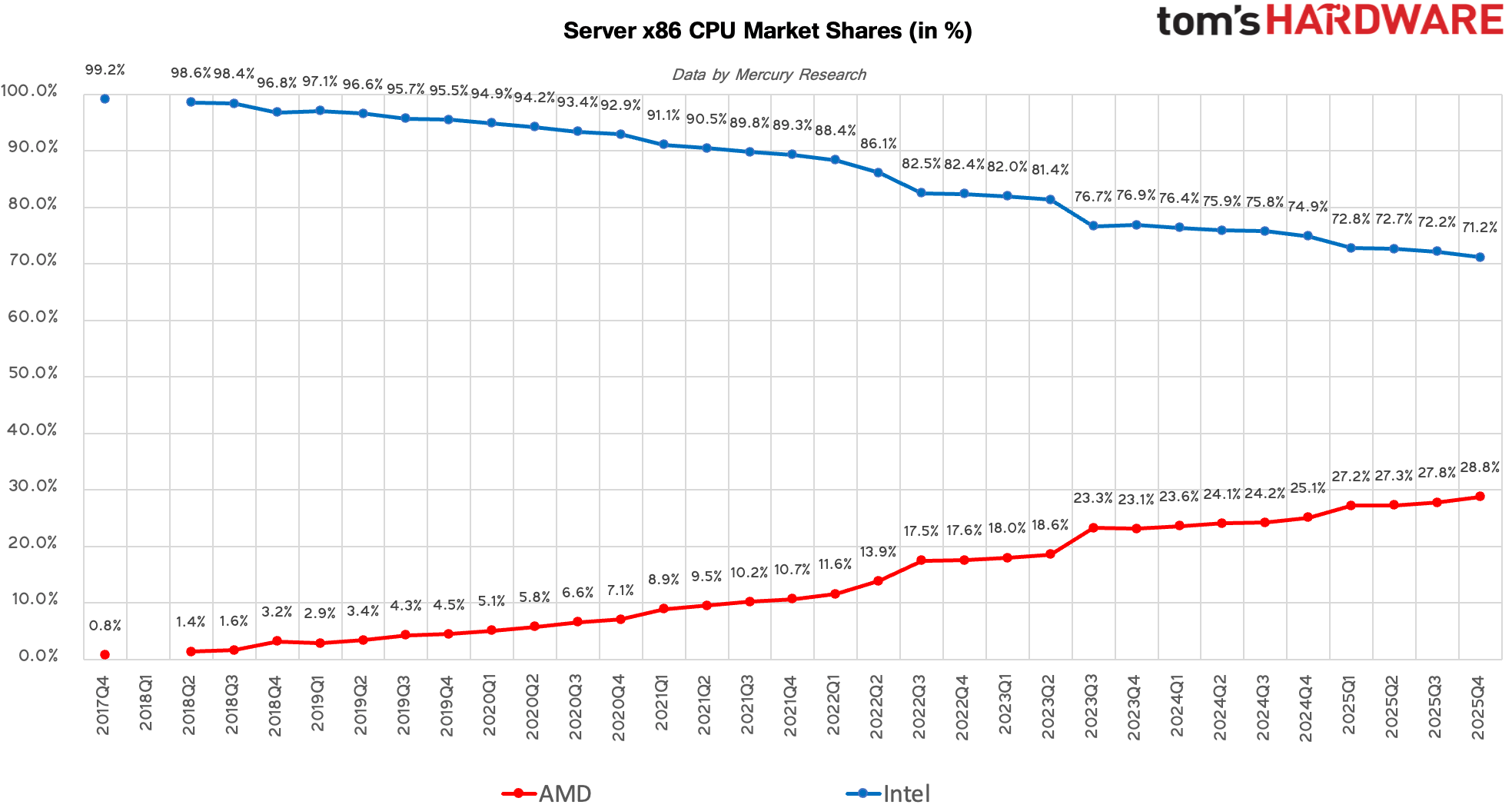

Server CPUs: Another quarter, another percent of the market for AMD

As data center CPU market is particularly conservative, it is hard to quickly gain or lose share. For AMD, this translates into 'another quarter, another percent of the market' gain, which means that the company is gaining ground from its rival slowly but surely and is closing the year with a new high.

Although Intel shipped 71.2% of all x86 server CPUs during the quarter (without taking into account shipments of Hygon Dhyana CPUs), AMD's server CPU unit share reached 28.8%, up 1% sequentially and 3.1% year-over-year as adoption of EPYC processors across cloud, enterprise, and AI/HPC deployments is accelerating.

As for revenue side of matters, AMD's server CPU revenue share climbed to a record 41.3%, which highlights its success in selling higher-priced, higher-margin processors. Intel commanded the majority of server CPU revenue overall — 58.7% — though it is evident that it is losing to its rival in the premium segments of the market.

Summary

If we were to summarize AMD's performance on the CPU market in 2025 in one sentence, we would say that the company was not only shipping more CPUs, but was increasingly capturing the most lucrative parts of all the markets it served due to its strong product mix and high ASPs. By contrast, Intel shipped fewer CPUs and increasingly lost the most lucrative contracts to its rival.

As a result, AMD closed 2025 with a record momentum as it managed to increase its market share across client, desktop, mobile, and server CPUs and reached a new all-time high in both x86 CPU units and revenue share, according to Mercury Research. In the fourth quarter of 2025, AMD shipped 29.2% of all x86 processors by volume and 35.4% of all x86 CPUs by revenue, both record numbers for the company.

While AMD's success was driven by a strong product mix, Intel's declines were a result of a combination of events, including a lack of competitive offerings for the high-end parts of the market as well as supply constraints in the low-end. Intel admits that to improve its position going forward, it will need to regain performance and process technology leadership as well as have enough manufacturing capacity to serve the market. Which is exactly what its management is working on these days.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

3 weeks ago

18

3 weeks ago

18

English (US) ·

English (US) ·