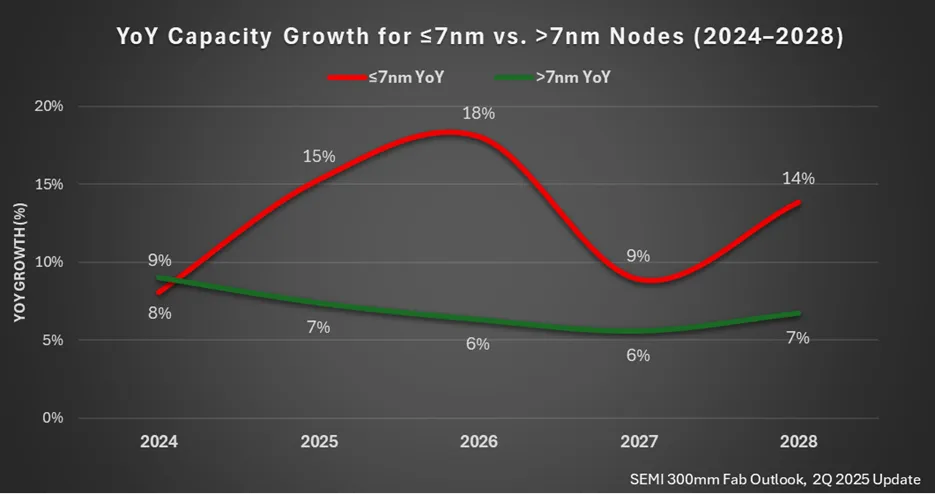

As more applications and industries adopt advanced technologies, the demand for various kinds of chips is increasing. While some applications can manage with older, trailing-edge process nodes, an increasing number of devices require chips produced on advanced fabrication processes (7nm and below). To that end, production capacity for advanced manufacturing technologies is expected to expand by a whopping 69% through 2028, according to SEMI.

The study conducted by SEMI forecasts that overall 300mm wafer output is set to increase at a yearly growth rate of 7% from late 2024 until 2028. This trajectory would bring monthly production volume to 11.1 million wafers, marking an all-time high for the industry.

A major factor behind this surge is the rapid expansion of capacity dedicated to more sophisticated manufacturing technologies, such as 7nm and below, which are projected to increase output by 69% over the period, rising from 850,000 wafers starts per month (WSPM) in 2024 to 1.4 million monthly units by 2028. This segment is expected to achieve a compound annual growth rate (CAGR) of approximately 14%, which is twice the rate of the overall semiconductor sector.

The report states that monthly capacity will move from 982,000 wafers in 2025 to 1.16 million in 2026, passing the 1 million threshold for the first time. In the area of 2-nanometer and smaller processes, volumes are projected to accelerate sharply, more than doubling from below 200,000 wafers in 2025 to beyond 500,000 by 2028.

Spending on production equipment for sophisticated nodes is also rising steeply. Investments are expected to increase from $26 billion in 2024 to more than $50 billion by 2028, representing an 18% annual growth rate. In fact, this may be a pessimistic scenario as Intel and TSMC alone plan to spend up to $18 billion and $42 billion on capital expenditures in 2025, respectively, with the majority of these companies' CapEx being high-end fab equipment.

Of course, sales of production tools designed primarily for 2nm and more advanced production nodes are expected to soar by 120% through 2028, increasing from $19 billion to $43 billion.

The report says that the primary engine driving semiconductor industry growth is the explosive demand for generative AI. This includes both the need to train the ever-growing large language models (LLMs) and large reasoning models (LRMs) and to deploy AI inference at scale across a variety of applications.

"AI continues to be a transformative force in the global semiconductor industry, driving significant expansion of advanced manufacturing capacity," said SEMI President and CEO Ajit Manocha. "The rapid proliferation of AI applications is stimulating robust investment across the semiconductor ecosystem, underscoring the industry’s pivotal role in fostering technology innovation and meeting the surging demand for advanced chips."

At the same time, manufacturers are rapidly expanding capacity at advanced nodes to offer performance efficiency both for AI and other compute-demanding workloads, including next-generation factories. Together, AI proliferation, next-generation manufacturing, and consumer applications like self-driving vehicles are creating an unprecedented surge in advanced semiconductor production.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

5 months ago

69

5 months ago

69

English (US) ·

English (US) ·