TLDR

- Alibaba’s Cainiao logistics division is combining its self-driving technology unit with Zelos Technology in a transaction worth $2 billion

- The combined business will operate under the Cainiao Robovan brand and manage over 20,000 autonomous delivery vehicles

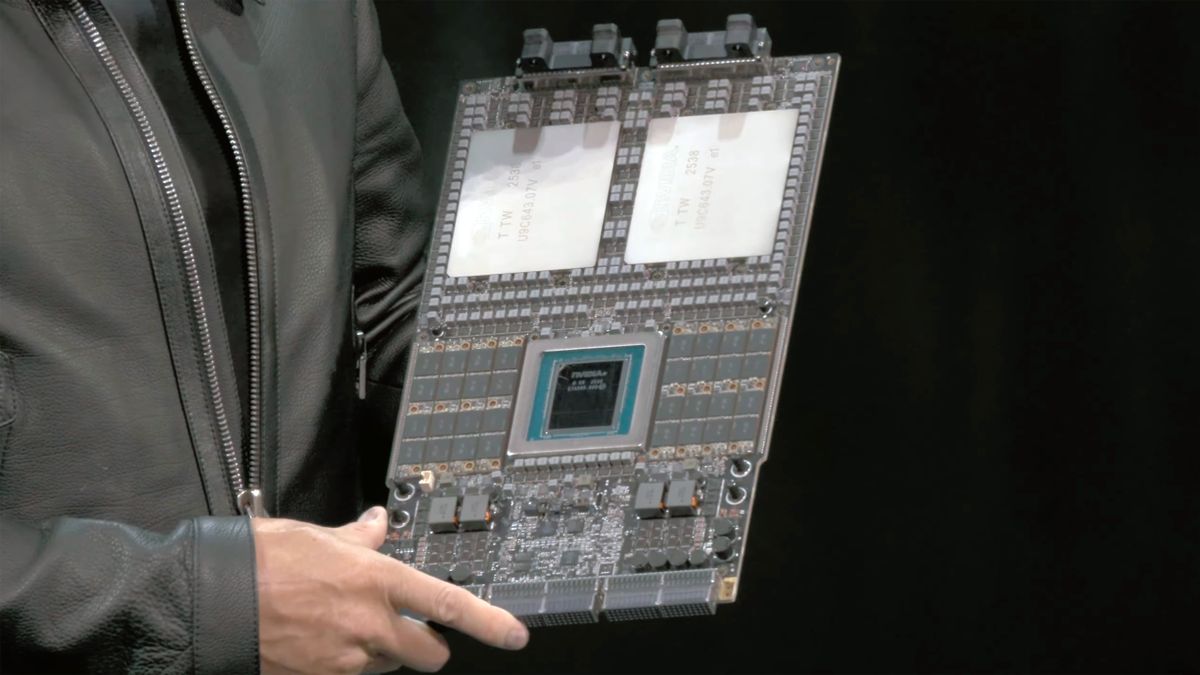

- Alibaba introduced the Zhenwu 810E processor through its T-Head division, designed to compete with Nvidia’s data center chips

- Zelos specializes in autonomous delivery for postal services, consumer goods, and express logistics since its 2021 founding

- Alibaba will hold equity in Zelos while the robotics company maintains operational control of the merged entity

Alibaba stock advanced in early trading after the company disclosed progress in two key technology areas. The developments span semiconductor design and autonomous logistics.

Alibaba Group Holding Limited, BABA

The e-commerce giant’s T-Head semiconductor division launched the Zhenwu 810E processor. The chip recently surfaced on Alibaba’s corporate website.

Technical observers suggest the processor targets performance comparable to Nvidia’s A800 and A100 models. These chips power artificial intelligence applications in data centers worldwide.

Alibaba has not published complete technical documentation for the Zhenwu 810E. The processor supports the company’s cloud computing platform and machine learning systems.

Logistics Technology Consolidation

The Wall Street Journal reported Cainiao’s plan to merge its autonomous vehicle operations with Zelos Technology. Sources with knowledge of the transaction provided details to the publication.

The combined entity carries a $2 billion valuation. Alibaba will acquire an ownership position in Zelos through the deal structure.

Cainiao’s self-driving vehicle division will integrate with Zelos operations. The merged business will use the Cainiao Robovan name.

The new company will control more than 20,000 robotic delivery vehicles. Board representation for Cainiao is expected as part of the agreement.

Strategic Technology Development

Chinese technology firms are increasing investment in proprietary chip design. Restrictions on advanced semiconductor imports have accelerated this trend.

Custom processor development allows Alibaba to optimize hardware for specific applications. This approach improves compatibility with internal software systems and cloud services.

The robovan merger expands Alibaba’s logistics automation capabilities. Automated delivery systems reduce labor costs and increase operational efficiency.

Zelos brings expertise in autonomous delivery across multiple sectors. The company serves postal operations, retail distribution, and express shipping clients.

Market Response

Analysts covering Alibaba maintain positive ratings on the stock. TipRanks data shows 14 buy recommendations with an average target price of $203.09.

The stock has gained approximately 90% over the past twelve months. Wednesday’s announcements contributed to pre-market price increases.

Neither Alibaba nor Zelos provided official statements regarding the merger report. Reuters was unable to independently confirm the Wall Street Journal’s reporting.

A Cainiao executive will join the Zelos board following deal completion. Zelos will retain management authority over the combined autonomous vehicle operations.

The Cainiao Robovan fleet will serve postal services, fast-moving consumer goods distribution, and express delivery markets. Operations will begin after regulatory approval and transaction closing.

✨ Limited Time Offer

Get 3 Free Stock Ebooks

Discover top-performing stocks in AI, Crypto, and Technology with expert analysis.

- Top 10 AI Stocks - Leading AI companies

- Top 10 Crypto Stocks - Blockchain leaders

- Top 10 Tech Stocks - Tech giants

4 weeks ago

24

4 weeks ago

24

English (US) ·

English (US) ·